Some 15 years ago, Rolls-Royce (LSE:RR) shares were trading for 92p. Incidentally, that was down 50% versus the same period in 2007 — this is certainly a stock with a history of volatility.

At present, Rolls-Royce shares are trading for £2.11. As such, the stock is up 131% over 15 years, although this figure hides the ups and down experienced in the interim.

So, if I’d invested £10,000 in the blue-chip stock back then, today I’d have £23,100. That’s not a bad return on my investment, reflecting an annualised return of around 9% a year.

Plenty of turbulence

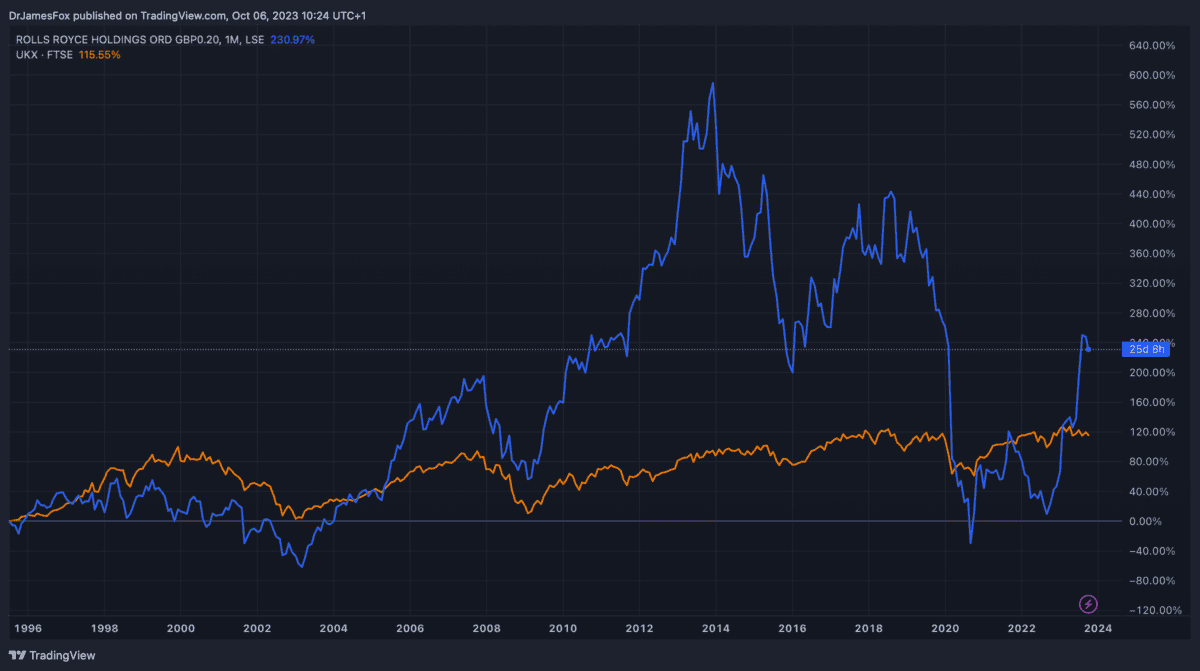

The civil aviation giant has experienced plenty of turbulence over the past 15 years. This is highlighted by the chart below, which shows the stock’s volatility over the long run versus the FTSE 100.

While it’s challenging to explain all of the volatility, it’s equally the case that Rolls operates in three very exciting sectors — civil aviation, defence, and power systems.

These are sectors with innovation at their core, and are complemented by Rolls’s ancillary projects in areas like modular nuclear reactors.

Innovation is understandably very attractive for investors. With a competitive advantage in all three of these sectors, the company is consistently delivering new products and services that have the capacity to drive growth.

Equally, sometimes the positive investor sentiment that drives the share price forward can collapse. As we can see from the above, the Rolls-Royce share price exhibits similar movements to the index, but they tend to be much more pronounced.

Worth the risk?

The shares have surged over the past 12 months. They’re up 197% over the year, making this the best performing stock on the index.

However, legends of investing like Warren Buffett often tell us to avoid the crowd, and to be wary when other investors are being greedy.

Nonetheless, there’s some evidence that the bull run may have further to go. As we can see from the below chart, Rolls-Royce’s price-to-sales (P/S) ratio indicates a discount versus aviation peer General Electric, and defence peers BAE Systems and RTX Corp.

Of course, the P/S ratio isn’t the only valuation indicator. But we can also see similar small discounts when we look at other metrics including the enterprise-value-to-revenue ratio.

Nonetheless, it’s important to remember that a large part of the company’s value proposition is its long-term position in growing industries.

For example, civil aviation, which is Rolls’s largest market, is expected to grow exponentially over the coming two decades. Airbus and Boeing have highlighted demand for more than 40,000 new aircraft by 2042.

The majority of this demand is for narrow-body jets, which typically don’t use Rolls engines. As such, the engineering giant may need to tilt its offering towards the narrow-body market in order to benefit more readily from the trend.

Overall, i’d say that while there’s better value elsewhere on the FTSE 100, Rolls remains an enticing investment opportunity for the long term.