I think it’s tempting to buy a FTSE 100 index fund, after all, that’s an easy route into investing. But the 20-year FTSE 100 average annual return is 5%, and that’s not very competitive.

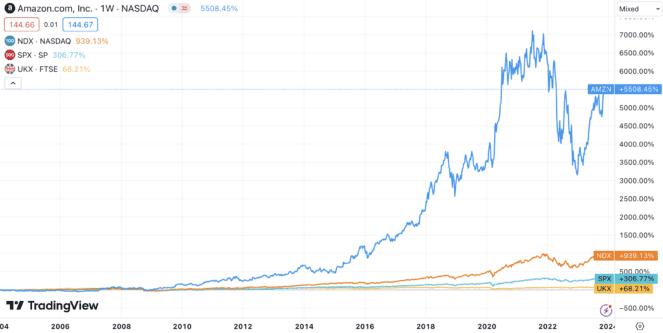

To illustrate this, let’s look at the share price increases of the FTSE 100 versus the S&P 500, the Nasdaq 100 and Amazon shares:

That’s three OK index funds versus soaraway Amazon with the Footsie at the bottom. This is why I pick individual companies to invest in.

How I choose

When looking for a new company, I rarely start with the financials.

Instead, I look at the products and services I use day in and day out. I’m never surprised when the companies I use religiously also have monumentally strong financial statements.

About half of my portfolio is built up of companies that I use. There are others I don’t use — Ferrari, for example. While I wish I could, but it might be some time yet!

So how do I find and decide on the companies I have no first-hand experience of? Well, one way is through stock-screeners. These handy tools filter financial data and list only the companies that meet particular criteria.

What I look for

I’m typically hunting down value opportunities. But I also want the companies that are selling cheaply to be vigorous growers. So, I’ll set parameters that include but aren’t limited to:

- 10-year average annual revenue growth of 30% or more

- Over five years, a price down 30% or more

This is a very simplified version of the power of screening data. I often use many more inputs than this. Yet, with just these two simple parameters, what I can uncover is amazing.

It’s also essential that I make sure I use a reputable screener. One with good reviews, including endorsements from major financial institutions, is best, as I want the data to be accurate.

I found four companies that could have been included in the FTSE 100, S&P 500, or Nasdaq 100 that met my two criteria listed above. These were JD.com, Paycom, Etsy and SolarEdge Technologies.

That’s down from around 600 companies (the Nasdaq 100 and S&P 500 cross over a lot).

Well, I might say that’s a slightly easier dataset to analyse.

How I analyse

But hold on, just because a company’s revenue growth is good and the share price is down doesn’t make it a good investment.

This is where deeper financial analysis comes in. I often think of reading financial statements like playing chess because attention to detail is everything. I also have to know how each component of these statements coincides with actual operations and consider broader economic factors.

The key things I look for first are how much profit is being generated as reported on the income statement and debt on the balance sheet.

Beyond that, I’m digging into areas of weakness, significantly poor ratios, and discounted cash flow analyses. I compare these metrics to companies in the same industry.

The bottom line

While this is a hypothetical screening for shares, and I’m not buying these companies, this captures the essence of how I work in the real world.

Investing isn’t easy. If it were, everybody would be rich. I believe it takes time, patience, discipline, intelligence and strategy. But after a while, results do show.