To some investors Hargreaves Lansdown (LSE:HL.) is a growth stock, to others it’s a dividend stock. And, for me, it’s both. Not only does the brokerage company look seriously misvalued, it also has great long-term prospects.

So with the firm trading towards the bottom of its 52-week range, let’s take a closer look.

Share price tanks

The Hargreaves Lansdown share price is down 48% over two years. It’s been a considerable fall from grace. The movement has reflected the slowdown in investor activity on its stocks and shares supermarket platform.

While Hargreaves continues to register net client growth quarter on quarter, it’s nothing like the performance seen during the pandemic — when people had very little else to do than trade. Moreover, general investor activity has slumped amid broad negativity about the stock market.

Robust business model

Thankfully, Hargreaves Lansdown has a robust business model. And I don’t think this is thoroughly appreciated by the market.

The business lends its customers’ cash deposits out to the market, thereby operating on leverage. In turn, this allows the company to earn interest on its customers’ money.

In its H1 results, the business said it had a 168 basis point margin for cash. That’s up 976% over 12 months, and all because interest rates have risen. By comparison, the margin on stocks is just 30 basis points.

As such, Hargreaves’ interest income accounted for 35% of total revenue. With interest rates pushing higher, we can probably expect the FY2023 figure to be even higher.

Long-term prospects

Looking beyond the cost-of-living crisis, it’s likely that more Britons will engage in investing. This will likely be incentivised by falling cash returns when interest rates moderate.

That’s a boon for Hargreaves, but also for its peers. One thing the company needs to be wary of is competition from cheaper brokerages. Hargreaves has already cancelled its fees for Junior Stocks & Shares ISAs. It may need to do more to beat off the competition.

Valuation

Growth stocks tend to trade with multiples in excess of the index average. But Hargreaves doesn’t. It could be trading at around 11.3 times forward earnings when making conservative estimates on FY earnings.

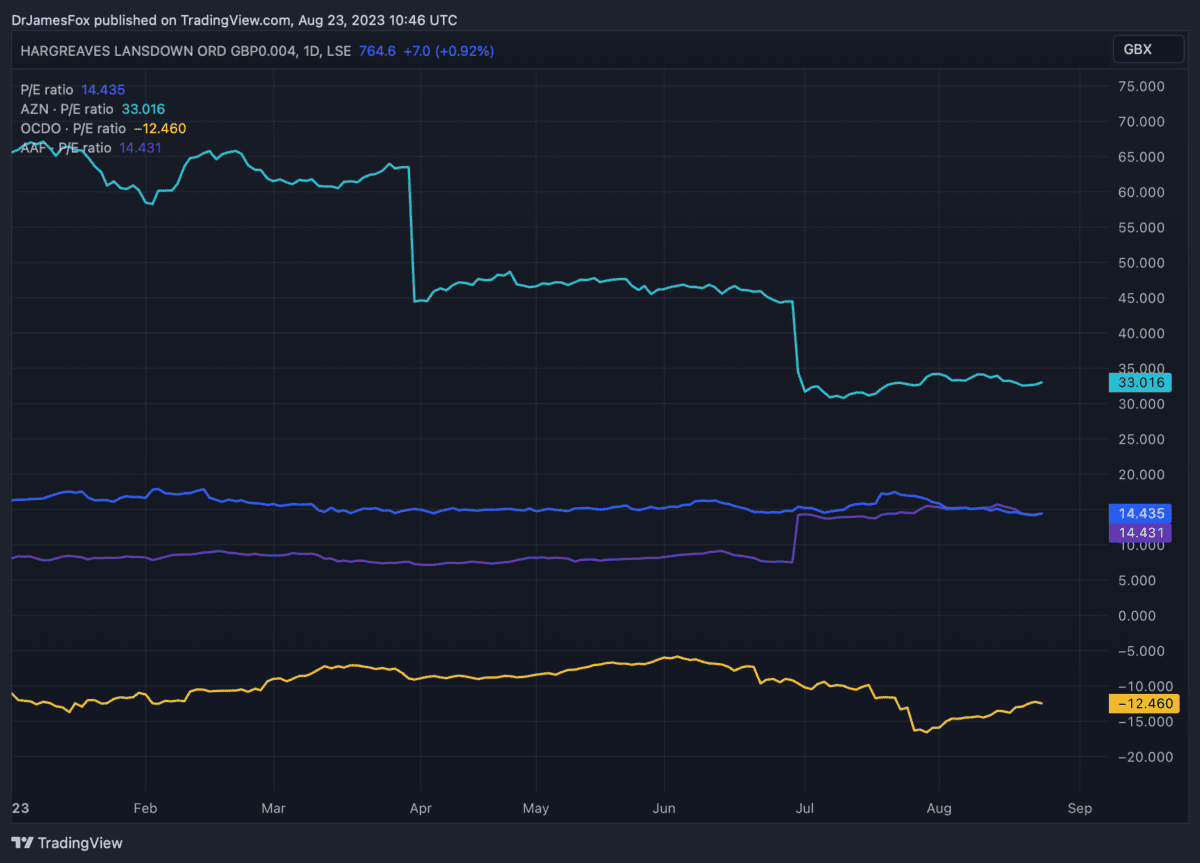

That means it’s cheaper than the index average. As we can see from the chart below, on a current P/E basis, it trades in line with Airtel Africa, but appears much cheaper than AstraZeneca. Ocado isn’t profit-making so the chart shows it at a negative.

We can also see that Hargreaves is trading at a considerable discount to its own five-year average. Between June 2018 to 2022, the average P/E was 29.4 times

I can’t conclusively say that Hargreaves is the best growth stock on the FTSE 100. However, it’s certainly the case that the valuation is particularly attractive. Moreover, it offers an index-beating 5.2% dividend yield.

It’s most certainly a stock that deserves more attention.