Ask 100 people why they invest, and more than half will talk about a second income, whether that’s to be taken today or at some point in the future.

However, on average, Britons save roughly £105 a month — a figure that varies significantly depending on an individual’s income.

As such, it’s unsurprising that many of us don’t have a huge amount of money set aside.

So if I was starting with £2,500 in savings, I’ve got to be realistic. There’s no way I can expect to generate a life-changing second income in the near term.

Even with all that money invested in Phoenix Group, which pays an index-topping 10.5% dividend yield, I’d only be earning £262.5 annually.

Getting richer

So if I’m aiming for a life-changing second income, the first step is to build some funds.

There are three parts to my strategy:

- Investing: Savings accounts offer meagre returns, even today despite interest rates being higher than they’ve been for decades. While my HSBC savers account offers me 2% AER, I aim for double-digit returns on my investments.

- Keep on contributing: It goes without saying that the more I contribute, the easier it is to grow my portfolio. It’s like providing more fuel to the fire, and even £105 a month could make a huge difference over the long run.

- Reinvesting: It’s something we Fools write about a lot. Reinvesting allows for compounding, leading to exponential growth over time.

Compounding

If I start with £2,500, contribute £105 a month, and place it in my HSBC savings account with 2% AER, after a year I’d have £3,822. Total interested earned: £62.

However, if I start with £2,500, contribute £105 a month and invest it, targeting a 10% annual return, after a year I’d have £4,081. Total interested earned: £321.

There’s a clear advantage to the investing route here, although I must recognise investing isn’t risk-free.

But the real benefit of the investing route comes over the long run, and when I harness the power of compound returns.

That’s because when I reinvest, I’m creating an ever-expanding base from which I can earn even more interest.

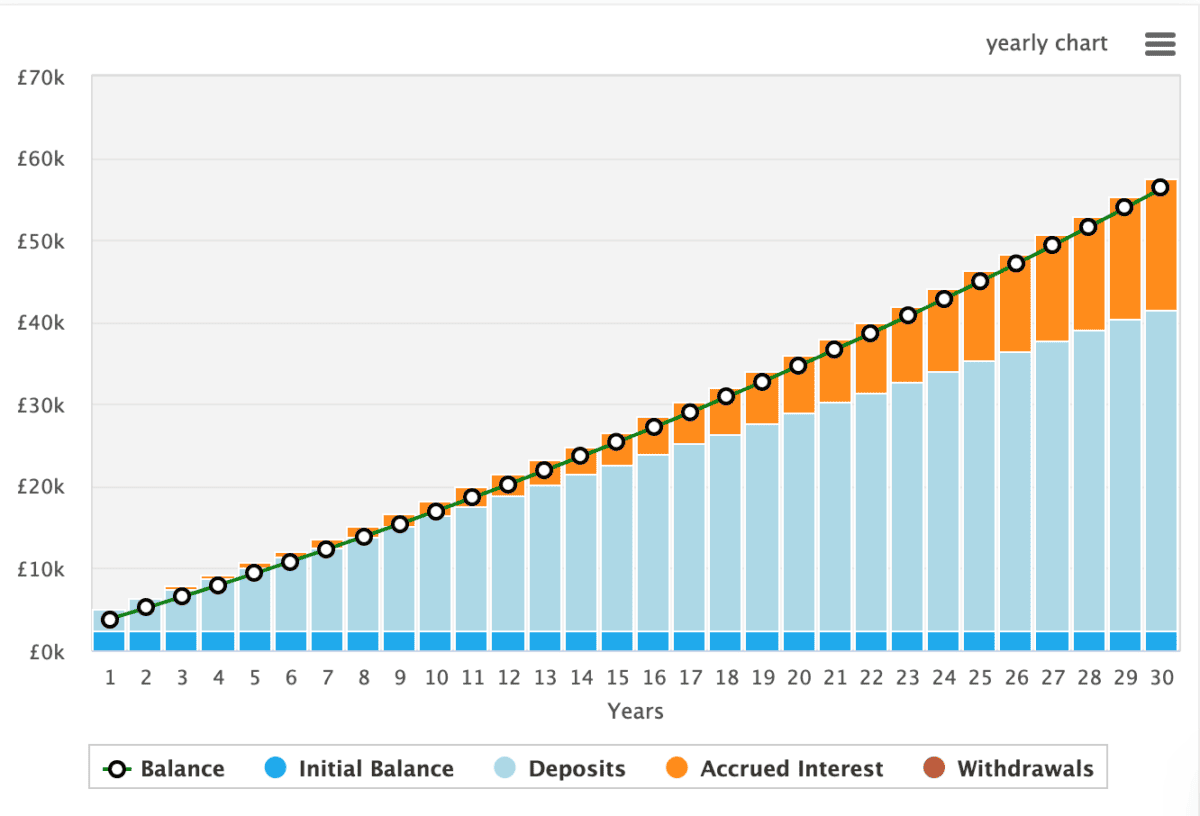

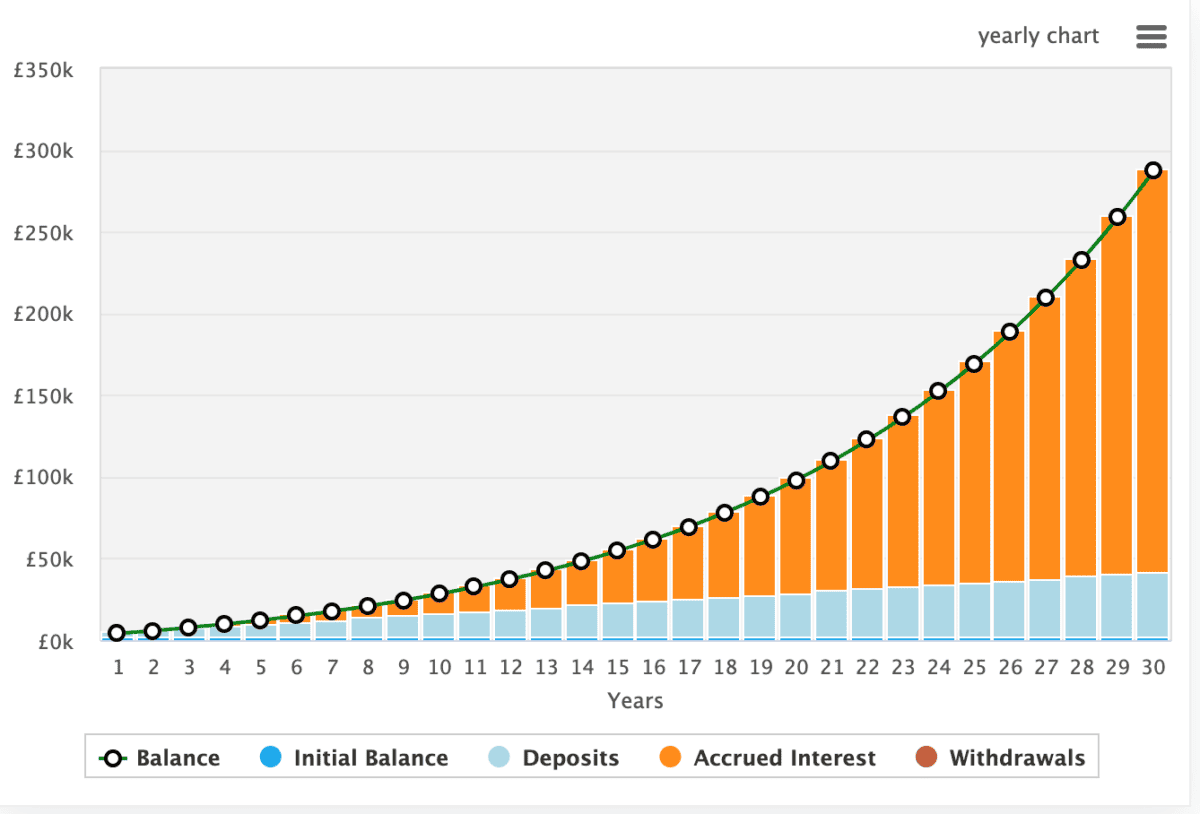

Here’s what happens when I continue the earlier examples over a 30-year period. Figure 1 shows my savings growing at 2%, while Figure 2 shows my investments growing at 10%.

My take

After 30 years, in example one, I’d have £56,289, and on the 30th year it’d generate a second income worth £1,100. Meanwhile, at the end of example two, I’d have £289,944, which would generate £27,113 in the final year.

Is there a catch? Well, it’s all about risk. There’s practically no risk involved in leaving my money in a savings account.

However, if I invest poorly, I could lose money, and losses can compound. That’s why I need to research my investments and take advantage of democratising platforms such as The Motley Fool.