Glencore (LSE:GLEN) is one of the largest commodity traders in the world. It also happens to be one of the largest companies in the FTSE 100. Glencore shares have taken a tumble recently (down 9% over the past month) which is pushing up the dividend yield. With the stock currently yielding 7.54%, it’s an attractive second income option for investors. Let’s dig deeper.

Generous earnings provide a buffer

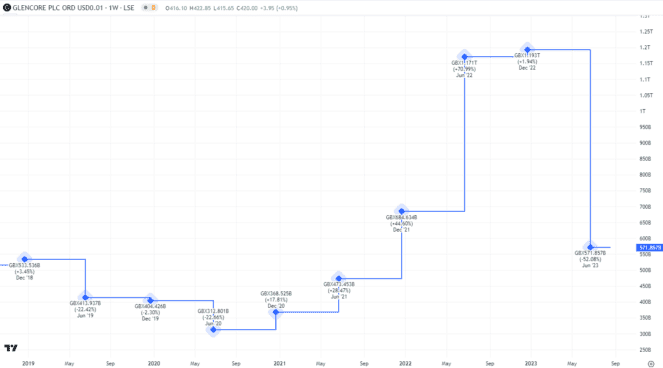

One of the key elements I consider when looking for a dividend stock is the earnings. After all, if the business isn’t making money, it’s going to really struggle to pay a dividend! One measure of this is earnings before interest, tax and depreciation (EBITDA). The below chart shows the figures for Glencore over the past few years.

Some will be concerned about the most recent drop in earnings. However, we need to remember that 2022 was a real outlier of a year. The volatility thrown up by the Ukraine war provided a unique market that Glencore was able to profit from. Yet earnings were always going to normalise after this.

Earnings are still higher than during 2020 and 2021, so this gives me confidence that dividends will continue to be paid out if the figures remain similar going forward.

Watch out for the payout ratio

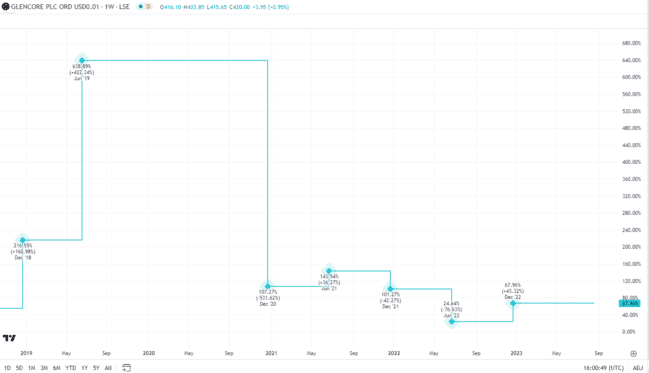

Another metric to consider is the payout ratio. This measures the proportion of net income that is paid as a dividend. If it’s 100%, the business is using all the income for that period to pay as a dividend. The figures for the past few years are below.

The figures above 100% for 2020 and 2021 weren’t sustainable. However, thanks to higher profits from last year, the current pay outratio is 68%. I’d expect this to increase over the next year due to profits normalising, but I don’t see any sustainability issues here at the moment.

However, this is definitely an area for income investors to keep an eye on. A business can survive for a while paying out above 100% via retained earnings, but not for a long period before the dividend has to be cut!

Keeping a lid on expenses

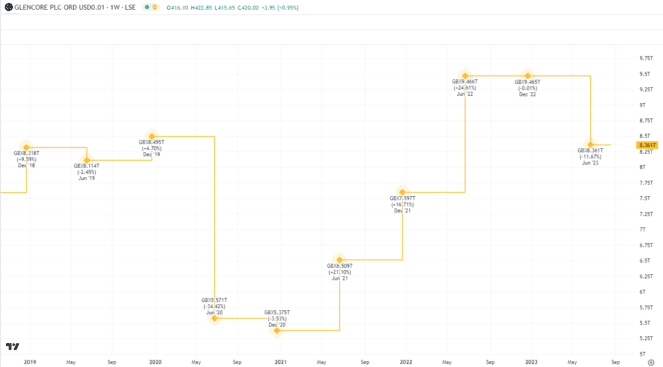

Finally, I note the fall in operating expenses from the latest half-year report. Expenses are one of the key things that a business can control. After rising for much of 2021 and 2022, it was good to see a 12% drop in the 2023 H1 figures.

This is important because if revenue stays stagnant and expenses rise, profit gets lowered. This has the impact of putting pressure on paying out dividends from lower profits. From this angle, the drop in expenses is a welcome outcome and gives me confidence that Glencore can keep this measured going forward.

Overall, the above charts do support the statement that Glencore should be able to continue to pay out dividend income. On that basis, I’m considering adding the stock to my portfolio and think investors should do the same.