Legal & General (LSE: LGEN) stock is around 13% lower than it was five years ago. That’s a bit surprising because the FTSE 100 insurance giant has steadily increased its dividend over that time. I’d assume a stock that pays reliable and rising passive income would come to be valued more highly or time, not less.

The flip side to this poor share price performance is an extremely high dividend yield. But is the payout sustainable? Let’s take a look.

Income royalty

Legal & General (L&G) is a financial services group that specialises in pensions, insurance, and asset management. It is also a Dividend Aristocrat, which means it has paid and increased its dividend payout to shareholders over a long period of time.

In 2024, brokers are expecting a dividend of 21.4p per share, representing 5% year-on-year growth. With the current share price of 219p, that gives the stock a massive forward dividend yield of 9.75%.

That means I could expect to receive £1,000 in passive income next year from a £10,250 investment today.

This return would outpace the current rate of inflation and is much higher than I’d get from any top-paying savings account today.

Of course, broker forecasts aren’t always right. But the firm is confident in its future profitability, setting investors up nicely for inflation-busting passive income.

Benefitting from an ageing global population

One of the things I admire about L&G is that it is incredibly well-run. Sir Nigel Wilson, who is set to retire in December, has been its chief executive for over a decade.

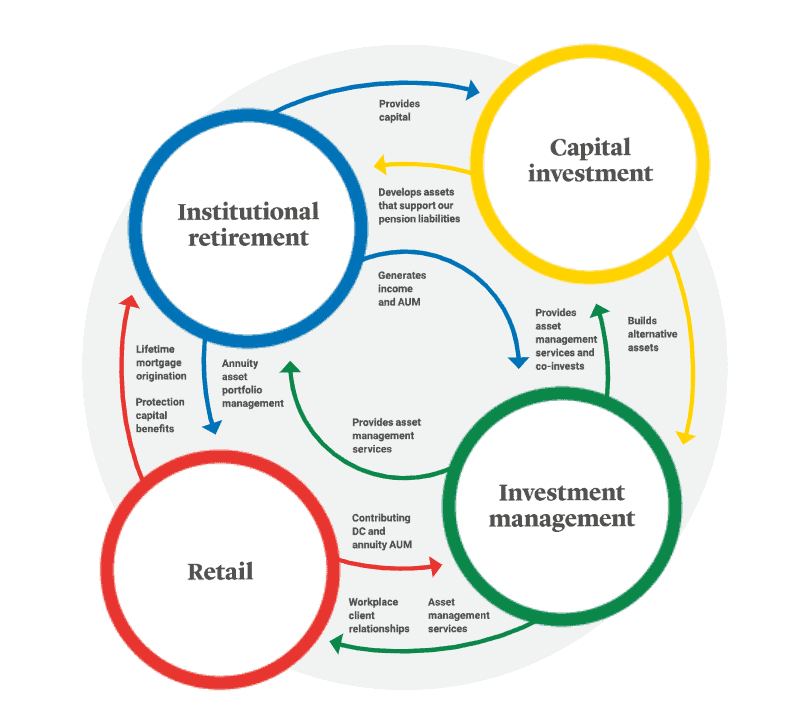

During his tenure, he has simplified the group and built a synergistic business model. That means each division works in tandem with the others to some degree, fuelling further growth opportunities. This can be seen visually below.

Notably, Wilson has positioned the company to capitalise on the accelerating global pension risk transfer trend. This involves transferring a defined benefit scheme’s risk away from an employer that sponsors a pension plan. L&G, with nearly 200 years of experience in managing risk, is a leader in this growing market.

Also, according to the World Health Organisation, the world’s population of people aged 60 years and older will double to 2.1bn by 2050. An ageing global population represents a significant long-term market opportunity for the company.

Is the payout sustainable?

Of course, income from a stock is never truly guaranteed, even from Dividend Aristocrats. Individual payouts do get cut or, worse still, suspended. This could be due to recessions, scandals, economic cycles, and even global pandemics.

That said, there are ways for investors to check the relative safety of a payout. The most popular method is dividend cover, which shows how many times the prospective payment is ‘covered’ by earnings. Coverage of two or above is normally thought to indicate a healthy margin of safety.

Last year, the insurer’s payment was covered 1.9 times by earnings. To my mind then, this cheap income stock is one of the best in the FTSE 100. I already own L&G shares, but I think I’ve just talked myself into buying a few more at some point this year.