I’m not typically a dividend investor, and I always like to reinvest any I receive into my portfolio. But when I find a great company that also provides a second income from dividends, that’s a bonus.

So, I started with all of the companies in the FTSE 250 and FTSE 100 indexes. Then, I filtered them down based on specific parameters.

Here’s one I think could be up there with the best regarding the financials and the dividends it pays.

Hargreaves Lansdown

I want to understand the company better before getting into the dividends.

So, Hargreaves Lansdown (LSE:HL) is a UK-based financial services organisation offering investment management and stockbroking services.

It is in the FTSE 100 index, which puts it in the top 100 companies based on value listed on the London Stock Exchange.

While the company’s share price is down nearly 70% since the pandemic began, it’s up over 260% since it first became publicly traded in 2007.

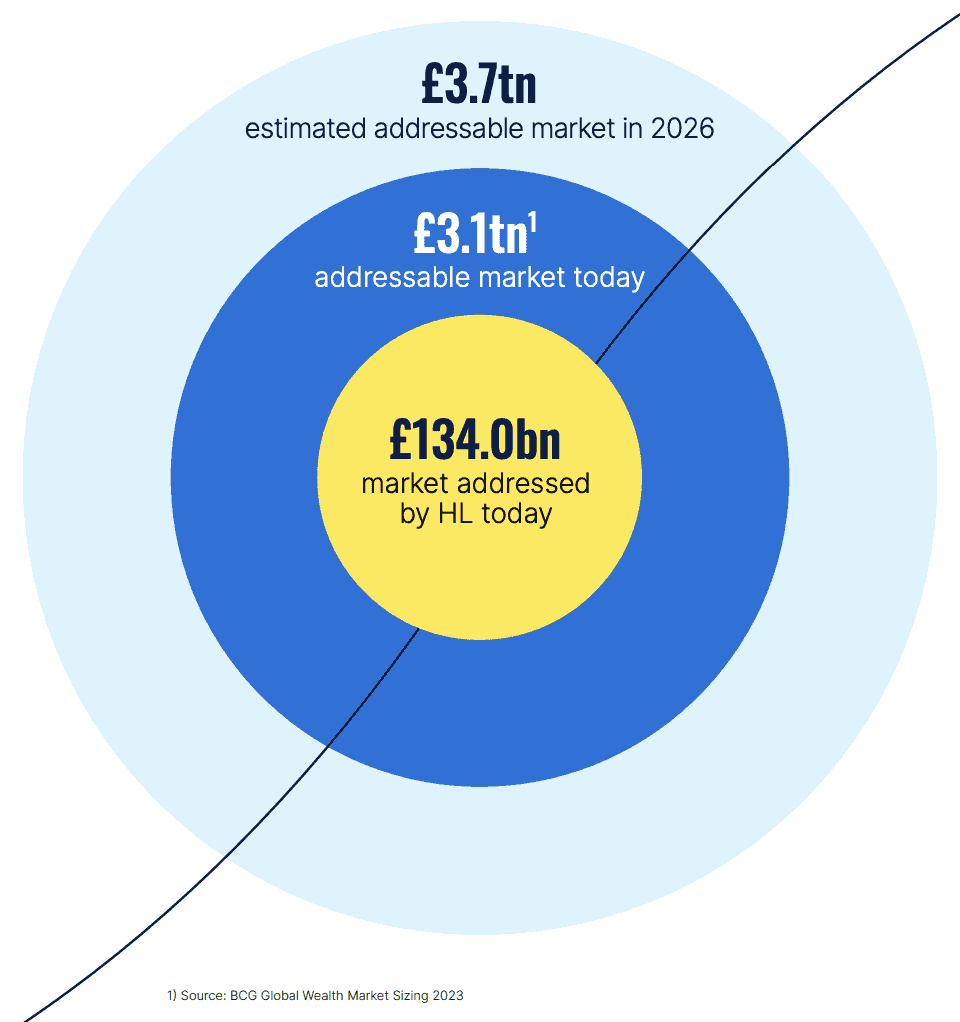

The management has presented in its 2023 annual report that they have £134bn of the £3.1tn financial services market they could potentially tap into:

A closer look at its dividends

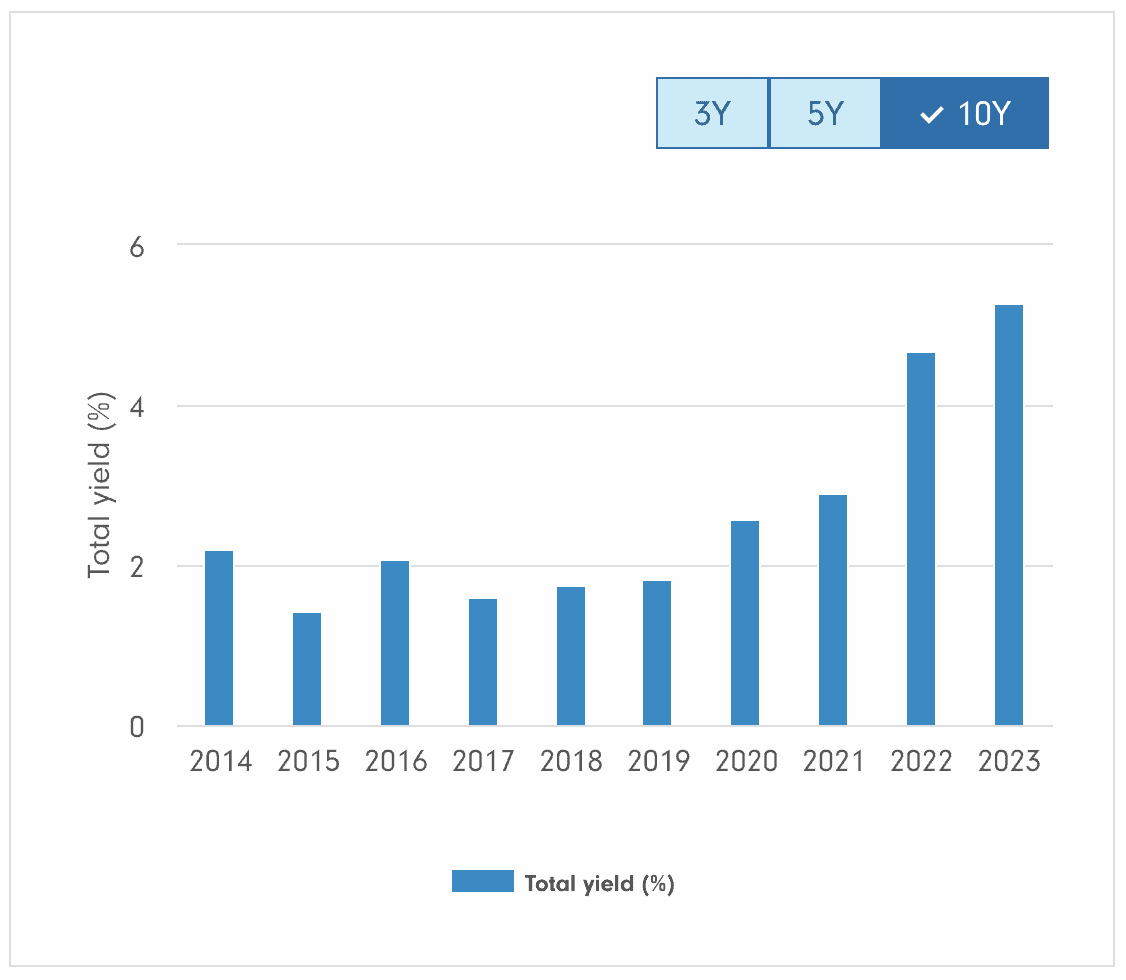

Hargreaves Lansdown has a 5.5% dividend yield right now, meaning it pays out that percentage of the total investment in dividends.

There have also been no dividend reductions since 2016! That’s music to my ears when I think about potentially building a passive income.

Here’s a really useful visual chart representing the history of the company’s dividend yield since 2014:

Of course, dividends are never guaranteed, and they can fluctuate at any time, given the board and the management’s decisions.

A Christmas bargain?

Seeing the price down so significantly right now could mean the shares are on sale for me right in time for Christmas.

Evidence to me why buying the shares at such a low value could be a good idea is a 10-year 8.40% average annual revenue growth rate.

Also, the average annual revenue growth rate over one year is 26%. I think that’s impressive.

However, one of the weaker areas of the company’s financials is its equity-to-asset ratio.

This is a ratio I find very useful in outlining how much of a company is entrenched in debt.

The higher the ratio, the better.

For Hargreaves Lansdown, the ratio is 0.55. That’s worse than 80% of over 1,700 companies in the asset management business.

Yet, I think the overall picture of Hargreaves Lansdown presents a bargain opportunity for me if I was focused on dividends.

My verdict

As I’m not typically a dividend investor, I’m not buying the shares right now because other companies have taken my attention.

However, I think the company has strong financials and is trading at a low price. The 5.5% dividend yield is also impressive to me. So, for those reasons, I’m putting it on my watchlist.