We haven’t experienced a stock market correction in the technical sense in recent months, but it’s clear for everyone to see, the FTSE 100 is underperforming.

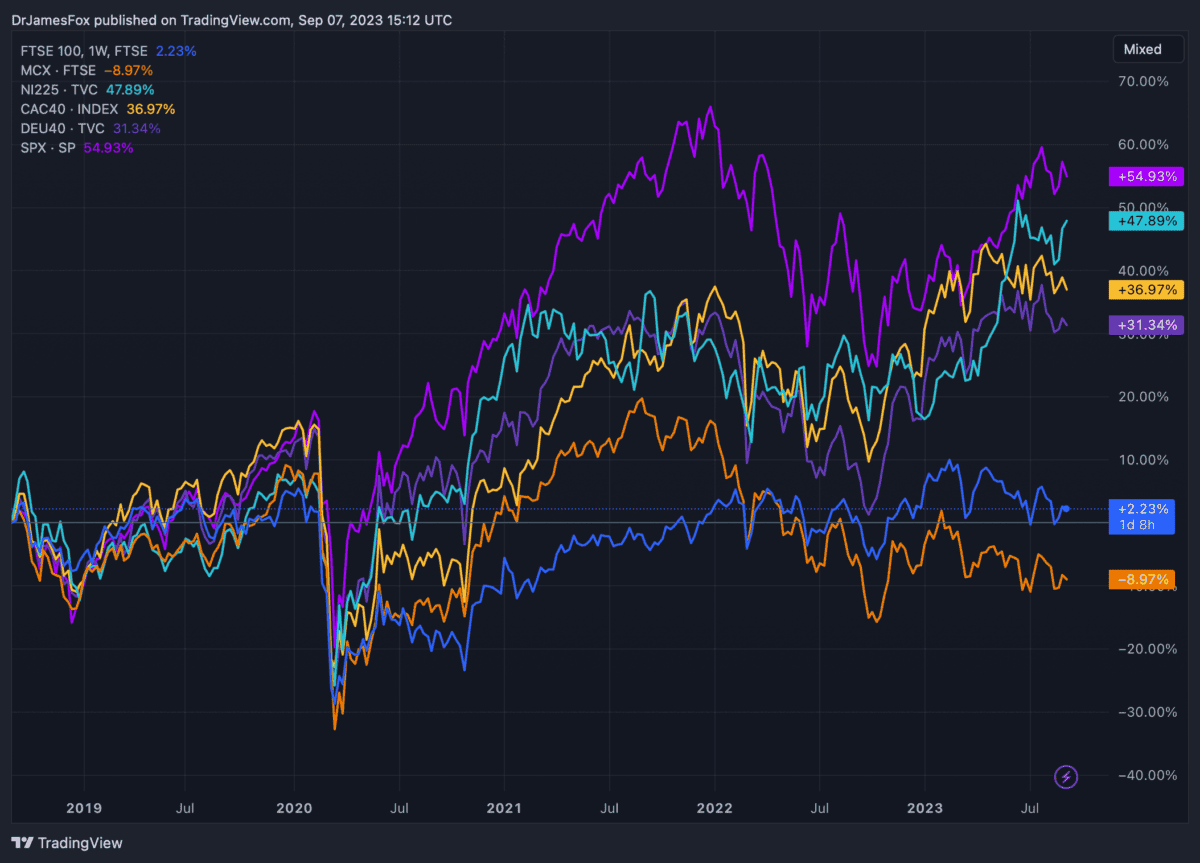

In fact, over five years, the FTSE 100 is up just 2%. It’s among the worst performing major indexes worldwide.

The UK stock market

There are many negative pressures taking their toll on the lead index. These include:

- Rising interest rates (part 1). As interest rates rise, capital is often reallocated is cash and debt. These asset classes offer stronger returns when interest rates are higher

- Rising interest rates (part 2). Higher interest rates can increase borrowing costs for businesses. It also dampens investment activities and increase servicing costs

- Ukraine conflict. The ongoing war has introduced uncertainty and volatility into the global economy, affecting stock markets. Investors are concerned about the potential consequences on economic growth and stability

- Weak economic indicators. Recent economic data from both the US and Europe has displayed signs of weakness, further contributing to the decline in stock prices

- Raised commodity prices. Prices of commodities like oil and gas remain high, placing additional pressure on businesses

- Self-fulfilling prophecy. Investors don’t want to put their money in underperforming markets. The index, despite attractive valuations, continues to perform worse than the S&P 500.

The above chart highlights the relative performance of the FTSE 100 over five years. Only the FTSE 250 has performed worse over the time period.

Investing in depressed markets

Investing in tricky times, a strategy favoured by renowned investor Warren Buffett, involves seizing opportunities when stock prices are undervalued due to market pessimism.

During market downturns, quality companies can often be found trading at a discount to their intrinsic value, making them attractive prospects for value-oriented investors.

Buffett’s approach to depressed markets emphasises patience and a long-term outlook. Instead of succumbing to short-term market volatility and emotional reactions, investors following his lead focus on the fundamentals of the businesses they invest in.

Market-beating returns

By identifying financially strong companies with competitive advantages and enduring appeal, and holding onto these over time, investors can potentially reap substantial rewards when market sentiment eventually improves.

Buffett’s successful track record underscores the effectiveness of this strategy, demonstrating that investing with a rational and disciplined approach in depressed markets can lead to long-term wealth accumulation. It’s not a risk-free strategy, but it does work.

It’s important to remember that historically, markets have eventually rebounded. For instance, after the 2008 financial crisis, the FTSE 100 dropped to about 3,500 points. By 2021, it had surpassed 7,000 points, nearly doubling.

This means investors who bought during the downturns benefited from substantial growth when the market recovered.

Market-beating returns can be achieved by seizing opportunities in depressed markets, as they tend to be temporary setbacks. By buying low and holding quality investments patiently, investors have the potential to benefit from significant gains when market sentiment improves and stock prices rise.

This is how investors could get richer!