It’s been a solid month so far for the Scottish Mortgage Investment Trust (LSE: SMT) share price. As I write, it has risen 11.8% to reach 718p.

However, that’ll be cold comfort for those who invested at 1,500p two years ago. Scottish Mortgage shares are still down about 52% from that point.

What happened

The share price shot up on 1 November when the US Federal Reserve announced that it was holding interest rates steady. This was the second consecutive time it kept its benchmark interest rate steady.

A further boost came with the publication of US consumer price data on 14 November. This showed that inflation fell more than expected in October, sending US stocks rising across the board.

While Scottish Mortgage invests globally, over half of the portfolio is in US stocks (53.5%). For better or worse, what happens stateside has a big impact on the share price.

That said, the Bank of England’s decision on 2 November to also keep the base interest rate steady (at 5.25%) would have boosted investor sentiment.

Strong top holdings

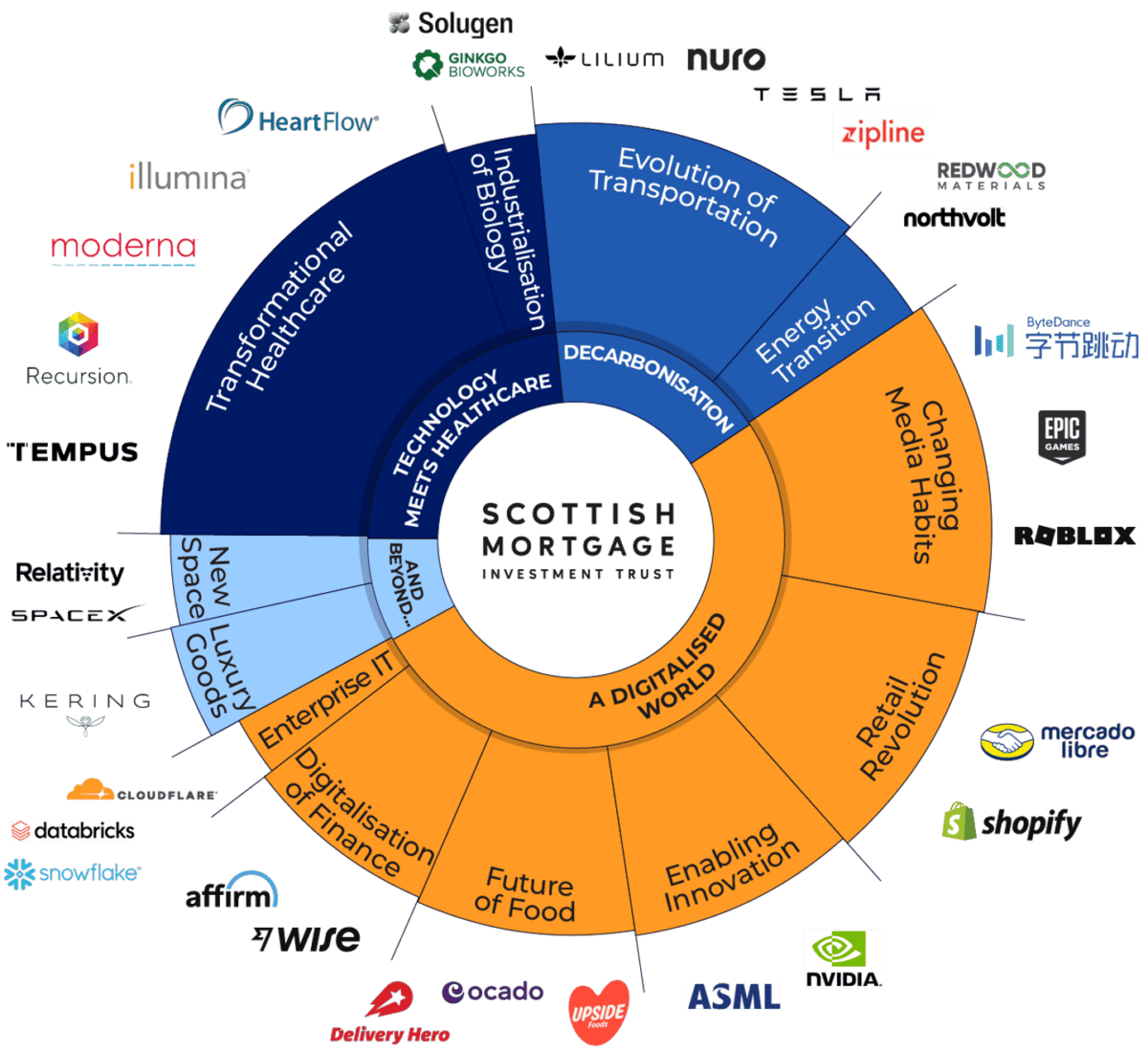

The FTSE 100 trust runs a concentrated portfolio, with its largest 10 holdings accounting for around 45% of total assets.

The top four stocks, which make up around 22% in total, have all risen sharply so far in November.

| % gain (since 1 November) | |

| ASML | +14.5% |

| Nvidia | +20.5% |

| Amazon | +9% |

| MercadoLibre | +16.5% |

The standout performer has been Nvidia (NASDAQ: NVDA). The stock has surged an incredible 245% this year after the company reported enormous demand for its artificial intelligence chips.

To put this demand in context, Nvidia posted revenue of $5.9bn in Q3 last year. In Q3 this year (due to be announced on 21 November), it’s expected to report $16bn. Its earnings per share (EPS) is estimated to grow by over 450% to $3.39.

Yet Nvidia’s outlook could be negatively affected by the US government’s latest restrictions on the export of powerful chips to Chinese customers.

Already, Baidu has announced a new deal to source chips from Huawei. So this issue has the potential to become something of a headwind for the Nvidia share price.

Portfolio strugglers

We’re now seeing the strain of higher interest rates and a tough macroeconomic environment on some of the trust’s smaller investments.

For example, trucking software firm Convoy went bust in October. This was despite the unlisted start-up being valued at $3.8bn only last year. It announced that “a massive freight recession and a contraction in the capital markets” had prevented it from being acquired by anyone.

Another holding, ChargePoint, appears to be in crisis. The electric vehicle charging firm just slashed its Q3 revenue forecast and both its CEO and CFO immediately stepped down. The holding has fallen 82% in one year.

Other portfolio disappointments can’t be ruled out.

On a more positive note, SpaceX got the most powerful rocket ever built (Starship) to space on 18 November. Unfortunately, it self-destructed shortly afterwards, but this is widely seen as a step forward for the future of space transportation.

Ultimately, it’ll be the future progress (or not) of large holdings like SpaceX that determine how Scottish Mortgage shares perform. On these, I remain very optimistic as a long-term shareholder.