Warren Buffett is among the most successful investors of all time. He’s amassed a fortune worth in excess of $120bn.

I could never hope to amass a fortune that large. However, I can certainly use his teachings to help me build my wealth over time.

We all have very different ideas of what it means to be rich. But for me, it would probably revolve around the notion of earning a passive income.

So maybe I could aim for a portfolio that could deliver double the average UK income in the form of passive income.

If I was starting from nothing, that could also certainly be considered ‘getting rich’. But is it possible? Absolutely, but it wouldn’t happen over night.

Here’s how Buffett can help me achieve it.

The power of compounding

“My wealth has come from a combination of living in America, some lucky genes, and compound interest“, Buffett has said.

And he’s been investing for a long time. In fact, he’s had nearly 70 years of compounding to help his portfolio grow.

But we can all benefit from compound returns because It’s not reserved for the wealthy or financial experts.

By starting early, investing wisely, and staying consistent, anyone can unlock the remarkable potential of compounding just by reinvesting year after year.

Over time, even small contributions can grow into substantial wealth, thanks to the snowball effect of earning returns on both the initial investment and its accumulated earnings.

Don’t lose money

Buffett’s “Rule 1: Never lose money. Rule 2: Never forget Rule 1” reflects his emphasis on capital preservation.

For him, avoiding losses is paramount because recovering from a financial setback demands disproportionately larger gains. For example, if I lose 50%, I’ve got to gain 100% to get back to where I was.

This principle underscores the importance of thorough investment research, risk management, and a focus on the long term. It’s also why we see Buffett looking for a margin of safety on his investments.

He wants to invest in stocks that are undervalued because they may not have far to fall, but they could gain quicker than the index average.

How could I do it?

So what do I need to do? Well, bringing it all together, I need to do my research, use resources to help me make wise investment decisions, and reinvest my returns. But, of course, if I’m starting from nothing, I need to be making regular contributions.

Currently, the average income in the UK is around £30,000. And I’m going to assume it grows at 2% annually. So how much passive income would I need to earn to get double the average UK income?

| Average income | Double average income | |

| Now | £30,000 | £60,000 |

| 10 years | £36,635 | £73,270 |

| 20 years | £44,739 | £89.478 |

| 30 years | £54,636 | £109,272 |

Well, here’s how I think I can come pretty close to earnings twice the UK’s average income, at least according to my forecast.

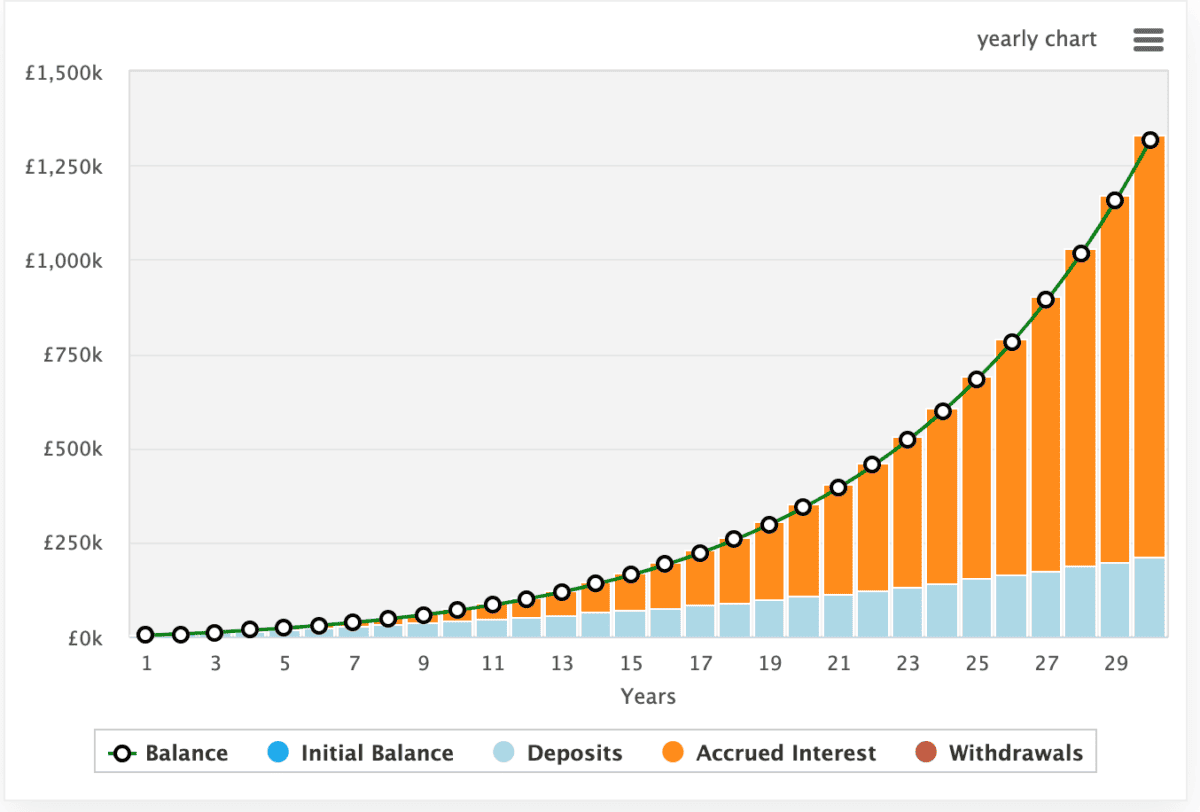

The chart below shows wealth accumulation when contributing £250 a month — increasing at 5% annually — reinvesting, and achieving an annualised return of 12%.

After 30 years, I’d have £1.32m. And with that invested in stocks paying an 8% dividend yield (which is achievable today but maybe not in 30 years), I’d receive £105,600. That’s not bad.