Many of us invest for passive income. One stocks that’s central to my passive income strategy is Phoenix Group (LSE:PHNX) which surged on 13 November. It’s a UK-based insurer that traditionally has focused on buying up mature or closed life insurance and pensions funds.

And if I had the money today, I’d buy another 1,000 shares in this company. At the current price, that would be almost £5,000 worth of stock, and would deliver just over £500 in passive income annually.

Here’s why.

A passive income giant

The obvious reason I invest in Phoenix Group is for the dividends, currently offering a yield of 10.5%. That puts it among the top dividend payers on the FTSE 100. And what’s more, it’s relatively safe. The dividend was covered 1.6 times by earnings last year.

One of the attractive aspects of holding Phoenix Group in my portfolio is its focus on stable and predictable cash flows.

As the company administers closed funds, it benefits from a steady stream of premiums and annuity payments without the exposure to underwriting risks associated with new policies.

And it’s these cash flows that make the dividend appear even stronger. After all, consistent and robust cash flows are a crucial foundation for sustaining dividend payments.

Insurers are overlooked

I believe insurers are overlooked at the moment. Part of the reason for this may relate to the Silicon Valley Bank (SVB) fiasco earlier in the year. Several stocks pushed lower after the related events and haven’t truly recovered.

Phoenix shares dipped after the Silicon Valley Bank crash and have continued moving downwards, despite some positive earnings. One reason for this is that insurers typically have large bond portfolios, and older bonds have seen their values fall as interest rates have risen.

Nonetheless, these are unrealised losses as the bonds are normally held through to maturity. More importantly, the business is continuing to perform and recently upgraded its cash generation targets after completing the funds merger of its Standard Life and Phoenix Life businesses into a single entity.

And this is reflected in the stock’s valuation. The company currently trades at 6.1 times earnings versus its five-year median of 10.9 times. This suggests investors are willing to pay less for the stock today than they have been throughout the past five years, despite the passive income offer.

Debt

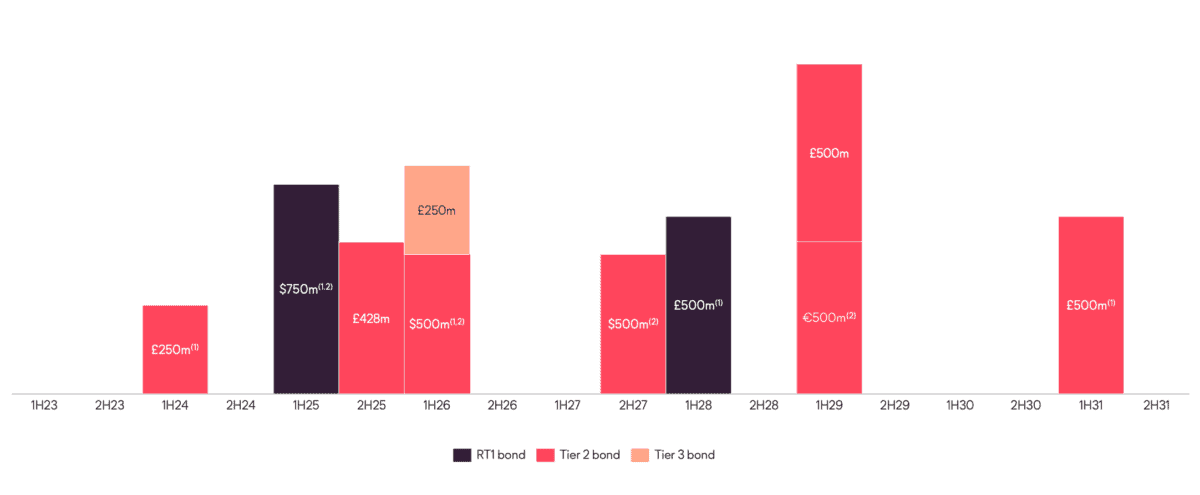

It’s worth noting that some analysts suggest Phoenix is over-leveraged. Interestingly, the company says it’s towards the lower end of its targeted leverage range. Importantly, the debt maturity profile appears quite evenly spread.

Income secured?

There’s no such thing as a guaranteed source of passive income. Phoenix Group’s dividend coverage could be a little bit stronger, and this makes it vulnerable to changes in the macroeconomic environment and an uptick in insurance claims, due to things like catastrophic events.

Nonetheless, Phoenix Group is also experiencing several business tailwinds, including from auto-enrolment pensions and trends in bulk purchase annuities (BPA). In fact, with just 15% of defined benefit pension liabilities transfers to insurers, the BPA market could continue to grow.

Coupled with the points noted above, I believe it’s among the strongest passive income picks. And that’s why I’d buy more.