The FTSE 100 index reached its highest closing value of 8,012.53 points on February 16, 2023. This marked a significant milestone for the index that had been treading water for some time. The index is only up 12% over five years.

The index’s surge to 8,000 points was driven by a combination of factors. This included strong corporate earnings, a recovering global economy, and the outperformance of the resources sector, which is well-represented on it.

That bull run came to an end with the Silicon Valley Bank fiasco, and we’ve seen further downward pressure during the year.

A resurgence

The FTSE 100, along with other global indexes, surged last week as central banks hinted at an end to an aggressive fiscal tightening programmes aimed at countering inflation. This reduced the uncertainty surrounding interest rate hikes, which had weighed on market sentiment.

More generally, concerns about a potential economic downturn have subsided, with positive economic data and improving corporate earnings boosting investor confidence.

The Purchasing Managers’ Index (PMI) for the UK and other major economies showed strong growth in the manufacturing and services sectors, while corporate earnings reports generally exceeded expectations.

Interest rates and stocks

The relationship between interest rates and stocks, particularly their attractiveness to investors, is rooted in the opportunity cost of capital.

When interest rates are low, returns from fixed-income investments like bonds are less attractive. As a result, investors may turn to stocks seeking higher potential returns.

Conversely, when interest rates rise, the appeal of fixed-income investments increases, potentially making stocks less attractive.

However, the relationship is nuanced, considering various economic factors.

More broadly, in a low-interest-rate environment, stocks may be favoured for their growth potential, while in a high-interest-rate environment, income-generating assets like bonds might gain preference.

So, with interest rates expected to fall, capital should move away from debt and cash, towards stocks.

And the faster interest rates fall, the more quickly we can expect to see this transition from debt to stocks.

A healthy forecast

Forecasts change all the time. However, one I often keep an eye on is from the Economy Forecast Agency. Its prediction isn’t always correct, but from time to time, it’s been very accurate.

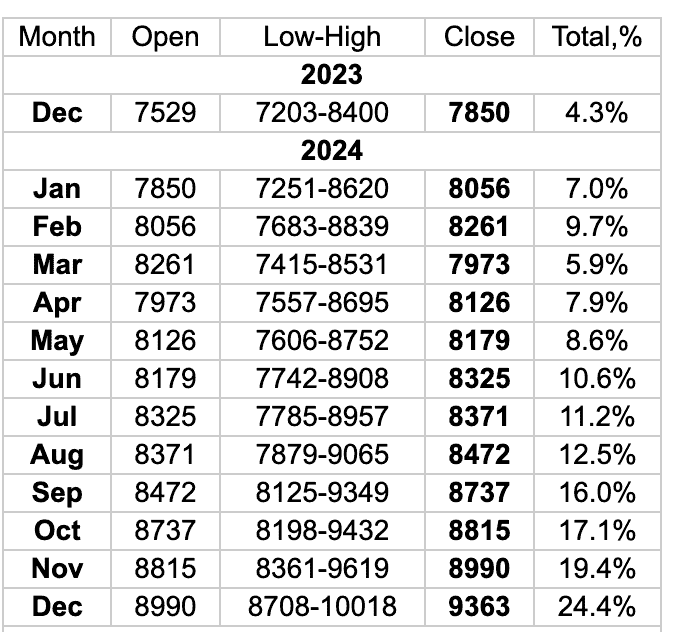

Following the recent dovish narratives from the US Federal Reserve and changing sentiment within the Bank of England, the forecast has recently been upgraded. And it looks pretty good.

As we can see, the agency expects to see the index close above 8,000, at 8,261 in January, representing a healthy 7% premium on the current position. That’s great.

It also suggests that UK stocks will go from strength to strength during the year. The index could close at 9,363 in December 2024. That’s 24.4% above where we are now.

Maybe we can assume that this improving forecast is related to falling interest rates. If so, a January rise to 8,000 might not happen, but a 2024 rise to that level just might.