I love to look for shares on sale in the FTSE 100. That way, I usually think they’re more likely to go up.

One of the companies that’s just caught my eye is Associated British Foods (LSE:ABF).

What I liked about this company the moment it came on my radar was its financial statements. I’d actually never heard of it before I looked through the FTSE 100 list recently.

That’s not how I usually find shares, mind you. I like to have first-hand experience with the products.

So, I did some extra research on the company, and here’s what I found.

What does the organisation do?

Associated British Foods is a diversified business, including food, ingredients, and retail.

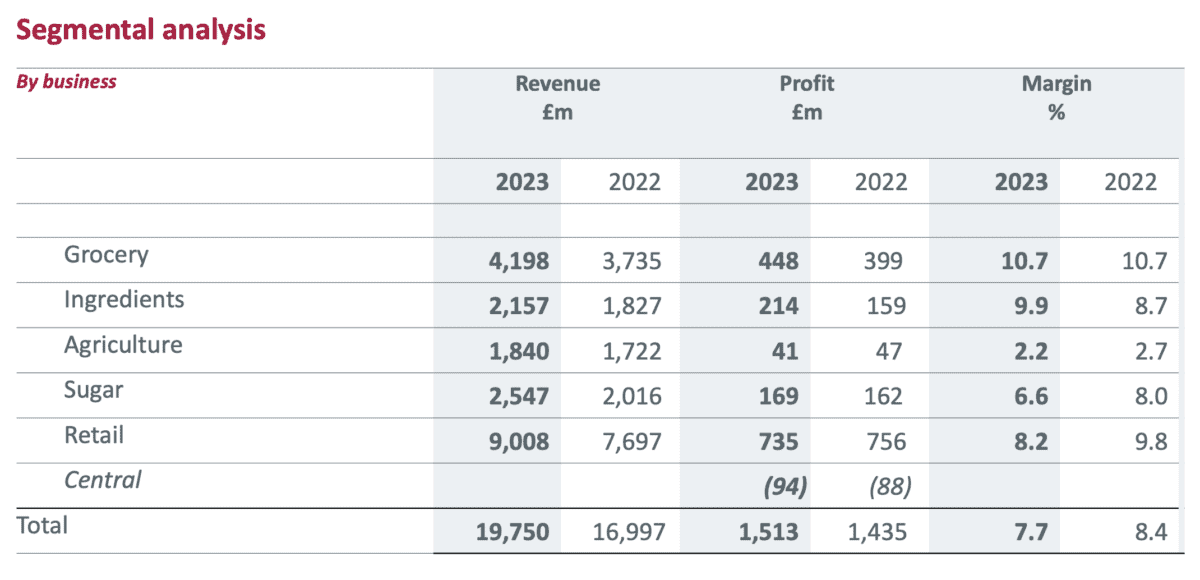

I’ve found a helpful table from the company’s 2023 investor presentation. Here are some of the words I think will be useful to know.

‘Segmental’ refers to different portions of the total revenue stream.

‘Margin’ refers to the profit divided by the total revenue.

And ‘Central’ refers to corporate costs rather than costs associated with any particular division.

Let’s take a look:

What I find most interesting about this table is that the largest revenue streams (retail and grocery) also have the highest margins (9.8% and 10.7%).

Now, it’s worth noting the company has significant competitors. These include Nestle, Danone, and Kerry Group. Having such strong peers in the industry could prove a long-term disadvantage to Associated British Foods.

What do the financials look like?

While it’s nice to know a company is well diversified, paying acute attention to financial statements is how I aim to get ahead in investing.

The three main statements in investing are the balance sheet, the income statement, and the cash flow statement.

Usually, I’ll look at the income statement first. Associated British Foods’ one seems pretty good. Revenue has steadily increased from £10.4bn in 2008 to £25.4bn today.

However, liabilities have been increasing on the balance sheet, typically concerned with debt and the company’s assets. In 2019, total liabilities were around 30% of total assets; today, they’re about 40%.

Based on the time that happened, it looks like the pandemic negatively affected the company. It’s done well to keep itself relatively stable, in my opinion.

A look at the price

Here’s why I’m most interested in Associated British Foods right now: the price. It’s currently down around 30% since 2015!

But the company’s price-to-earnings (P/E) ratio is around 18. That’s not too bad, but it’s not exactly cheap, considering 1,300 companies in the consumer-packaged goods industry have an average P/E ratio of about 18.5.

Mind you, one of the reasons the price could be down is that net income was £1.2bn in 2017, but it dropped to as low as £455m in 2020. The good news is now it’s back up to £1bn.

Personally, I think the shares look quite good right now.

Closing thoughts

While I think the business has some compelling points, it’s too soon for me to know whether I would buy the shares.

From my ongoing research, I know there are other companies I’m more convinced of, and some I already own that I want to buy more shares in when I can.

Let’s see, though; this is a good deal after all, in my opinion.