Many Britons find the idea of generating a second income daunting, especially with the demands of daily life. However, it’s important to emphasise that achieving this goal is entirely feasible with a disciplined approach and a commitment to regular savings.

By setting aside a portion of our earnings and investing wisely, individuals can gradually build a second income stream over time, offering financial stability and growth opportunities for the future.

It shouldn’t be daunting

Starting to invest shouldn’t be daunting, even if I don’t have a substantial amount of capital to begin with. The key is to establish a disciplined approach that includes regular savings.

By consistently setting aside a portion of my income and directing it towards investments, I can gradually build a portfolio over time. This approach focuses on long-term financial discipline and the power of compounding, allowing me to grow my investments steadily.

It’s not about how much I start with. It’s about the consistency and commitment to saving and investing over the long run that can ultimately lead to financial growth and security.

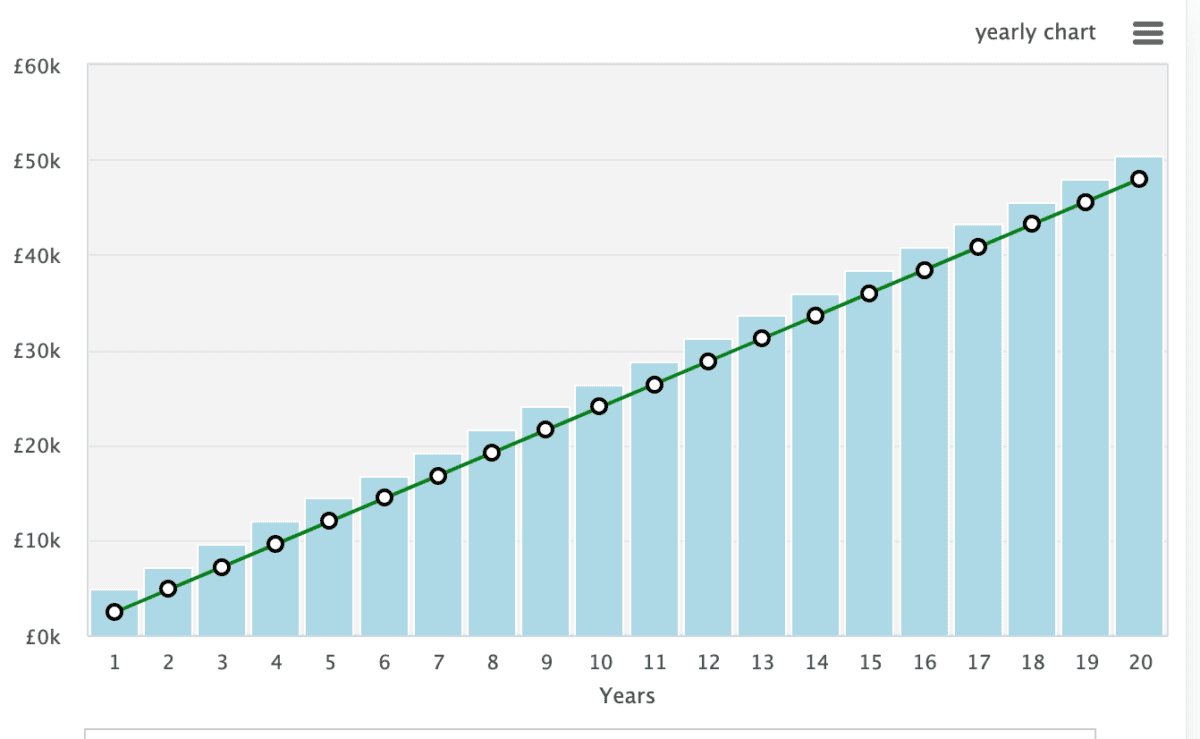

The chart below highlights the impact of saving £200 a month, excluding the positive impact of interest. After 20 years of putting aside £200 a month, I’d have £48,000.

Sensible investing

To build a portfolio over time, I must understand the importance of consistency and the potential of compound returns.

Regularly saving and investing, even small amounts, can add up significantly over the years. However, it’s not just about blindly pouring money into the market. It’s essential to research and understand the investments I’m making.

Thankfully, there are also resources out there, like The Motley Fool, that can help me make informed decisions. These resources, which are known for simplifying complex financial concepts, can be incredibly useful.

The secret sauce

Compounding is the secret ingredient for growing my portfolio over time. When I reinvest the returns I earn from my investments, those returns start to earn returns of their own. It’s like a snowball effect that can significantly boost my wealth.

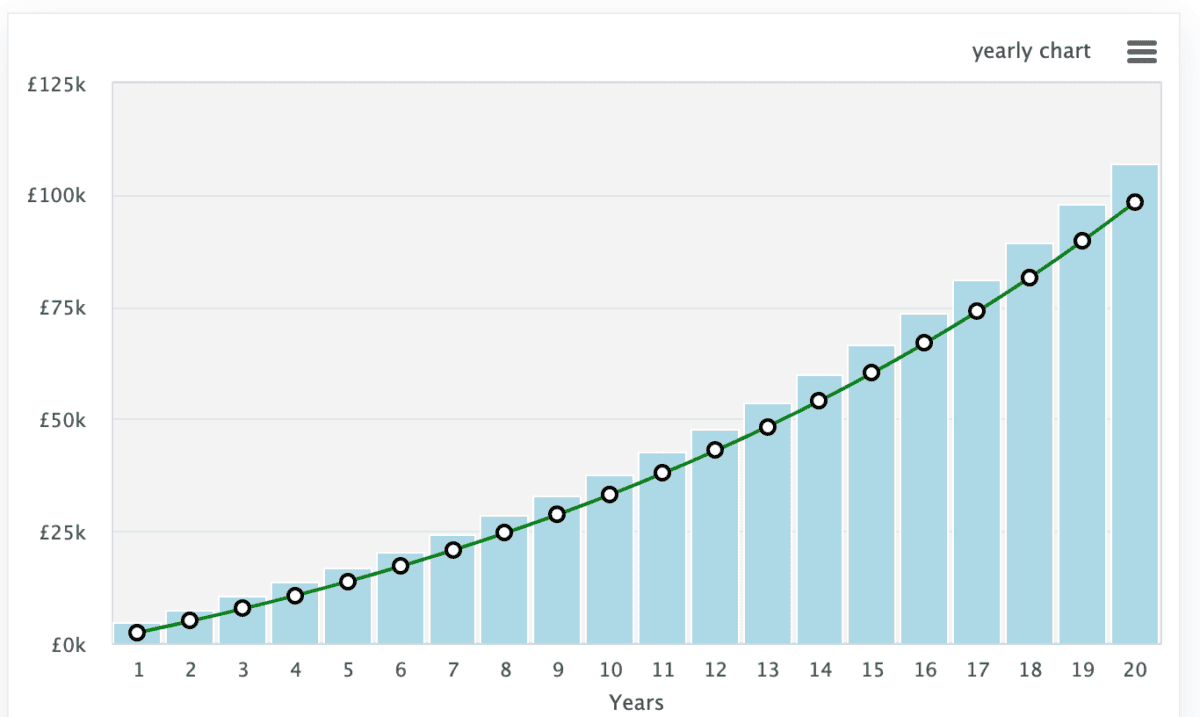

For example, if I invest £200 a month and achieve an average annual return of 7%, I’ll have nearly £100,000 in 20 years. That’s the power of compounding. The longer I stay invested and let my money work for me, the more impressive the results will be.

So I’m not just saving and investing for today, but for my future self. With patience and discipline, I can harness the incredible growth potential of compounding and watch my portfolio steadily expand over the years. It’s a strategy that aligns perfectly with my long-term financial goals.

The second income

The above figure, £100,000, is just an example, and there are so many variables. These include time, rate of annual return, and the size of my contributions. Using the above assumption of 7% yield, my portfolio could generate around £7,000 a year as a second income.

However, it’s essential to remember that stock market returns can fluctuate, and there are no guarantees. The actual income may vary depending on the performance of the investments within my portfolio.