In the UK, much of our wealth in held in the homes we live in or in low-rate savings accounts. And that means it can be very challenging to build wealth and earn a second income.

But it doesn’t have to be that way. Even with limited starting capital, it’s possible to build a substantial portfolio, and create a second income that’s large enough to sustain oneself.

So, here’s how it’s done.

Building wealth

With £1,000 in savings, I couldn’t hope to earn more than £80 a year as a second income from investing. I’ve got to be realistic and accept it’s going to take time.

However, through a deliberate mix of consistent contributions, targeting robust returns, and compounding, I can lay the groundwork for future financial success.

Firstly, regularly injecting funds into the portfolio serves as a crucial accelerator, amplifying the compounding effect.

It doesn’t have to be a huge amount, perhaps just £100 a month. But the more I add, the more money I’ll hopefully have in the future.

Moreover, by strategically aiming for strong, yet achievable returns, I can hope to see my wealth multiply over time.

This thoughtful approach recognises the interconnected roles of contributions, compounding, and stable returns in sculpting a prosperous financial future despite limited starting capital.

Investing wisely

Investing offers the opportunity to generate returns far greater than one can achieve by putting money in a savings account.

One portfolio that I follow is up 68% over the past 18 months. It’s incredible growth and it just keeps delivering.

However, this can mislead novice investors who are drawn in by past performance, and in the end, make the wrong decisions.

As Warren Buffett tells us: “Rule No. 1: Never lose money. Rule No. 2: Never forget Rule No. 1.”

This succinctly captures his emphasis on the importance of capital preservation in the realm of investment, but it’s very important for all of us.

If we lose 50%, we’ve got to gain 100% just to get back to where we were.

This is why it’s important to make the most of online resources, like The Motley Fool, that have done so much to democratise investing in recent years.

How it could look

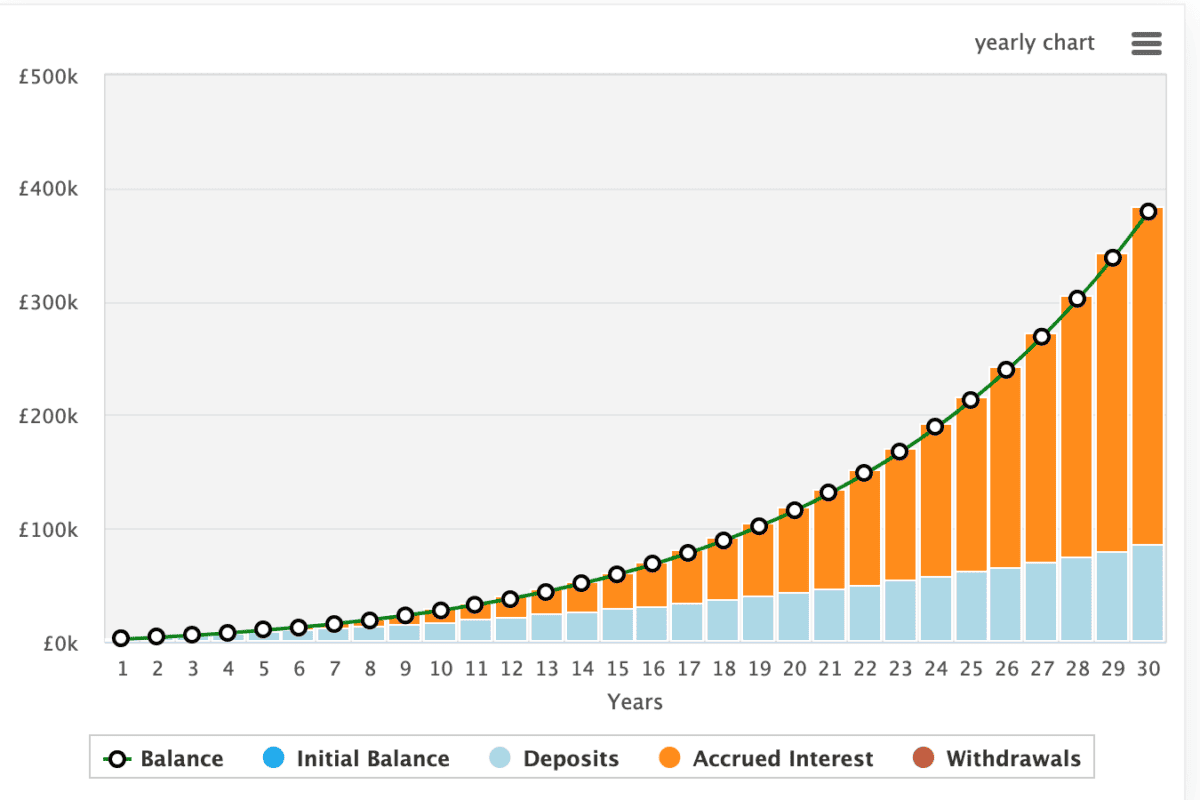

Let’s imagine I’m starting my investment journey with £1,000 and every month I contribute £100, while increasing the size of that contribution by 5% annually.

Of course, it’s going to take time to get where I want to be, but that’s inevitable. So, here’s how my investment journey could look.

In this example, I’ve used a rate of annualised returns of 10%. That’s a strong return for a novice investor, but it’s perhaps in line with what a more experienced investor might look to achieve.

After 30 years, I’d have £379,158 and with this, I could look to generate around £30,332 without touching the principal.