Rolls-Royce (LSE:RR) shares have broken out of range — 145-155p — which they were caught up in for much of the year. So what should investors make of Rolls as it trades at 224p? Let’s take a closer look.

Outpacing the FTSE 100

Since the start of 2023, the FTSE 100 has declined 0.2%. Meanwhile, Rolls-Royce shares have gained 123%, making them the biggest winner on the index this year.

The engineering giant is currently experiencing a significant surge in momentum, triggered by upbeat analysis and a series of consecutive earnings beats.

So if I had invested £1,000 in Rolls-Royce shares at the beginning of the year, today I’d have £2,230. That’s a very strong return on investment.

Long-term momentum

Looking ahead, it becomes evident that Rolls-Royce could be strategically positioned to capitalise on favourable long-term trends.

In defence, there has been a noticeable rise in global tensions, and this trend is expected to intensify, especially considering the challenges posed by resource scarcity and population growth.

Rolls-Royce’s expertise in defence technologies could prove invaluable in addressing evolving security needs within NATO and further afield.

In the field of civil aviation, Rolls-Royce’s largest segment, there are promising indications of a substantial surge in demand for air travel.

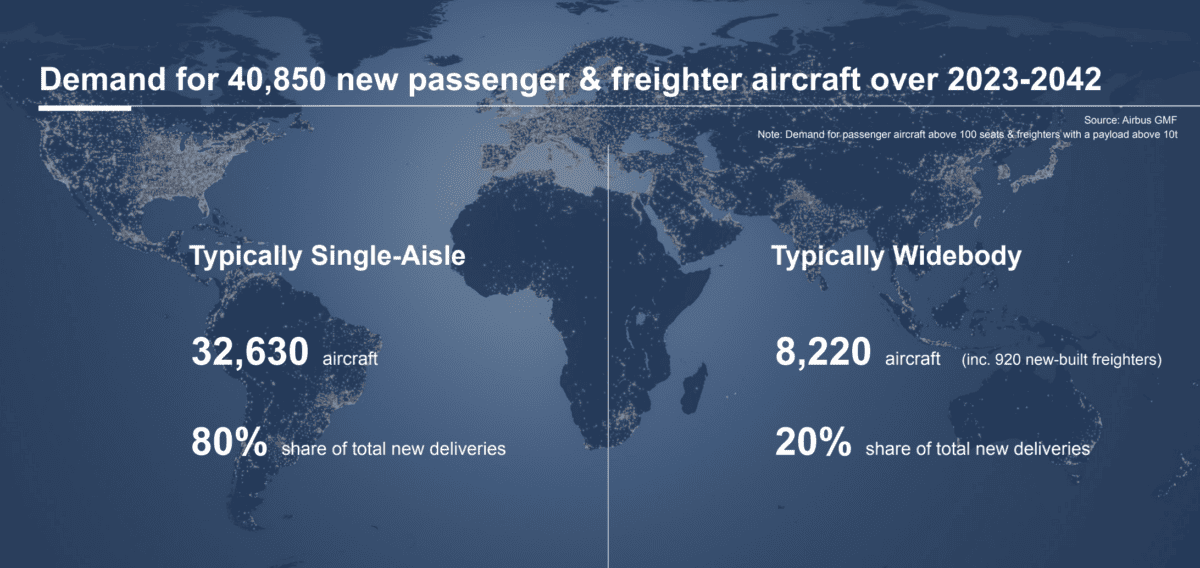

Projections from Airbus anticipate a requirement for an additional 40,850 aircraft by the year 2042, with 80% of them being single-aisle planes.

Rolls-Royce is well-positioned to play a pivotal role in meeting the propulsion and engine needs for the expanding global fleet.

However, to fully capitalise on this trend, Rolls needs to shift its offer towards single-aisle jet. Traditionally, Rolls’s engines have been used on wide-body planes.

Value play?

These are just a couple of the catalysts that have prompted analysts to revise their price targets upwards.

UBS has maintained a consistently optimistic outlook on Rolls-Royce and, so far, its assessments have proved correct.

Within the bank’s more optimistic projection, the potential exists for Rolls-Royce’s stock to reach 600p. However, under a much more pessimistic scenario, UBS see the stock potentially declining to 100p.

The bank’s assessment indicates that Rolls-Royce’s guidance is on the conservative side.

Furthermore, its projection anticipates the possibility of Rolls-Royce attaining £2 billion in free cash flow (FCF) as soon as 2024, with the potential for £2.8 billion in underlying FCF by 2026.

However, in this post-pandemic world, uncertainties remain. The company is a very different beast compared to the one that entered the pandemic.

But there are snippets of information that suggest Rolls remains undervalued compared to its peers. Even at 224p. For one, its price-to-sales (P/S) ratio of 1.2 sits below General Electric‘s 1.5.

Despite this, I think there are clearer value plays on the FTSE 100 than Rolls-Royce, including Barclays. Stocks across the index have suffered amid a broad lack of confidence, despite generally strong earnings.