Growing stress on the National Health Service is helping private hospital groups like Spire Healthcare (LSE:SPI) to thrive. Revenues at this FTSE 250 operator soared 13.1% during the first half while operating profit leapt by almost a quarter.

These businesses are benefiting from super-long NHS waiting lists by helping to manage large patient backlogs. They are also witnessed a strong pick-up in private revenues as people choose to finance their own treatments through medical insurance, or via self-funding.

Private-related sales at Spire rocketed 10.4% between January and June. I’m expecting group turnover to continue rising over the short-to-medium term too as the government struggles to reduce hospital waiting times.

Profits explosion

The number of Britons awaiting treatment continues to rise and struck a fresh record of 7.8m in August. Waiting lists are tipped to go even higher, regardless of whether fresh strikes by medical workers happen. Charity Health Foundation thinks 8m people will be awaiting treatment by next August.

Health policy in the UK could change drastically following the next general election which is due to be held by January 2025 latest. But large backlogs following the pandemic and years of NHS underinvestment mean profits should continue to soar at private healthcare providers.

City analysts certainly expect Spire’s earnings to continue soaring. They predict a 41% profits leap during 2023, followed by rises of 71% and 32% in 2024 and 2025 respectively.

Long-term drivers

But can the company expect to keep growing profits rapidly beyond the next few years? I think it can and that’s why I hold it today (and plan to keep on holding it).

As the UK’s elderly population rapidly increases, the number of people seeking medical attention will also continue to climb. Age UK predicts that the number of over-65s in England will rise from 11m today to 12.1m within five years. This is then expected to hit 14.5m by 2043.

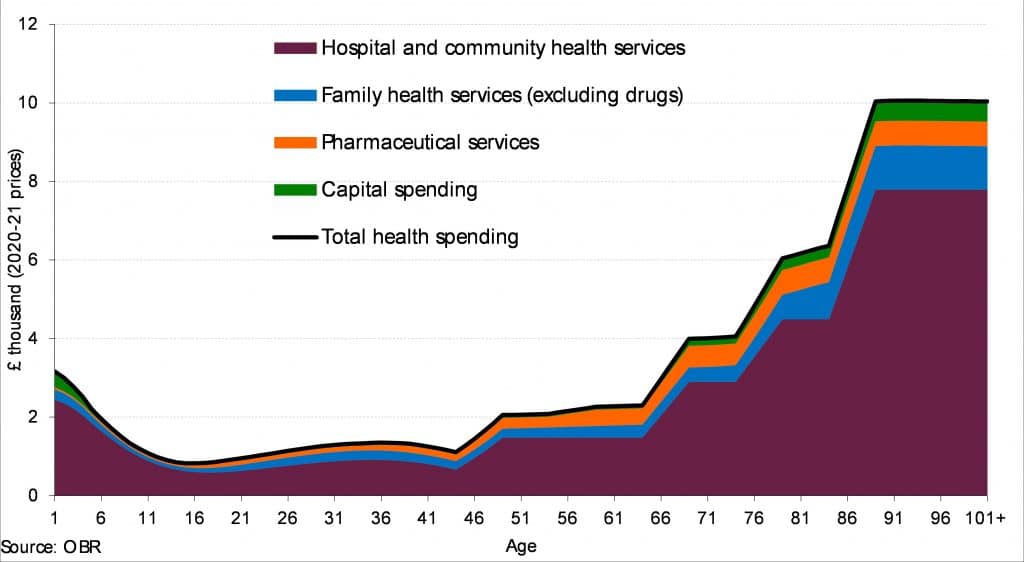

The Office for Budget Responsibility chart below illustrates how spending on healthcare (and especially on hospital visits) jumps as we get older too.

As the number of older people rockets, future governments will likely struggle to balance the books, increasing patient waiting times and compromising healthcare quality. It’s a mix that should continue to boost private hospital operators.

A top bargain

Spire — which owns around 70 hospitals and medical facilities across the UK — remains committed to expand to fully capitalise on this opportunity too. Its latest acquisition this month saw Spire spend £74m to snap up mental and physical health services provider Vita Health Group.

Staff shortages in the nursing industry could also affect profitability. But, on balance, I still expect this share to deliver excellent long-term returns.

And at the current price of 213p per share, I think it’s a brilliant bargain. It trades on a price-to-earnings growth (PEG) ratio of 0.9, just below the watermark of 1 that indicates a stock is undervalued.