Every quarter, companies are shuffled across indexes based on their market cap. Persimmon (LSE:PSN) and abrdn (LSE:ABDN) suffered poor performances in Q2, which led to their demotion to the FTSE 250. What would need to happen for them to make a swift return to the FTSE 100?

Building the foundations

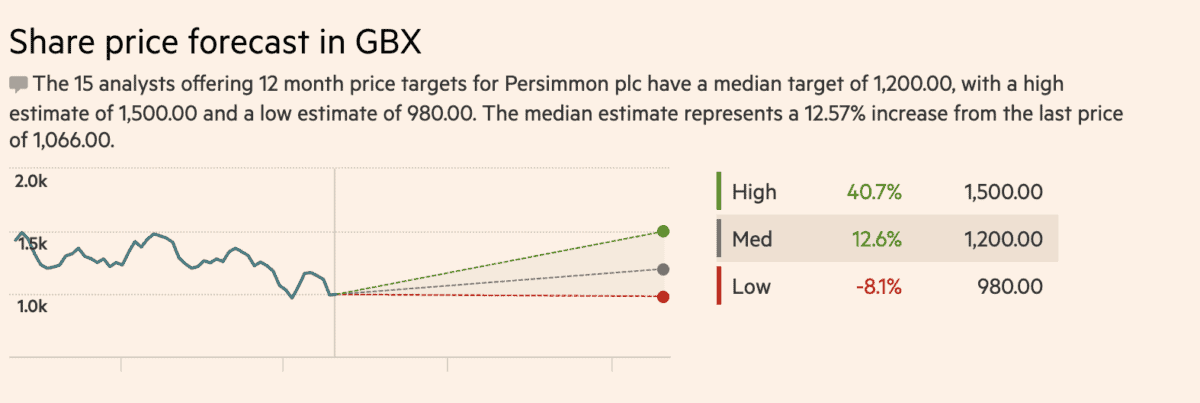

Persimmon’s market cap has sunk from a peak of over £10bn to less than £3.4bn on Friday. The homebuilder’s latest results were dismal, to say the least. The company saw its total completions drop by a dreadful 36% while its profits plunged 70%.

This comes on the back of weak housing demand. A combination of higher mortgage rates and the removal of the government’s Help to Buy scheme, which had propped up the firm’s sales for the past few years, cratered demand.

Nonetheless, there’s some room for optimism for this newly inducted FTSE 250 constituent. After all, Persimmon is still guiding for 9,000 completions this year. This shows that the recent rise in rates reflects temporary headwinds rather than a broken business model.

But perhaps more importantly, it operates in a scarce market. Given the UK’s severe structural housing shortage, demand for houses isn’t going away any time soon. As such, Persimmon could swiftly reclaim its FTSE 100 spot once macroeconomic conditions improve.

Managing assets efficiently

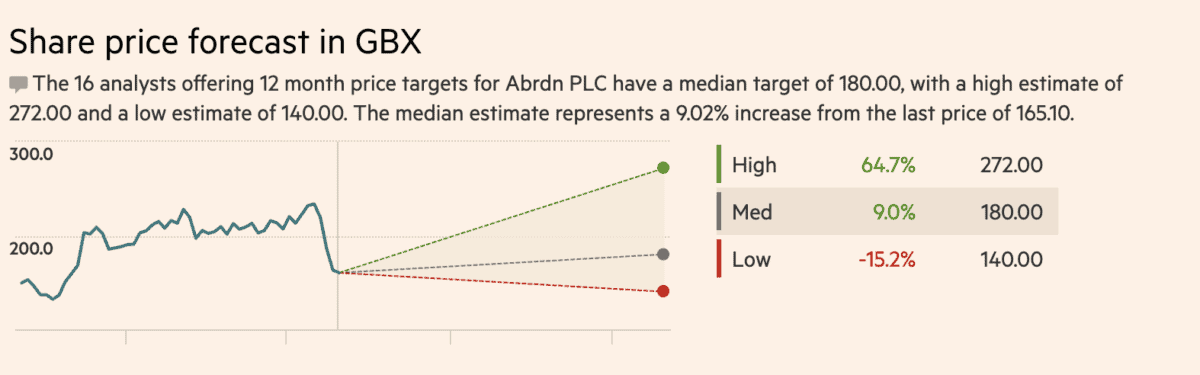

Alongside Persimmon, abrdn has also seen its share price sink. Falling markets and outflows have lowered its total assets under management by 4%. In turn, the asset manager reported a 15% fall in revenue amid rising rates and market volatility. Consequently, abrdn has finally realised its slow and painful demotion to the FTSE 250 after five years of share price declines.

But with its shares trading at just 0.6 times its book value and an 8.9% dividend yield to complement it, abrdn shares may look oversold at first glance. In fact, there’s a reasonable argument to be put forward that this share could present an excellent buying opportunity.

However, tempting as it may be, the challenging macroeconomic environment clouding abrdn’s prospects could persist. With interest rates expected to remain higher for longer, cash and bonds are anticipated to remain more appealing than equities for now. This is expected to continue to hamper asset gathering.

Moreover, it’s worth mentioning that abrdn’s current dividends are thinly covered by profits at 0.7 times its earnings. So, until macroeconomic conditions improve, abrdn shares may remain stuck in the FTSE 250 for quite some time.

FTSE 100 giants at FTSE 250 prices

Demotion brings reputational damage. Nevertheless, both stocks could still warrant purchases before reclaiming their FTSE 100 spots in the near to medium term.

Discounting the short-term noise, Persimmon’s long-term growth story remains unchanged. Housing supply is still structurally outweighed by demand. What’s more, investors shouldn’t be so quick to discount abrdn’s income stream and reach either.

Thus, for patient investors, buying future FTSE 100 members at FTSE 250 prices could prove to be incredibly profitable. Risks around the housing and financial markets mean investors need to have conviction about their respective comebacks. Their paths back to Britain’s premier index may be lengthy, but it’s certainly far from impossible. And if inflation continues to moderate, or even quicker than projected, both Persimmon and abrdn could make their returns sooner rather than later.