The FTSE 100 didn’t reward investors particularly well in 2023. Over the 12 months, the index saw around 2% growth, with some companies like Rolls-Royce outperforming massively, and others, like Vodafone, underperforming.

However, there are signs 2024 could be a better year. The index rose 3.2% in December as traders started forecasting significant interest rate cuts in the year ahead.

So if we are lucky enough to experience a rally, who could be the big winners?

What could push the index up?

As the Bank of England lowers interest rates in 2024, fixed-income assets, like bonds and cash, will likely become less appealing, due to diminished yields. As such, investors may shift towards stocks seeking better returns.

This transition can push stock prices higher, driven by the search for more lucrative investment opportunities in the stock market amid a lower-yield environment for traditional fixed-income assets.

In simple terms, if the rate of return on my savings account falls to 2%, I could be tempted to look for better returns on the stock market.

Housing

Of course, it’s worth highlighting that investors and traders look to predict movements in things like interest rates in order to get ahead.

So that can mean changes in interest rates are, to some extent, already priced in. But that’s not always the case as forecasts are by no means guaranteed.

With interest rates, the obvious place to start is housing. Developers have really underperformed the FTSE 100 over the past two years. This happened as inflation pushed building costs up and rising rates reduced housing affordability.

So could fortunes improve? Well, certainly. Falling rates will likely foster demand. And there’s been some positive data too — the housing market has proven much more resilient than many anticipated.

As such, companies like Barratt Developments could outperform the market. Although my personal favourite, due to its affordable housing division, is FTSE 250 stock Vistry Group.

Banks

Banks have seen gains in December amid improving forecasts — a smaller-than-expected recession and falling inflation should contribute to a decline in interest rates.

Of course, the impact of high rates on banks is multi-faceted. On one hand, we’ve seen net interest income increase. On the other hand, the risk of customer defaults has risen.

In 2023, I believe that the ‘risk’ element was the reason bank stocks pushed lower — after all, some institutions were posting record revenues.

But as interest rates cool, and the threat of mass defaults reduce, I believe banks could be among the biggest winners going forward.

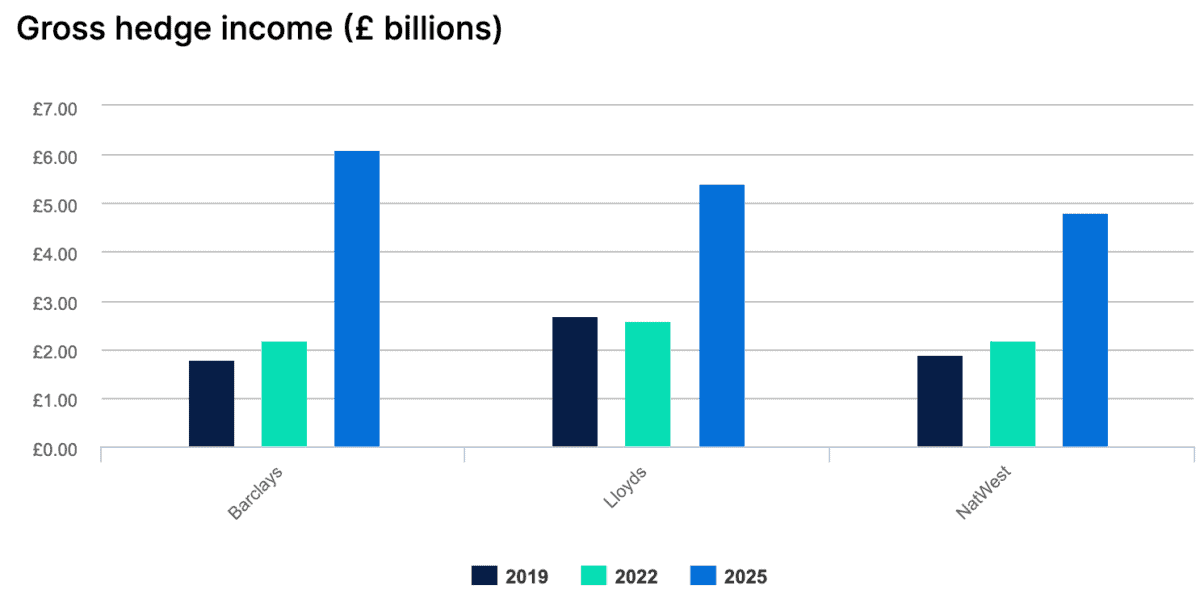

And before we say “what about net interest income?” That’s where hedging comes in. Lloyds and Barclays are among the cheapest banks — according to price-to-earnings (P/E) ratios — in the UK, they could be due a recovery.

What else?

Forecasting the market isn’t easy, especially when taking a broader perspective like we are today.

Other stocks that could be big winners, in my book at least, including Hargreaves Lansdown, which may gain promotion to the FTSE 100 again soon.

Why’s that? Well, as yields on cash and bonds fall, I’d expect to see capital return to stocks as Britons seek stronger returns.

And, of course, heavily indebted firms like BT Group and Vodafone could prosper too. This is by no means an exhaustive list, but my thoughts on the year ahead.