I’m convinced that buying UK shares is the best way to build long-term wealth. I myself have opened a Stocks and Shares ISA, an instrument that allows me to invest up to £20,000 in growth and dividend stocks without having to pay tax.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Here’s how — thanks to the miracle of compound interest — I’m hoping I could turn this into a five-figure passive income once I retire.

Investing in the FTSE 100

For decades, UK shares have been a great way for average investors to make cash. The FTSE 100, for instance, has delivered an average annual return of 7.48% since it came into being 40 years ago.

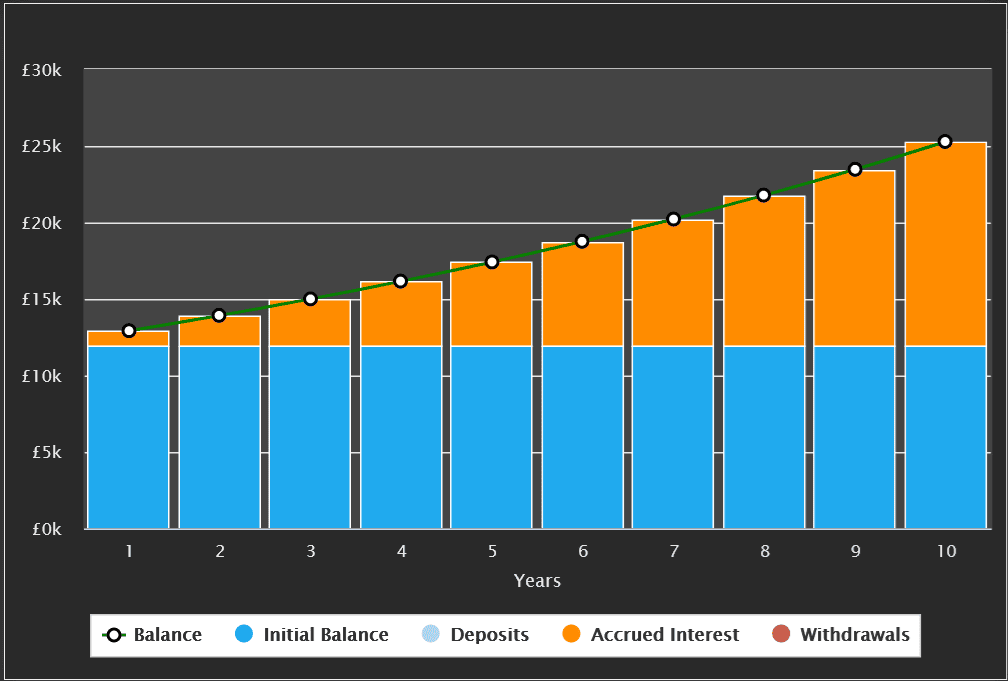

If that annual average were to continue, I would, with an investment of £12,000 in Footsie stocks today, make a profit (excluding fees) of £897.60.

Over a 10-year period I would have made an impressive £8,976. This is far better than any savings account could have made me over that time.

But this is assuming that I withdrew my yearly gains as passive income to spend. With compounding, where I plough back any dividends I receive, I have an opportunity to make bigger (and potentially life-changing) returns.

With dividends reinvested, I could make an investment pot worth a whopping £25,294.45, as shown below.

Compound gains

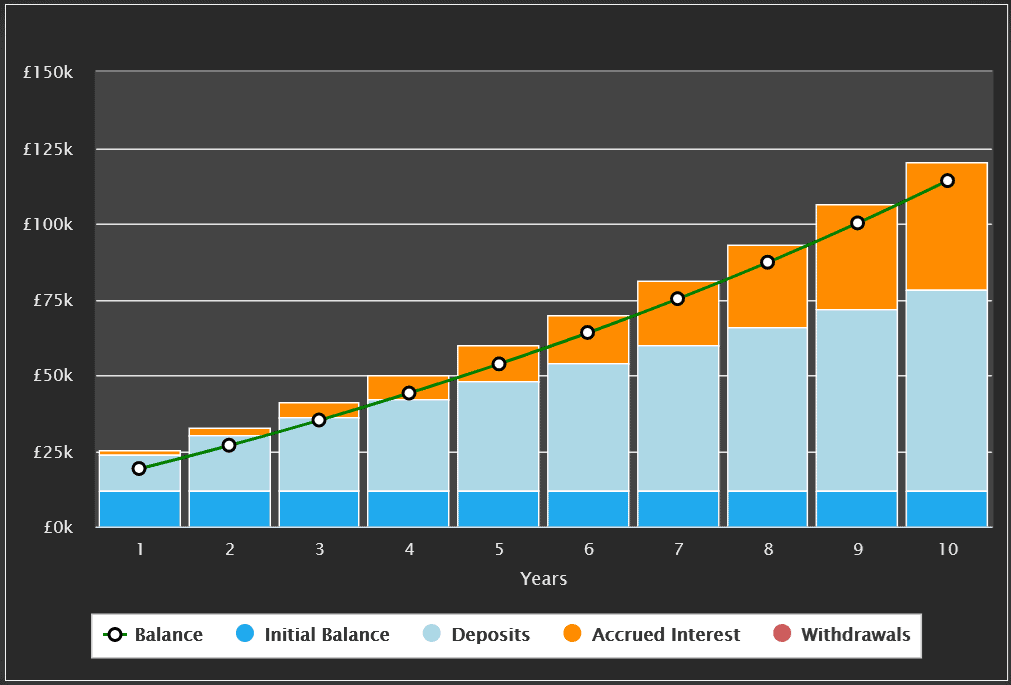

The beauty of compound interest allows me to make money on any dividends I reinvest as well as on my initial investment. And if I can afford to invest regularly after buying my first FTSE 100 shares, my eventual return could really take off.

Let’s say that I can purchase another £500 of Footsie stocks each month. That’s on top of the £12,000 I’ve already used to invest. I would have a huge £114,161.10 sitting in my account, as seen in the chart below.

£31k+ passive income!

As I mentioned at the top, I’m buying shares to help me live comfortably when I retire. So I plan to continue investing in FTSE 100 stocks up until that point.

This is where things really get exciting. The principle compounding means that the longer I invest for, the greater sum of money I can expect once I stop.

If I invested that £500 a month for 30 years, I would have built up a pot of £783,417.49, assuming that 7.48% annual average stays the same.

Applying the 4% retirement drawdown rule — which would give me money for three decades before my investments run out — would provide me with a yearly passive income of £31,336.70.

A great way to invest

Of course past performance is no guarantee of future success. That average rate of return could well erode in the coming years thanks to company, industry, and macroeconomic factors.

But those figures above show what can be achieved. The growing number of Stocks and Shares ISA millionaires also underline what can be achieved by drawing up and sticking to an investment plan.

And the chances of successful investing today are improved thanks to the wealth of information available from experts like The Motley Fool.