Plenty of us put a bit of cash aside each month. But not all of us make that money work as hard as it could do. And unfortunately, that’s what we need to do if we want our savings to turn into passive income.

So how can I turn my monthly savings into a monster passive income?

Savings accounts

The majority of us in the UK put our money in savings accounts rather than investing in stocks and shares. In fact, as a country, our participation in the stock market is quite low, at just 8%. Meanwhile, Britons have ploughed over £1.8trn into savings accounts rather than investing.

Obviously, it’s great that we’re putting money aside. However, savings accounts don’t offer the best rates of return.

For example, my HSBC savings account is currently offering me 2% AER, and that’s up from 0.25% over the past decade.

If I had left my money in there, I really wouldn’t have seen much growth. And looking forward, I still wouldn’t be getting much in the way of interest.

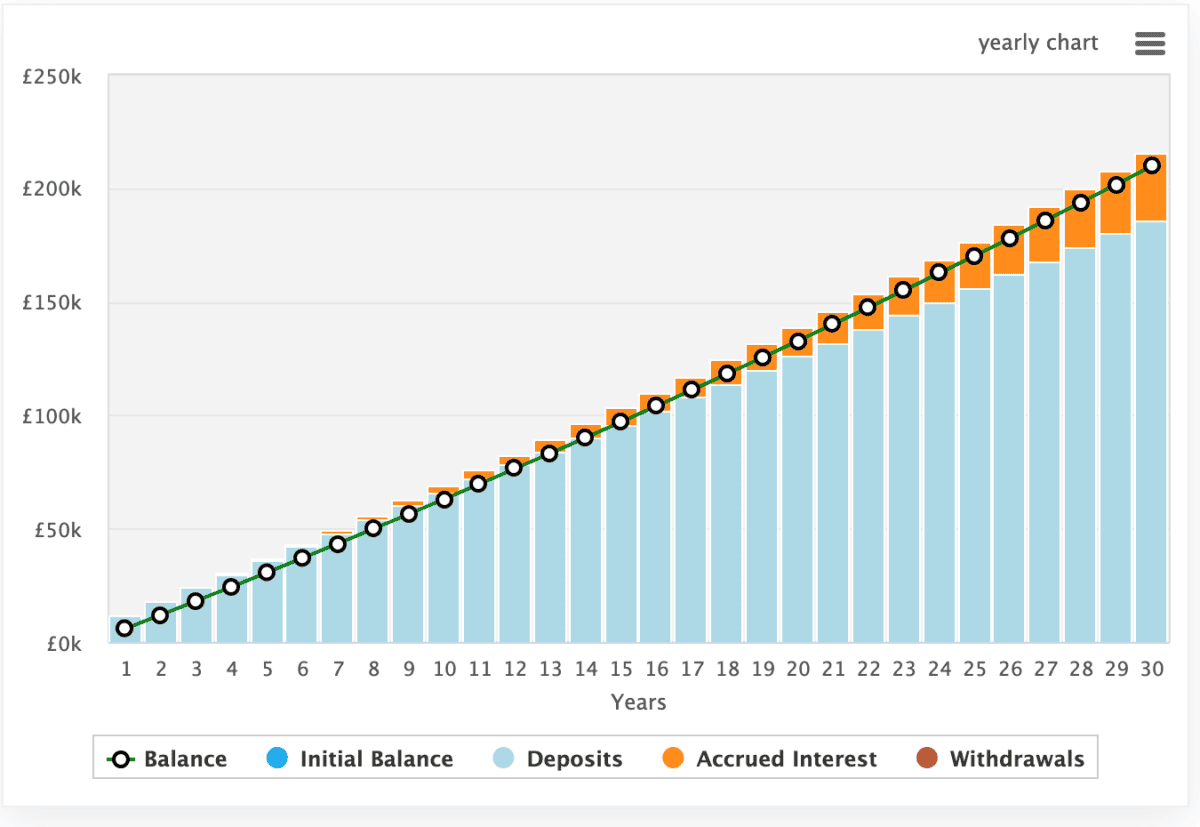

Just look at the example below. Here, I’ve assumed AER of 1% on average over 30 years while putting aside £500 a month — which is my personal aim.

But as we can see, the accrued interest is only a fraction of my deposits. After 30 years, I’d have £209k, with £29k of that being interest.

We can do much better.

Investing and compounding

On the other hand, investing is more risky, but offers the opportunity for much better returns. In fact, novice investors aim for returns in the realm of 6-10%, while I aim for annualised returns in low double digits.

And, of course, these returns compound over time. Compound returns mean earning money not just on the original investment, but also on the money I’ve already made.

It’s like making interest on my interest. Over time, this snowball effect can grow my wealth faster, as my earnings keep building on themselves.

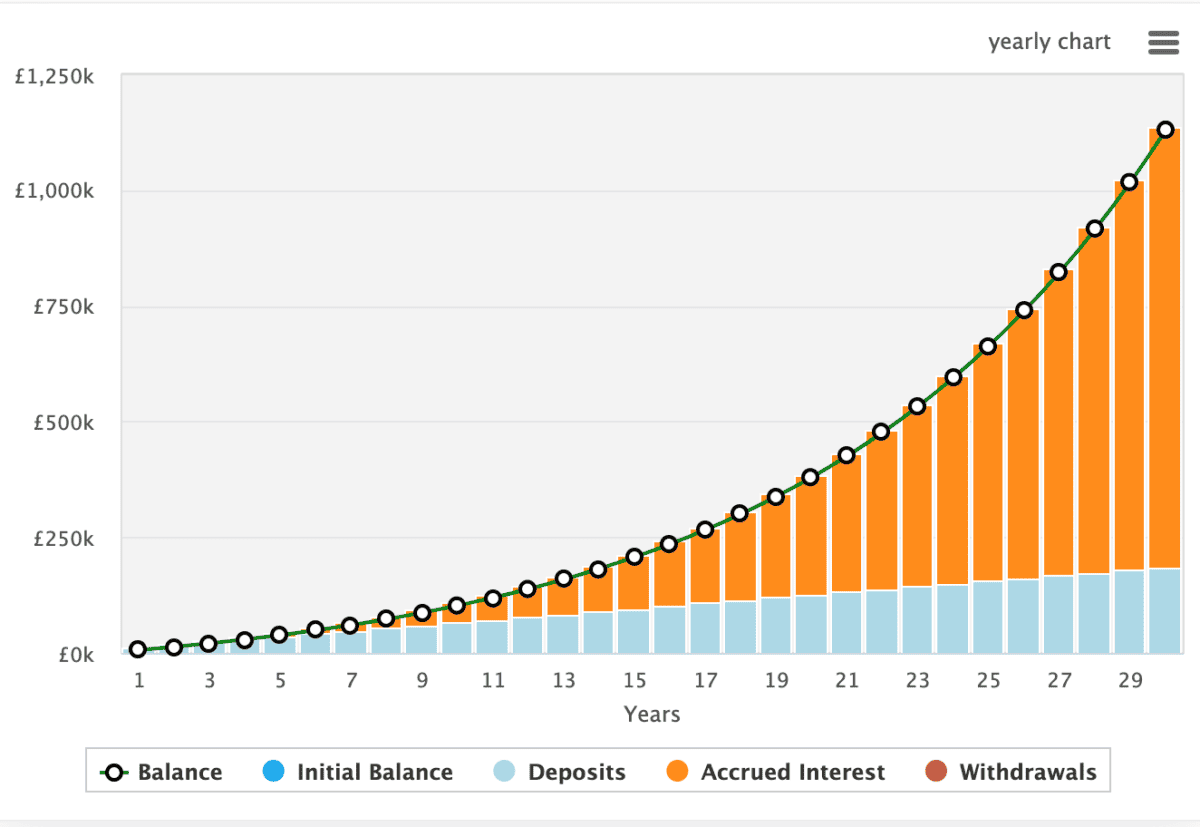

As we can see from the example below, the growth rate is exponential as my money compounds year after year. Here’s how £500 a month grows with a 10% annualised return. After 30 years, I’d have £1.13m.

Generating passive income

Once I’ve generated a level of wealth that I’m happy with, I can then think about generating passive income. The easiest way to do this would be to transition my investments towards dividend-paying stocks.

Of course, we’re talking 30 years’ time but, at the moment, I’d invest in companies like Legal & General and Phoenix Group which offer dividend yields of 8.1% and 10.1% respectively.

If I were able to achieve an average dividend yield of 8% with a portfolio of £1.13m, I’d be earning £90,400 a year in passive income. That’s a really healthy return, even though inflation would make it worth a lot less than it is today.

It all sounds great, but I’ve got to be wary of making mistakes. Many novice (and experienced) investors get it wrong and lose money. I also have to remember that I might undershoot my percentage returns target. That’s why I need to use the array of resources available to me, including The Motley Fool.