Back in the late 1990s, at the height of the dot.com bubble, Vodafone shares (LSE: VOD) were a staple of investor portfolios. A quarter of a century on from that period of speculative mania, its share price is still worth a fraction of its peak of nearly 500p.

Of course, that was then. This is now. So, can I make a case for adding it to my portfolio today?

12% dividend yield!

Offering the highest dividend yield in the FTSE 100 is certainly a headline grabber. The problem is that this juicy yield is solely a function of a falling share price.

As a consequence of this drop, the sustainability of its dividend has been called into question. The company remains circumspect on this front. During H1 results in November, all it would commit to is to “reevaluate our capital allocation if the shape of the Group was to change”.

Whether or not it does cut its dividend is, to me, neither here nor there. What matters more, as a long-term investor, is whether the company is capable of sustainable growth.

Capital intensive

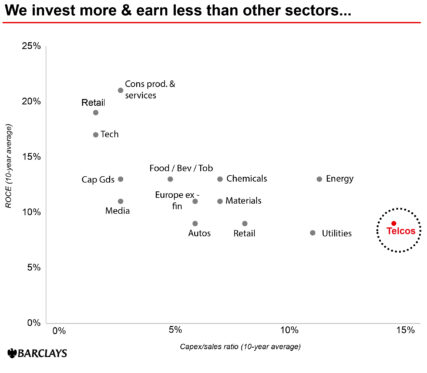

Following the likes of Warren Buffett and Terry Smith, one key metric I like to use in assessing growth, is return on capital employed (ROCE).

The following chart shows how telcos are considerably more capital intensive than any other industry. But they struggle to turn that capital into excess profits. It’s little wonder that total shareholder returns has been so poor for over a decade.

Source: Vodafone Company Presentation

Capital dynamics are unlikely to change into the future. For example, consider the investments that are required into the roll out of 5G. Still, this fact alone doesn’t explain why the Vodafone share price has underperformed relative to its peers.

Crisis of identity

There are so many reasons why the company has fallen behind its peers. Poor customer satisfaction, together with a secular decline in revenues across key markets, are two prominent ones. But fundamentally I see these issues as existing as a subset of a larger problem.

Vodafone’s heritage is firmly in consumer connectivity. But as that market approaches saturation, it has begun pivoting to more profitable endeavours, namely business revenues.

As a consequence, I believe it is going through a kind of crisis of identity. The needs of business and consumer clients are quite different. But what both do expect is simplicity and, above all, a reliable service.

I have no doubt that Vodafone will remain a dominant player in the space. Its brand is one of the most powerful and recognisable, not only in the industry but across the world.

My main problem is I remain to see any real evidence that a turnaround is imminent. Yes, a new CEO is in place. She has not minced her words concerning the state of the company.

Like a super tanker, changing direction isn’t going to occur simply by moving the helm. Therefore, before I consider buying any of its shares, I need to see tangible evidence that its transformation is beginning to gain some traction.