Growth stocks have the capacity to transform my portfolio, and some already have. But equally growth stocks can be much more volatile than their more mature peers. It’s also true that many growth stocks fail to achieve their potential.

Investing regularly

Regular investment in growth stocks provides a powerful strategy for long-term wealth accumulation.

By investing regularly, investors harness the benefits of compounding returns, manage risk through dollar/pound-cost averaging, and participate in the potential of innovative and expanding companies.

This approach not only diversifies the portfolio but also allows for flexibility and adaptability in response to market dynamics.

With an emphasis on fundamental analysis, growth stock investments offer the potential for substantial capital appreciation and act as a hedge against inflation.

So, if I were able to invest £200 a month in growth-focused stocks, I could look to smooth out some of the volatility of the market, while taking positions in high-potential stocks.

A strategy for growth

As mentioned, growth stocks have the capacity to deliver huge gains, but there’s also more risk involved when investing in growth-oriented firms.

As such, I need to have a strategy and a set criteria for my investments. Personally, I like using the price/earnings-to-growth (PEG) ratio as a central part of my growth strategy.

Essentially, I’m looking for companies with a PEG ratio below one, because that suggests the market doesn’t fully appreciate these firms’ expected earnings growth.

The ratio is calculated by dividing the price-to-earnings (P/E) ratio by the expected annualised earnings per share growth over the next three-five years.

Selecting stocks

So, what could my growth-focused portfolio look like. Well, here’s a list of companies with PEG ratios below one, many of which I already own.

| Stock | PEG Ratio |

| AppLovin | 0.64 |

| Celestica | 0.67 |

| Li Auto | 0.04 |

| Lloyds | 0.5 |

| Nvidia | 0.95 |

| Rolls-Royce | 0.5 |

| Super Micro Computer | 0.6 |

These are just a handful of companies that, according to the PEG ratio, are undervalued. The lower the number, the greater the undervaluation.

Investing for growth

As someone who has been investing for a while, I aim for low double-digit returns annually. But maybe if I focused on the stocks listed above, I could see stronger returns.

The thing is, however, I also want to have a diversified portfolio — one which includes, bonds, funds, and more mature companies that can reduce risk.

Nonetheless, despite the risks associated with growth stocks, I expect to make some of the above companies a larger part of my portfolio in 2024.

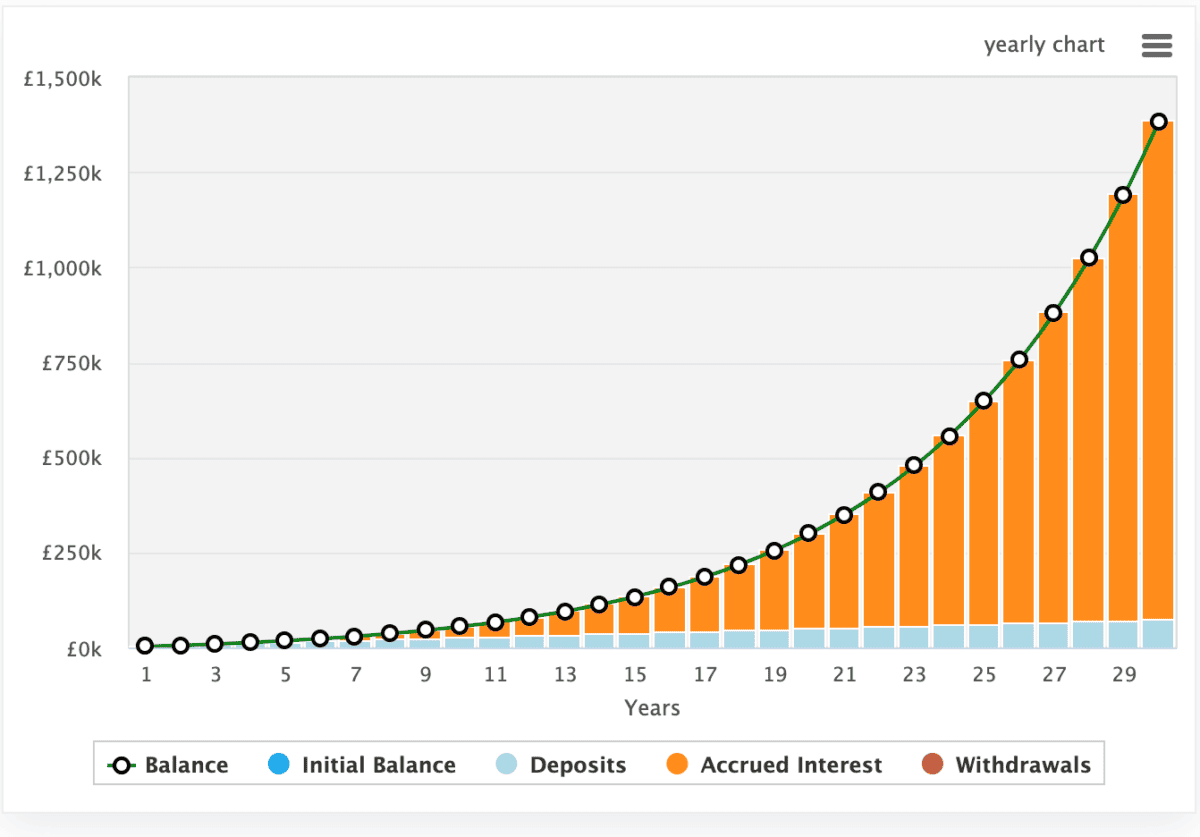

For example, if I could achieve 15% annualised returns, it would take 30 years for my £200 a month to turn into £1.38m.

In the below chart, we can see how this 15% returns compounds year after year, generating exponential growth. As such, much of the growth comes in the latter years.

Of course, 15% annualised returns would be a considerable achievement for an average retail investor. If I were to average 8% annualised returns, which is still considerable, I could expect to have around £300,000 after 30 years — just from £200 a month.