I’m searching for the best FTSE 100 bargains to snap up next month. And Imperial Brands (LSE:IMB) looks, at least based on current City projections, like one of the greatest value stocks money can buy.

Not only does it trade on a forward price-to-earnings (P/E) ratio well below the FTSE average of 14 times, its dividend yield for the current financial year also smashes the UK blue-chip average of 3.8%.

But how do Imperial Brands shares stack up against the opposition? And should I buy the company for my portfolio in October?

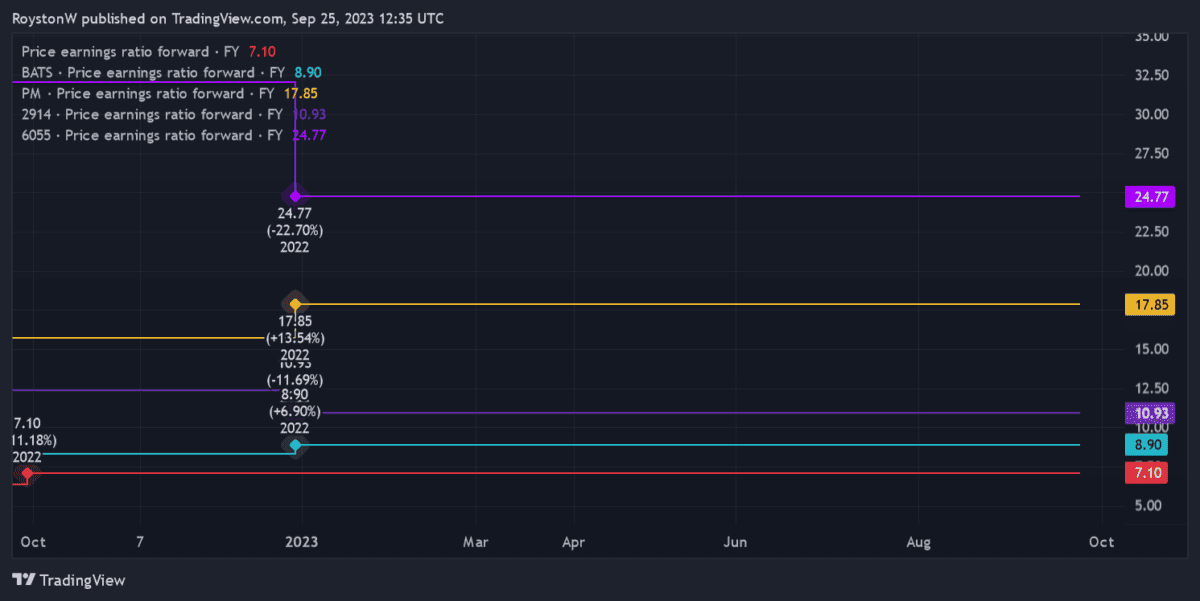

P/E ratio

The first port of call is to check out the tobacco titan’s P/E ratio against its competitors. As the chart above shows, Imperial Brands scores very highly.

Its earnings multiple for this year narrowly beats that of FTSE 100 rival British American Tobacco. However, the gap between it and overseas-listed competitors Philip Morris International, Japan Tobacco International, and China National Tobacco Corporation (CNTC) is actually quite large.

In fact, the latter’s P/E ratio in the mid-20s is miles ahead of Imperial Brands’ 7.1 times.

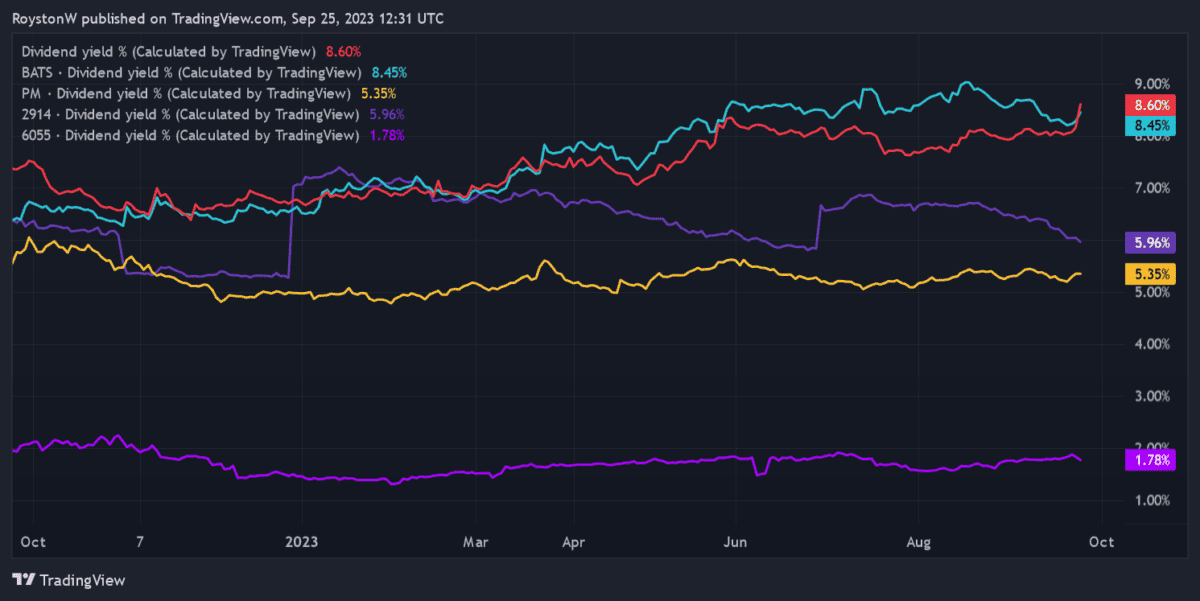

Dividend yield

As the chart below indicates, Imperial Brands also offers the best dividend yields among the world’s Top Five tobacco manufacturers. Once again it offers much better value that CNTC, too.

P/B ratio

The final thing to consider is the firm’s price-to-book (P/B) ratio versus those of its rivals. This metric divides a company’s share price by its book value per share, which is defined as total assets less any liabilities.

As the chart shows, Imperial Brands doesn’t offer market-leading value for money here. With a figure above one, the company also trades at a premium to the value of its assets. This is higher than British American Tobacco’s reading of just 0.8 too.

That said, its ratio is far better than that of Philip Morris’ negative reading. This is on account of the US manufacturer’s gigantic debt pile.

Should I buy Imperial Brands shares?

Based on the the charts above, a case can be made that Imperial Brands offers solid value for money. As mentioned at the top of the piece, it also offers more attractive P/E ratios and dividend yields than most FTSE 100 shares.

This doesn’t mean I’ll buy the firm’s shares for my portfolio, however. Its share price has crumbled since the mid-2010s as lawmakers have stepped up plans to stub out the habit for good. Bans and restrictions on the sale, advertising, and use of cigarettes and other tobaccos can be found around the globe.

And the fight against Big Tobacco continues to intensify. This is why analysts at Citigroup think that the US, Australia, and parts of Europe will become completely smoke-free by 2050.

Imperial Brands will point to its huge investment in e-cigarettes and oral products as reasons to be optimistic. But laws surrounding the governance of these next-gen technologies are also being rapidly tightened in a further threat to the industry’s long-term health.

On balance, I’d much rather buy other cheap FTSE 100 shares right now.