If history is anything to go by, 2024 could be a big year for the FTSE 250. In the UK, interest rates have most likely peaked (most economists expect several cuts this year). And in the past, when rates have peaked, the UK’s mid-cap index has outperformed the broader UK market by a decent margin over one, three, and five-year periods.

Here, I’m going to explain why the FTSE 250 tends to outperform after a peak in interest rates. I’ll also highlight three stocks in the index that I like the look of as we start 2024.

High returns

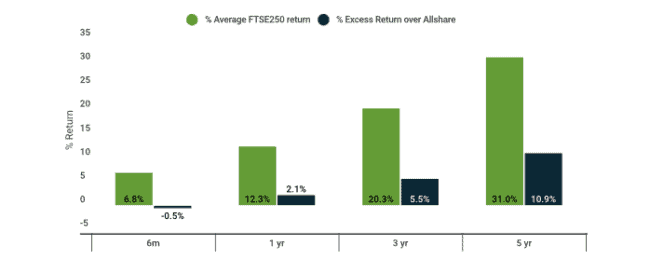

The chart from investment manager Martin Currie below shows the excess returns that the FTSE 250 has generated in the past when UK interest rates have peaked.

Source: Martin Currie

Over the following one-year period, for example, the index has delivered a return of 12.3% on average – 2.1% higher than the broader UK market.

As for why the index has outperformed in the past, it’s down to the fact that mid-cap companies tend to be more sensitive to interest rates than large-cap businesses (because mid-caps generally have more need for debt funding).

So, when interest rates fall, their profits can get a real boost.

Three stocks to consider

Moving on to FTSE 250 stocks I like right now, first up is pub operator J D Wetherspoon.

It has quite a bit of debt on its balance sheet, so lower interest rates should benefit the group.

At the same time, the company – which offers low-priced food and drinks – is well positioned in the current economic environment where consumers are looking to get more for their money.

Of course, the debt here does add risk. I think the company should be able to service it, however, given its cash flows.

The second stock I want to highlight is IT specialist Computacenter.

One reason I’m bullish here is that the company is well positioned to benefit from digital transformation across the corporate world. This is a massive theme globally today.

Another is that it’s a very profitable operation. Over the last five years, return on capital has averaged 24%.

Additionally, its valuation is very reasonable. Currently, Computacenter has a price-to-earnings (P/E) ratio of just 15.5. That’s quite low for a tech stock.

It’s worth pointing out that a downturn in IT spending is a risk in the short term. I’m confident in the long-term story, however.

Finally, I want to highlight Dowlais Group. It’s an engineering business with a focus on the automotive sector.

This stock looks really cheap right now. Currently, it has a P/E ratio of just 6.2.

I see a lot of value at that multiple.

Recently, the company said that it remains confident of delivering sector-leading performance going forward. It added that its largest business, GKN Automotive, has a number of major new programme launches planned across its portfolio, and these are expected to drive profitable growth ahead of the market.

A slowdown in the car industry is a risk here. At the current valuation, however, I like the risk/reward set-up.