Warren Buffett is among the most successful investors of all time, amassing a fortune worth in excess of $120bn. Meanwhile, Berkshire Hathaway, the company he’s run since 1970, is now worth $772bn.

So what are his golden rules and how can they help me turn an empty portfolio into a thriving one?

Don’t lose money

Buffett’s first rule, “don’t lose money”, underscores the importance of capital preservation in investment.

The thing is, if I lose 50%, I’ve got to grow 100% just to get back to where I was. So it can make my investment journey even harder.

This principle reflects Buffett’s belief that safeguarding initial investment is paramount for long-term success.

And by avoiding substantial losses, investors can compound their wealth more effectively over time. Because losses can also compound.

Find value

Buffett’s principle of “look for value” reflects his investment philosophy centred on acquiring stocks at prices below their intrinsic worth.

By seeking undervalued assets, he aims to capitalise on market inefficiencies and uncertainties, ultimately generating long-term wealth.

We can do this by using metrics such as the price-to-earnings ratio, the price/earnings-to-growth ratio (PEG), and the discounted cash flow valuation to identify undervalued stocks.

Historically, Buffett has sought to buy companies that are under-appreciated by the market and may not realise their potential for some time.

However, increasingly the ‘Oracle of Omaha’ has invested in companies with more momentum behind them — like Apple which represents more than half the total Berkshire Hathaway portfolio.

Of course, we can all have our own interpretations of Buffett’s stock picking.

Personally, I only buy stocks I believe are trading at a discount to their intrinsic value. However, some of the stocks I’ve recently added to my portfolio have already surged.

For example, I’ve bought back into stocks including Rolls-Royce and Li Auto, while taking new positions in AppLovin.

As we can see from the table below, they’ve already performed well this year, but remain undervalued when adjusted for growth.

A PEG ratio under one, normally suggests a company is undervalued.

| AppLovin | Li Auto | Rolls-Royce | |

| Performance one year | +233% | +61% | +212% |

| PEG ratio | 0.63 | 0.06 | 0.52 |

Compounding

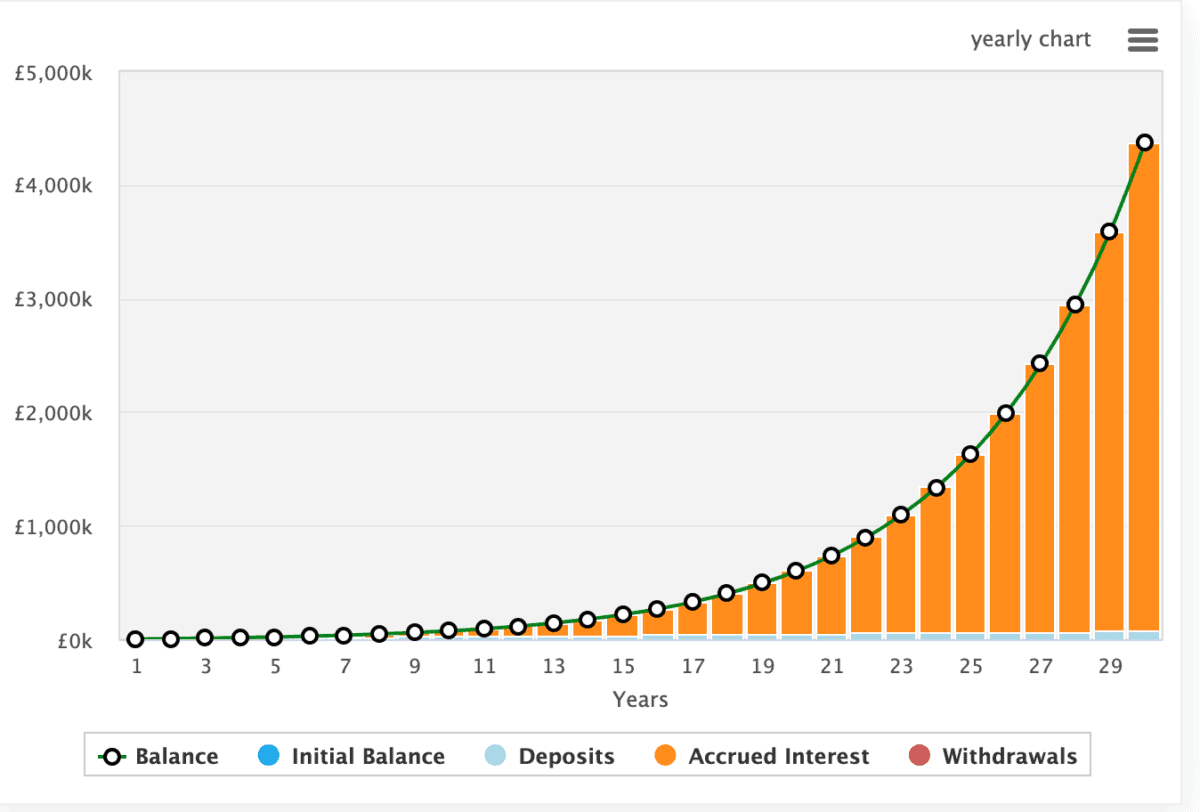

Buffett’s investment success lies in his ability to achieve strong annual returns, and compound these gains over decades.

The investing genius has achieved annualised returns of 19.8% from 1965 to the present, compared with 9.9% for the S&P 500.

Coupled with the compounding effect — magnifying growth by reinvesting profits — has led to remarkable wealth accumulation.

As we can see in the chart above, if I were to start with nothing, but contribute £200 a month to a portfolio, and achieve Buffett-esque returns, I’d have £4.4m after 30 years. That’s the power of compounding.

However, investing isn’t risk free. That’s why I need to make sensible investment decisions, and use all the resources available to me to avoid common pitfalls.