Last month, I thought Rolls-Royce (LSE: RR) shares might be taking a breather around £2. I was wrong.

Since then, they’ve soared 19% to reach 238p. That’s the highest the Rolls share price has been in almost three years.

The momentum is clearly incredible.

But does this mean I should buy more shares as we head into the New Year?

Stock upgrades

Rolls-Royce shareholders can thank analysts at Barclays for the recent lift in the share price. In late October, they upgraded their view on the stock and raised it from ‘equal weight’ to ‘overweight’.

An overweight rating indicates that the analysts think a stock can outperform the wider market or its peers. Investors should therefore have a larger weighting to it in their portfolios, according to their analysis.

Consequently, the bank also hiked its price target from 239p to 270p. If achieved, which of course isn’t guaranteed with broker price targets, it would represent about a 13.5% gain from the current share price.

On 8 November, Morgan Stanley also revised its price target upwards, from 166p to 275p. Its data suggests that flying activity for the firm’s large engine fleet has been extremely strong so far in H2.

So these upgrades rest upon the belief that full-year engine flying hours could meet or exceed the top end of Rolls’ guidance range of 80%-90% of pre-Covid levels. If so, this would likely see free cash flow also come in towards the top end of the company’s guidance of £900m-£1.1bn.

It’s no surprise then that analysts remain positive on the stock. This upbeat consensus could be one reason for me to buy more shares.

Current valuation

But after rising strongly, have the shares become overvalued?

This is a tricky one because we don’t know exactly what the company’s earnings are going to be. But forecasts suggest earnings per share of 11.4p next year. That would equate to a forward P/E ratio of around 21 for 2024. That’s not too bad, I feel.

Meanwhile, we can see below that the stock’s current price-to-sales (P/S) ratio is 1.3 times.

This is only slightly above the stock’s pre-pandemic P/S multiple, so I don’t see it as particularly overvalued. And it’s still cheaper than industry peers.

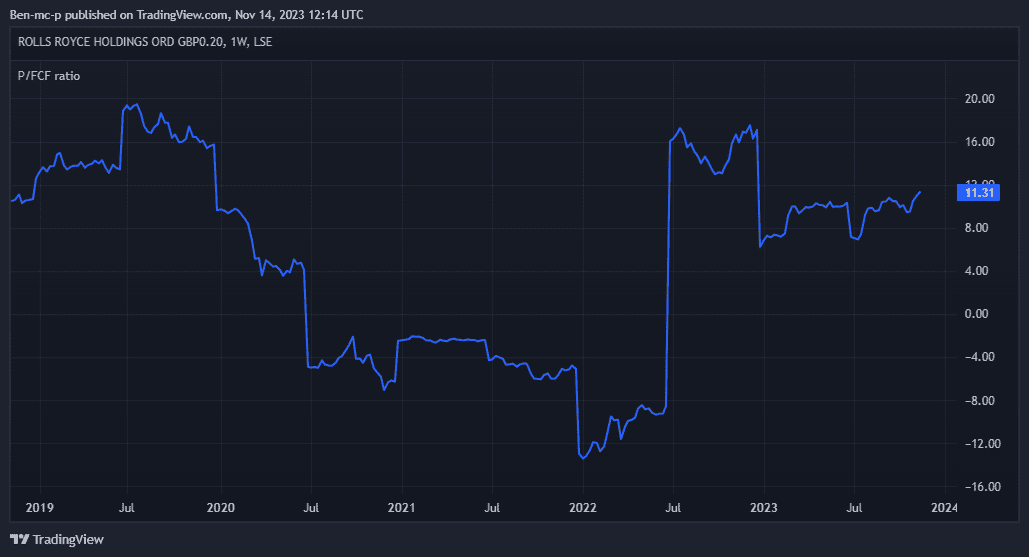

Similarly, the price-to-free-cash-flow ratio of 11.3 is basically where it was in 2019.

However, we know that the market is expecting the company’s free cash flow to move higher over the next couple of years. If that does happen, then I think the valuation today looks quite attractive.

Looking ahead

The danger, of course, is that something comes along to upset the apple cart.

Major disruptions to civil aviation — still the firm’s most important division — do happen. Beyond another pandemic, there is the potential for spreading conflicts in Ukraine and the Middle East. More restricted air space is unlikely to be positive for long-haul travel.

All things considered, though, I remain bullish.

In March, I wrote that “I think we could be in the foothills of a massive multi-year turnaround in the share price“.

With flying hours recovering quickly, and positive recent news on sustainable jet fuel, I still believe this.

So I’ll happily snap up a few more shares for 2024 when I’ve got the money lined up.