On 27 October, the NatWest (LSE:NWG) share price fell 18% following the company’s Q3 results. The partially-owned state bank narrowly missed expectations but registered a 33% rise in profits.

Reputation and defaults

It hasn’t been NatWest’s finest year. The Nigel Farage scandal had a significant impact on the company’s share price.

In June, Coutts, a private bank owned by NatWest, closed the account of the politician-cum-TV personality. The bank initially claimed that Farage failed to meet the Coutts eligibility criteria of holding £1m or more in his account, following the expiry of his mortgage.

However, it later emerged that Coutts employees had made negative comments about Farage’s political views and finances, and that the decision to close his account had been influenced by his political views.

The scandal led to an outcry in some newspapers and calls for NatWest to be held accountable. The company’s share price fell by nearly 20% in the following weeks, as investors lost confidence in the bank’s management and its ability to protect customer data.

This has exacerbated concerns relating to higher (and soon to fall) interest rates. The Bank of England’ (BoE) base rate has gone far above the levels often considered optimal. In turn, this leads to more default concerns and higher impairment costs.

Are things improving?

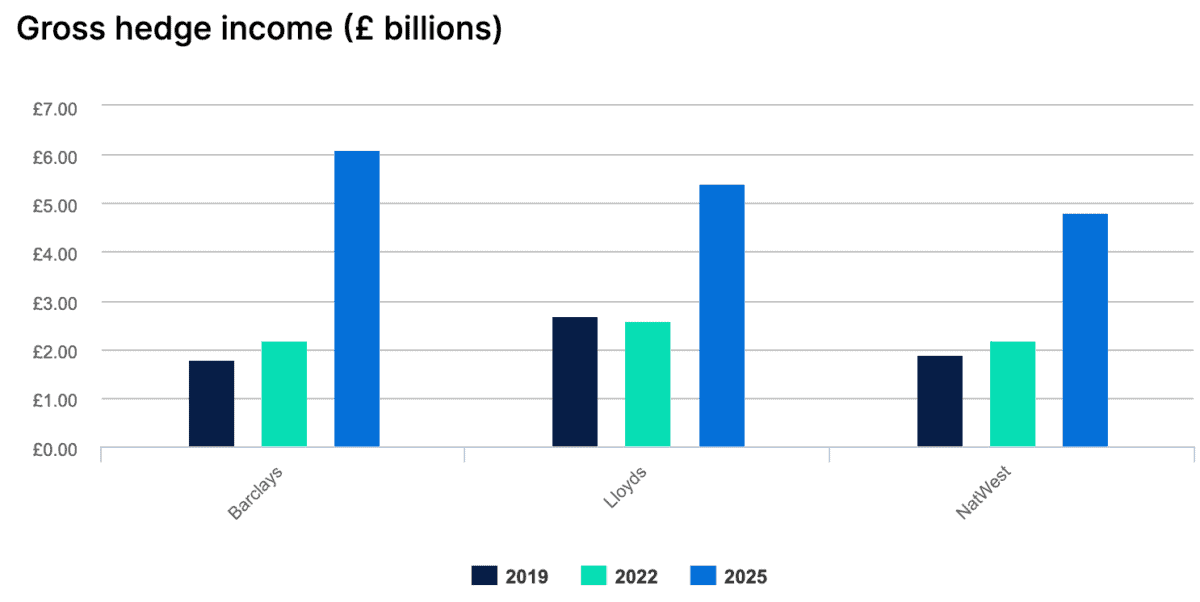

While falling interest rates can mean margin suppression, it also means fewer default concerns. Moreover, banks practice hedging which allows them to extend the tailwind of higher interest margins into the future.

Hedging is a process whereby banks use financial instruments like interest rate swaps and the bond market to ease out fluctuations in interest rates. But when interest rates go down, this can be a tailwind. For example, Hargreaves Lansdown analysts have forecast that NatWest’s hedging strategy will bring nearly £5bn in income in 2025.

Valuation

There’s also the matter of valuations. NatWest is currently trading at 4.2 times TTM earnings, and 4.8 times forward earnings. It’s actually the cheapest bank on the FTSE 100 and trades at a fraction of the valuation of its American peers.

In the following table, I’ve used forecasts for the company’s earnings per share in 2023, 2024, and 2025 to work out the price-to-earnings valuations for the coming years

| 2023 | 2024 | 2025 | |

| EPS (p) | 42 | 38 | 44 |

| P/E | 4.8 | 5.3 | 4.6 |

While these low P/E ratios might look very attractive, investors may be concerned about the lack of growth over the period, notably the decline in 2024.

As a side note, it’s quite unusual among banking stocks right now to see a drop off in 2024, so I wouldn’t be surprised to see this figure change. It may be an anomaly.

Nonetheless, looking at the medium term and beyond, I’m more bullish that these consensus estimates. Interest rates are moving closer to the ‘Goldilocks Zone’ — around 2-3% — and this should positively impact performance.

Despite the lack of growth, it’s certainly an enticing stock. I already hold some NatWest shares in my Stocks and Shares ISA, and I’m considering buying more.

Of course, stocks can always fall further, but the metrics are very attractive and the coming years should be more profitable.