Finding reliable high-yield stocks is the dream of many income investors. One such company that offers an incredibly generous dividend is Legal & General (LSE:LGEN). With its shares currently yielding 8.9% and having room to run, the insurer could present a gateway to generating a lifetime of second income.

Sky-high dividend yield

The first attribute that jumps out about Legal & General is its whopping forward dividend yield of 8.9%. This yield dwarfs the FTSE 100 average of under 4% by a massive margin. Immediately, this puts the shares on the radar of income-focused investors such as myself.

Legal & General has also demonstrated a strong commitment to dividend growth. The company has raised its payouts. After all, it has had a 4.2% compound annual growth rate over the past four years. Plus, management has even promised to maintain a target 5% dividend hike until 2024. As such, for investors prioritising passive income today, this degree of existing yield and growth is very hard to ignore.

Robust prospects

Aside from its exceptionally high yield, Legal & General’s prospects for continued dividend growth over the long run also appear promising. The firm stands to benefit considerably over the coming decade as pension deficits in the UK narrow and demand for annuity products continues to increase substantially.

In fact, less than a fifth of UK-defined benefit pension liabilities are transitioned to insurers like Legal & General to date. This means that the firm has an enormous amount of room to grow its market share in this lucrative industry.

As profits rise from writing significantly more annuity policies, Legal & General should have the financial firepower to keep steadily increasing its generous dividend yield in the years to come too.

What’s more, the group continues to invest in other potential growth engines. These include infrastructure projects and housing developments. These could provide additional fuel for future dividend hikes.

Long-term income

Profits are expected to fall by as much as 40% in 2023. However, this has come as a bit of a blessing to the shares’ dividend yield. This is because share prices and dividend yields are inversely correlated. The 14% drop in Legal & General shares over the past year has resulted in a stellar 8.9% dividend yield.

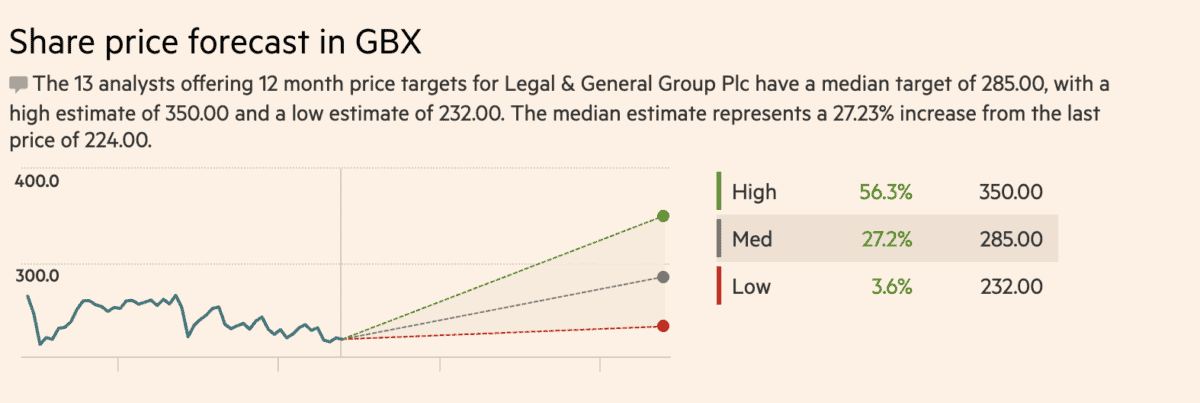

And despite the fall in profits, Legal & General shares are still projected to increase by as much as 27%, according to the latest analysts’ consensus. This shouldn’t come as a surprise, however. The stock currently trades at a relatively attractive forward earnings multiple of just 10.6 times after all. This is slightly lower than the insurance sector’s average of 12.6 times.

If Legal & General’s valuation expands closer in line with industry peers over the coming years while dividends continue marching higher, total returns for investors could be even greater than 27%. This provides some solid capital appreciation potential that would complement the already-generous 8.9% passive income stream.

That said, potential investors should still be wary of risks. Investing in this insurance giant could be a dangerous value trap, especially if the economy deteriorates. This could result in lower premiums from customers and lower profits, potentially resulting in a lower dividend as well. But given Legal & General’s compelling qualities and its high dividend yield, which is 2.0 times covered by earnings, I still see it as a reasonable risk to help me generate a lifetime of lucrative passive income.