In September 2018, NIO (NYSE:NIO) shares were listed on the NYSE, raising about $1bn selling American depositary shares at $6.26 apiece. Unsurprisingly, the first few weeks were quite volatile.

Over five years, NIO shares are up a phenomenal 74%. So if I’d invested £1,000 in NIO stock then, today I’d have around £1,850. That’s because the stock has rise dramatically, but the pound has weakened substantially during that period. NIO shares are denominated in USD and HKD.

That’s a very good return over five years. However, I’d almost certainly be kicking myself for not selling the stock when it was trading for $60 a share during the pandemic.

Nonetheless, are NIO shares worth buying today?

Price action

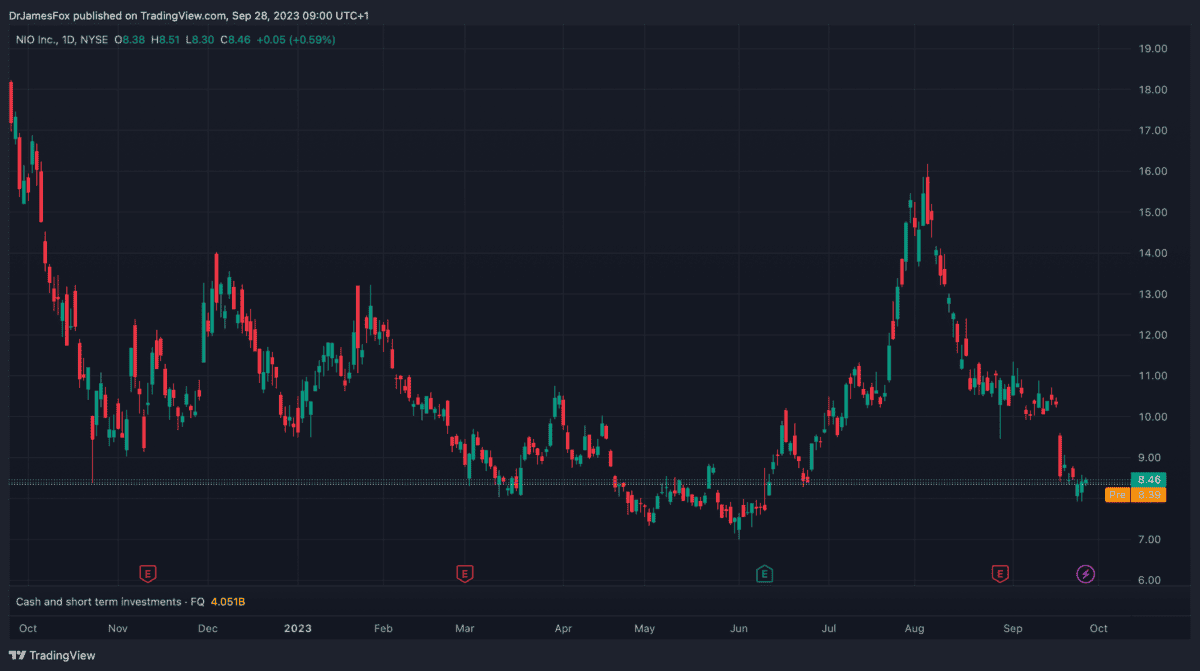

Over the past 12 months, NIO has remained one the most volatile stocks worldwide. The electric vehicle (EV) manufacturer’s share price is impacted not only by the performance of the business, but speculation about the health of the Chinese economy.

After rallying in the summer, the stock has returned to a little over $8. This is an important price point for the shares, as over the past year there’s been a lot of support coming in at this level. In other words, investors see minimal risk around $8 and capital returns.

While this is largely trader terminology, it’s important to recognise that the stock is trading near its support level.

The retreat

NIO has been on something of a rollercoaster ride for investors like me in 2023. After surging to $17, the stock has retreated for several reasons in recent months.

Firstly, we can see concerns about the health of the Chinese economy. Property developers and regional banks are under pressure. And this is a major concern as the real estate sector accounts for at least a quarter of the economy.

More recently, NIO announced that it had raised $1bn in capital and had to deny speculation that it was looking to raise a further $3bn. Increasing debt or share dilution would represent a major concern for investors, and this has pushed the stock back to its support level.

The promise

Despite the recent downward pressure on the NIO share price and the concerns about the Chinese economy, it’s a highly promising company.

NIO incorporates innovative features that set it apart in the EV market. Firstly, it offers battery-swapping technology, allowing drivers to conveniently exchange their depleted battery for a fully charged one at NIO garages in a matter of minutes.

The Shanghai-based company also boasts a diverse line-up of vehicles available for purchase, a key factor in attracting a broader customer base, as choice often translates to increased sales.

Moreover, NIO takes tech integration to a new level by equipping its vehicles with a voice-controlled assistant named Nomi. This cutting-edge feature enables users to control various functions, from opening windows to accessing the boot, through voice commands.

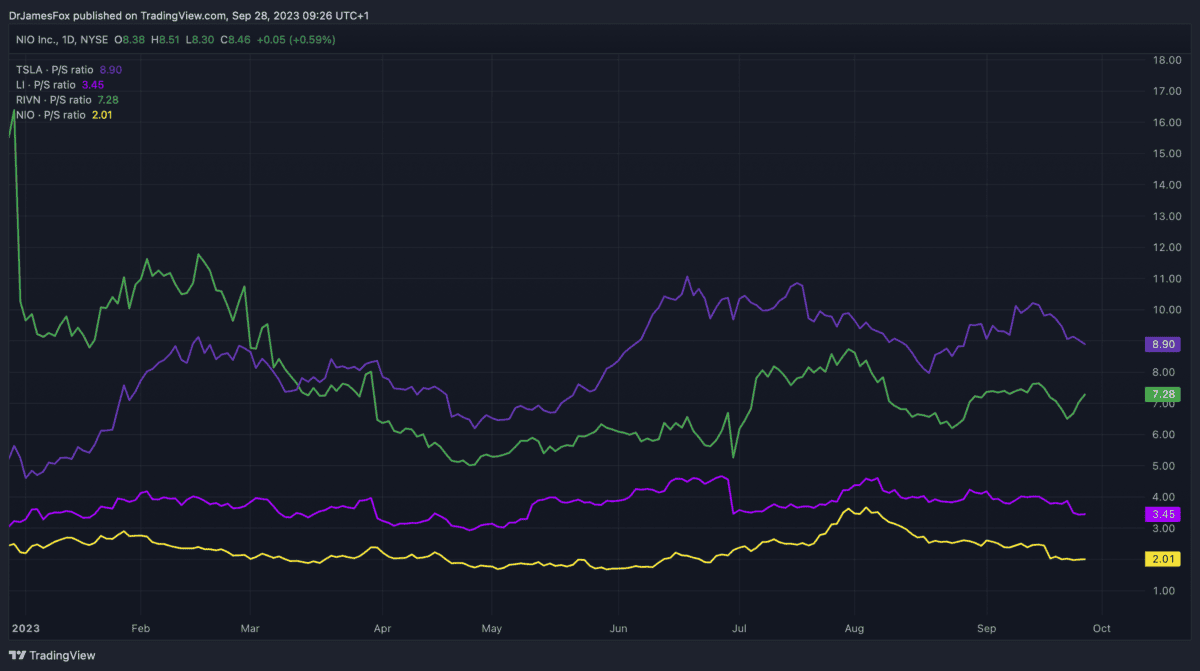

So with deliveries moving in the right direction — there’s speculation of 30,000 in September — and the share price just above the support level, I believe this Chinese EV stock looks very attractive — valuation metrics have become much more appealing than they were at $17. Nonetheless, I accept there are risks associated with investing in China.