I’m afraid to say I missed the Nvidia (NASDAQ:NVDA) bull run in 2023. The company’s graphics processing units (GPUs) — notably the H100 — have powered a revolution in artificial intelligence (AI), allowing for much more complex computational processes, such as deep learning.

Momentum

Nvidia isn’t short on momentum. The stock is up 249.5% over the past 12 months and this was driven by surging demand for its graphics processing units (GPUs). The company has beaten earnings time after time over the past 18 months.

Momentum is an often overlooked component on an investment strategy. In fact, it can be one of the best indicators of forward performance — although this isn’t always the case.

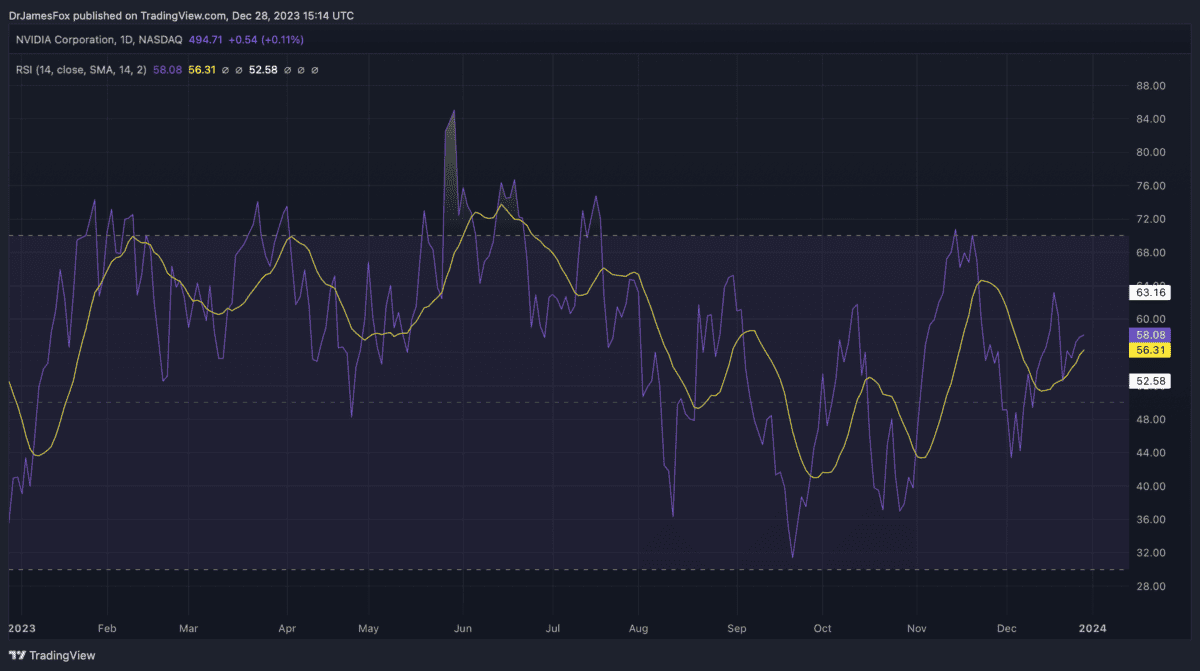

While not a perfect indicator of momentum, I’ve attached a relative strength index (RSI) chart below. It shows the stock has rarely encountered low levels of investor interest over the past 12 months.

Share price targets

At the time of writing, Nvidia shares are changing hands of $494. However, the average share price target is $658, which is 33.3% higher than the current price.

This is normally a good sign as it infers that analysts — notably those that hold a lot of sway over market narratives — have a positive position on the stock.

This isn’t something I always look at first, but it can be useful if I’m looking to see how my research matches up with that big brokerages or banks.

As such, I may want to view this 33% discount versus the consensus share price target as a buying signal. By contrast, I may see the fact that Tesla trades at a 7% premium to its consensus share price target as sell signal.

Valuation metrics

I believe the most appropriate valuation metric when assessing Nvidia is the price/earnings-to-growth (PEG) ratio.

This is an earnings metrics that is adjusted for growth and is calculated by dividing the forward price-to-earnings ratio with the expected annualised earnings growth rate for the next three to five years.

Normally, a ratio of one suggests that a company is trading at fair value. And anything under this may suggest the stock is undervalued.

Nvidia has a PEG ratio of 0.95, which suggest it’s undervalued based on projected earnings over the next five years.

So while it may look expensive using the price-to-earnings ratio, an annualised EPS growth rate of 42.3% over five years means its PEG ratio is attractive.

AI kingpin

Nvidia’s GPUs were once primarily used for gaming. But in the last quarter, the company’s data centre unit saw $14.51bn in sales, reflecting a remarkable 279% on the quarter a year previous.

Of course, other companies are after its crown and there’s no guarantee the firm will remain dominant for long.

However, Nvidia’s chips are by far the best option for efficiently processing the huge quantities of data needed to train and operate generative AI language models — and this means it’ll take a while for other companies to catch up.

In November, Nvidia introduced a new top-of-the-line chip for AI work, the HGX H200. The new GPU upgrades the wildly-in-demand H100 with 1.4x more memory bandwidth and 1.8x more memory capacity.

Personally, I’m still interested in Nvidia, and I’m looking to add the stock to my portfolio. I’m expecting more growth in 2024.