With the stock market volatile, I’m looking for reliable dividend stocks to generate passive income. One high-yield stock I’m bullish on is Taylor Wimpey (LSE:TW). It can realistically earn me over £12,000 annually in dividends with the power of compounding.

Strength in bricks-and-mortar

Despite the housing market downturn, Taylor Wimpey shares have shown better resilience than the firm’s peers. This is thanks to its focus on more affluent buyers who are less sensitive to rising mortgage rates. That’s important for passive income investors like me. Why? Because Taylor Wimpey pays a very generous dividend. And if I were to rely on stocks to generate a steady and stable stream of passive income, I’d need to gor for one with a robust and long-standing dividend policy.

Thankfully, Taylor Wimpey has one of the best dividend policies in the FTSE 100. With its obligation to pay out at least 7.5% of its net asset value, or at least £250m each year, its minimum dividend yield is approximately 6.2% based on today’s share price.

But that’s actually a worst-case scenario. Provided the company continues to perform, payouts are more likely than not to be higher than the 7.1p per share the board has guaranteed per year. After all, the builder recently beat expectations in its latest results and raised its interim dividend alone by 4% to 4.79p per share. With profits forecast to recover in 2024 and beyond, Taylor Wimpey’s dividend has ample room to grow, which would be a boon for my passive income stream.

Building income from compounding

So, how can investors generate £12,000 by investing in Taylor Wimpey shares alone? Well, it will have to come through discipline and steady contributions.

The first action is to commit an initial £20,000 investment. Assuming monthly contributions of £1,000 over eight years, and a conservative dividend yield of 6.5%, along with an 8% increase in dividends every year (which isn’t guaranteed, of course), investors could expect to generate £12,000 in passive income by their eighth year. Reinvesting those juicy dividends supercharges the compounding effect. Thus, Taylor Wimpey’s growth prospects and dividend policy make it an ideal pick for passive income.

Alongside this, they’re more likely than not to also see their investment appreciate in value given the positive historical gains of the stock market. After all, Taylor Wimpey operates in a constrained industry. The housing market is expected to continue to see a strain in supply until the 2040s at the earliest.

Headwinds to contend with?

Having said that, headwinds like inflation and the current macroeconomic environment present challenges for housebuilding stocks. Taylor Wimpey has shown its ability to navigate through difficulties while being able to commit to its payouts, but its ability to do this in future isn’t guaranteed.

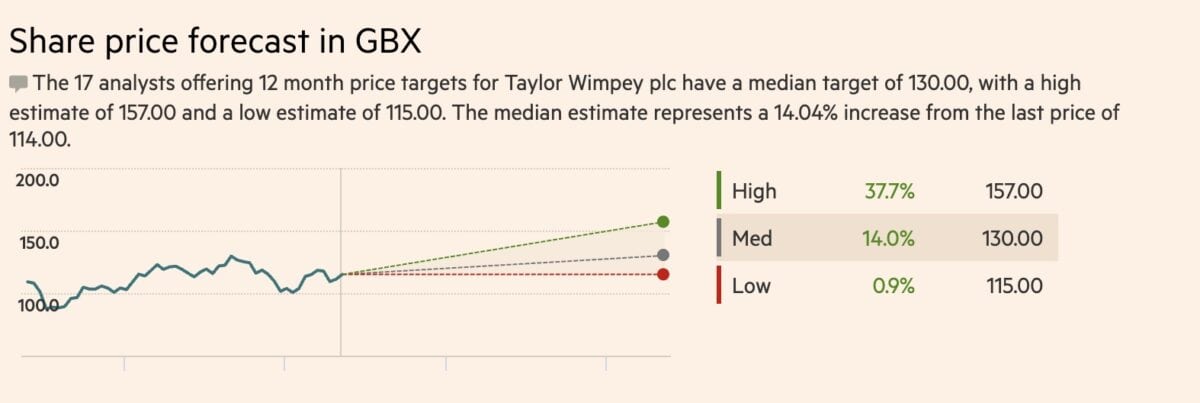

With an attractive dividend policy, loyal customer base, and experienced management, I think Taylor Wimpey offers a compelling opportunity for passive income investors like me. Starting with £20,000 and reinvesting initially could realistically generate over £12,000 in dividends down the road. Therefore, I’m loading up on this high-yield dividend stock today while its share price remains depressed.