If I were made to buy just a single FTSE 100 stock next year, which one would it be? It’s a useful thought experiment because it forces me to consider all the qualities I really value in a stock. And with just one pick, I would prefer this share to tick all my boxes rather than just most.

Importantly, I wouldn’t be investing for just 2024. As a long-term investor, my holding period is five to 10 years, and ideally longer.

So here’s what I’m looking for:

- A rock-solid competitive advantage

- An attractive industry with permanent and growing demand

- Exceptional management

- Not obviously overvalued

After scanning up and down the Footsie, I’m plumping for AstraZeneca (LSE: AZN). Here’s why.

A quiet compounder

First, it’s noticeable that the stock rarely attracts the same financial media coverage or daily search volume of, say, Lloyds or Rolls-Royce. Yet with a market cap £155bn, AstraZeneca is over £100bn more valuable than both those blue-chips put together.

That’s not to say it gets no attention, of course. The healthcare stock is up around 190% in 10 years, excluding dividends. But I don’t think it’s had the fanfare it perhaps deserves given this exceptional performance.

Attractions

Medicines are in permanent demand, which makes them very recession-resistant. Yet due to the costs and regulation involved, the pharmaceutical industry has very high barriers to entry. This can make it an attractive industry to invest in.

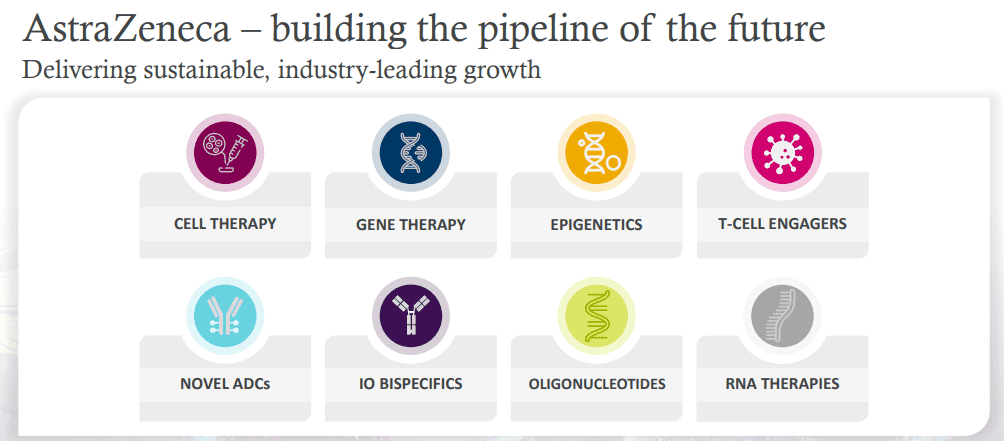

AstraZeneca’s vast research budget and worldwide footprint give it a durable competitive advantage, in my view. It currently has more than 120 projects in Phase II/III development across oncology, rare diseases, and more. This huge pipeline should more than offset the inevitable clinical trial failures along the way.

Last year, the firm reported revenue of $44.3bn and $3.2bn in net income. However, those figures are poised to head higher as it enters new growth areas and the global population ages.

Weight-loss market

The shares are trading at about 29 times trailing earnings. That’s less than peers Novo Nordisk (41) and Eli Lilly (107), two stocks that have boomed lately due to excitement around their respective weight-loss drugs.

Interestingly, however, AstraZeneca is also planning to enter this market after securing a licensing agreement for an oral weight-loss medicine. It hopes this pill could become a key differentiator to the current injectable alternatives.

The mushrooming weight-loss drug industry could be worth as much as $200bn within the next decade, according to Barclays. So it’s certainly one worth pursuing.

Now, one risk I’d highlight here is media speculation concerning the retirement of long-time chief executive Sir Pascal Soriot. Under his tenure, the drugmaker has been transformed into a forward-thinking, growth-oriented business.

Soriot has rubbished such reports as “fake news“. But could there really be smoke without fire? I’m not sure and he wouldn’t be easily replaced.

A head-scratching omission

Given my bullishness, why am I not already a shareholder?

To be honest, it’s a bit of a head-scratcher. Perhaps there’s always been something more alluring — a higher yield, faster growth — that has caught my eye. That’s a shame.

To make amends, I’m going to buy some AstraZeneca shares in 2024. They may not repeat their past outperformance, but I don’t think I’ll come to regret it down the line.