I’ve recently sold my Rolls-Royce (LSE:RR) shares. I had an average buying price below £1, so I was more than content to sell my gains.

However, I was also acutely aware that the rally was running out of momentum. Moreover, it was becoming apparent that there were clearer value picks out there on the FTSE 100.

So, with investors like me pulling out of the stock, could we see Rolls-Royce shares fall below £2 any time soon? Let’s explore.

How much are the shares worth?

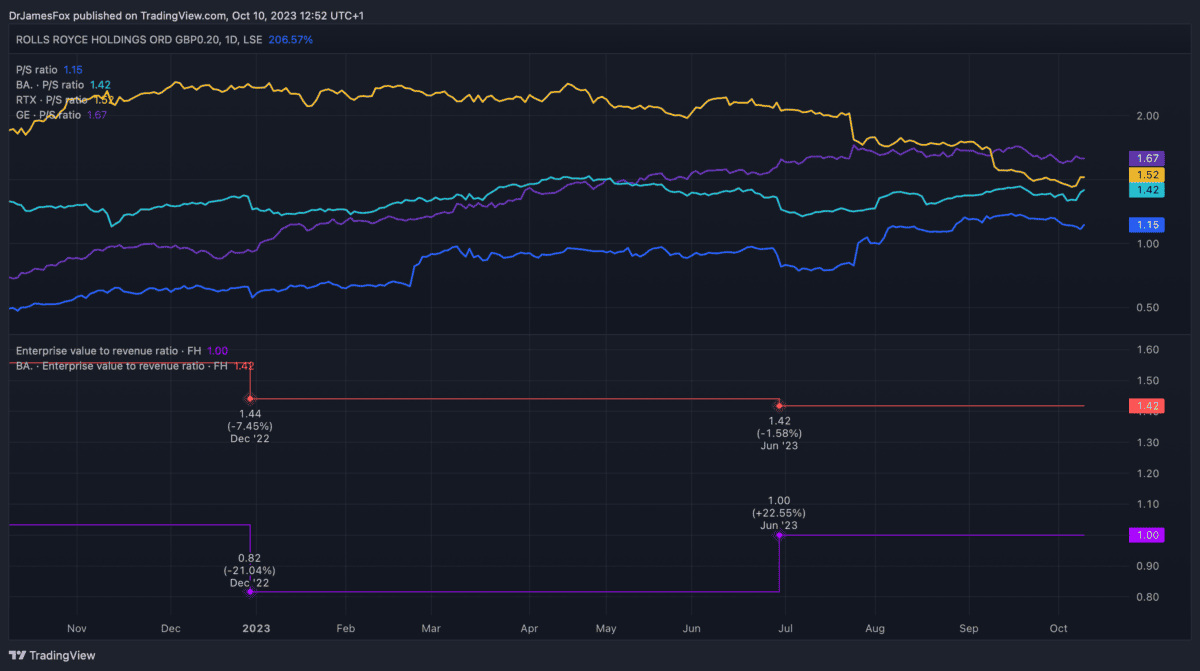

As we can see from the below chart, Rolls-Royce’s price-to-sales (P/S) and EV-to-sales ratios indicate that it trades at a discount versus aviation peer General Electric, and defence peers BAE Systems and RTX Corp.

However, these metrics aren’t perfect. For one, in an ideal world we compare companies on their profitability. After all, profit is what we’re all looking for, and some companies are more efficient at generating profit than others.

Currently, Rolls is still returning to profitability following the pandemic, which hampered the civil aviation business segment. The current price-to-earnings ratio suggests it’s incredibly expensive at 105 times earnings.

More surprises?

Rolls-Royce has beaten expectations twice this year, and this accounts for the surging share price. The stock had a lot of momentum generated by these events. Naturally, all eyes will be on the next set of earnings to see whether the engineering giant can continue to outperform.

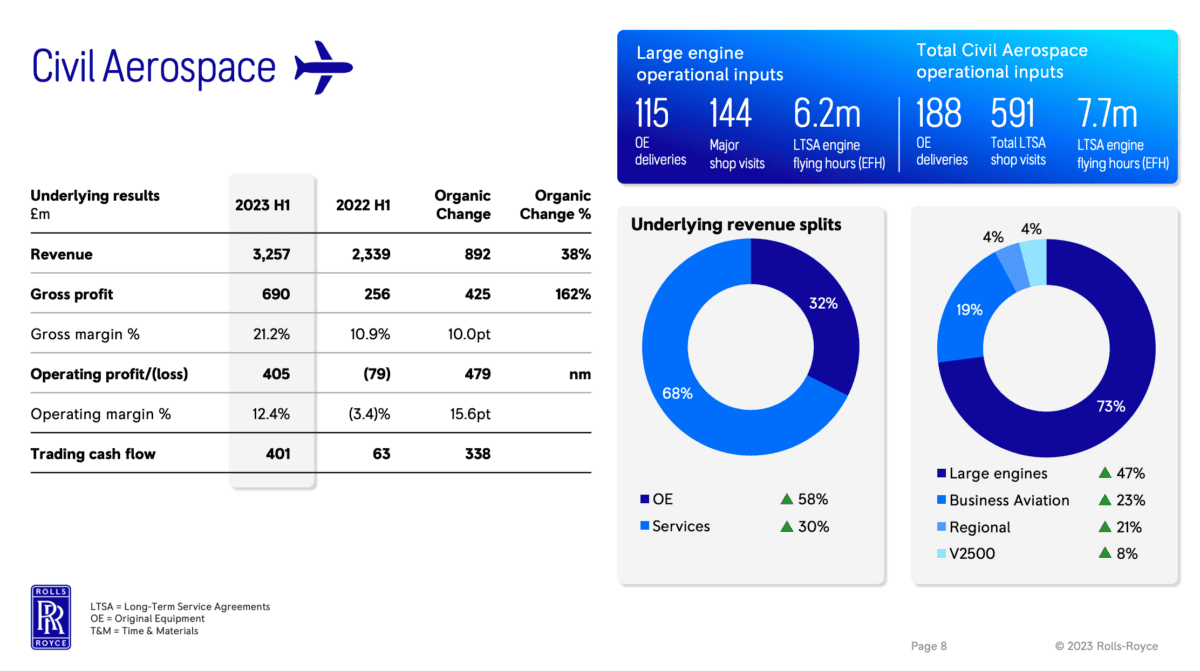

It’s worth noting that all three of Rolls-Royce’s main business segments (civil aviation, power systems, and defence) are growing. The big question is the extent to which these tailwinds have already been priced in.

Civil aviation is the biggest segment, and the one that needs the most attention. And here, revenue is generated primarily in four ways: engine sales, maintenance and service contracts, power-by-the-hour (flying hours), and aftermarket services.

Long-term investment thesis

While there may be some uncertainty in the near term, there’s an interesting long-term investment thesis, and it centres around civil aviation.

Aircraft makers have indicated that more than 40,000 new planes will be required over the next two decades. That’s at least 80,000 engines.

The problem for Rolls is that most of the demand is for narrow-body jets that don’t typically use Rolls-Royce engines.

However, the firm says it’s ready to rejoin the narrow-body market, but admits it may take a decade for a new opportunity to emerge.

Rolls, arguably mistakenly, left the narrow-body market in 2011. Since then sales, of Airbus A320 and Boeing 737 planes have boomed.

Retreating

Unless we see some very positive data, I’m expecting Rolls-Royce shares to retreat in the coming months. It’s hard to forecast, of course, but it seems that momentum is slowing.

For investors who believe in the long-term investment thesis, a sub-£2 share price could represent a good entry point. Overall, I’m a long-term investor and maybe I’d consider re-entering if the share price falls further.