Just as with many of its tech peers, Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) stock has boomed in value this year. Considering the shares are one of the S&P 500‘s biggest winners in 2023 thus far, here’s what I’d have if I’d bought stocks in the parent company of Google at the start of the year.

Advertising handsome returns

If I’d invested £10,000 at the very start of the year, Alphabet would have generated a return of approximately 45% on my investment. This translates to roughly a profit of £4,500 (excluding broker fees and/or capital gains tax).

| Metrics | Alphabet stock |

|---|---|

| Amount invested | £10,000 |

| Stock growth | 45% |

| Total dividends | N/A |

| Total return | £14,500 |

Given the time frame and broader performance of the stock market, Alphabet has actually produced a rather generous return. The FTSE 100 is pretty much flat, while the S&P 500 is up 17%. Nonetheless, there are a couple of reasons for the stock’s rally this year.

For one, inflation has continued to fall. This has encouraged an increase in discretionary spending, positively affecting advertising. Additionally, forecasts for a US recession were retracted. But most importantly, its focus on AI has excited investors about the potential to improve productivity and margins.

An intelligent investment

The strong double-digit gains that Alphabet experienced earlier in the year may have dissipated slightly since late July. However, this can broadly be attributed to the market’s overall stagnation, having risen sharply since March. Having said that, Alphabet’s gains aren’t just on the basis of AI hype.

Having reported terrible numbers throughout most of 2022, the downturn in the advertising industry seems to have reached its low. Consequently, the firm’s performance has begun ticking back up. It also helps that analysts’ estimates have been relatively muted, allowing the group to comfortably beat projections.

| Metrics | Q2’23 | Q2’22 | Change |

|---|---|---|---|

| Total revenue | £75.60bn | £69.69bn | 7% |

| Operating profit | £21.84bn | £19.45bn | 12% |

| Diluted earnings per share (EPS) | £1.44 | £1.21 | 19% |

Therefore, it’s no surprise to have seen Alphabet’s most recent Q2 results impressing with plenty of positives to take away. What’s more, the Nasdaq stalwart expects higher earnings to compound over time as its fast-growing Cloud division is now profitable on an operating basis.

Should I buy more?

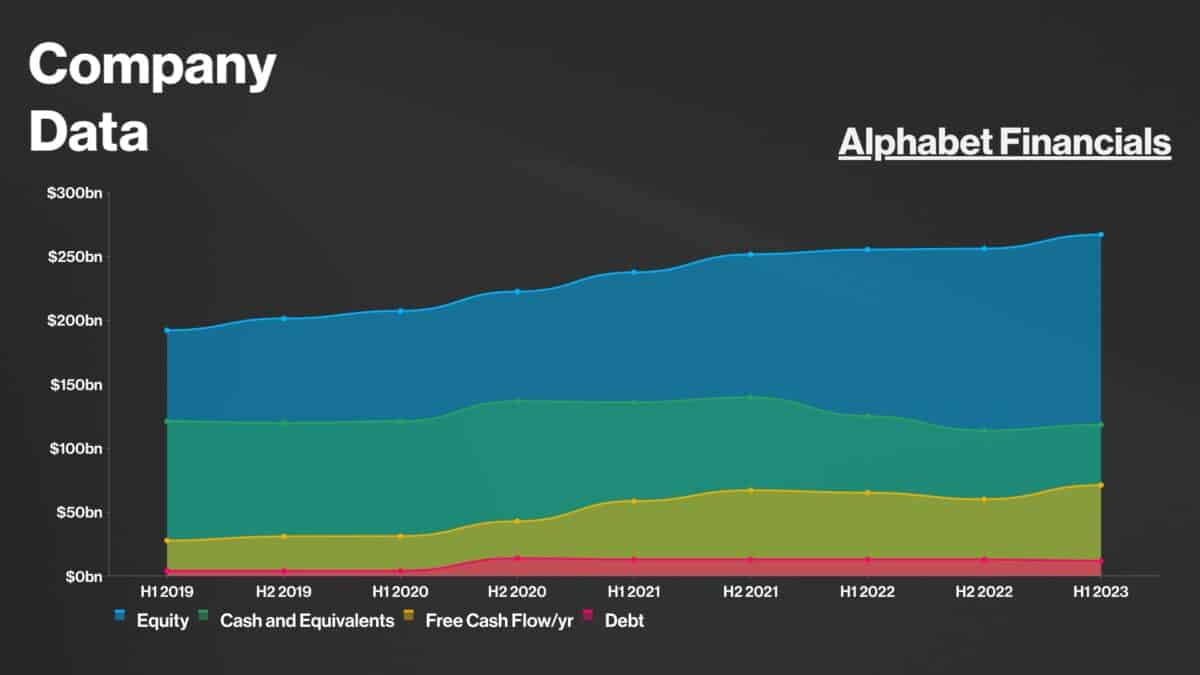

Healthy free cash flow and strong profit margins (21.1%) show that Alphabet is a strong business with excellent financials. Nevertheless, investors are questioning why the company sits on mountains of cash without returning most of its excess capital to shareholders. Even so, Alphabet retains its appeal.

Especially when considering its valuation multiples and potential to continue growing its earnings in the medium-to-long term, I feel Alphabet is an excellent business to invest in. In fact, the shares currently trade on a discounted forward price-to-earnings (P/E) ratio of 21.3 relative to their historical average of 30.2.

It’s no wonder why analysts have an average price target of $150 for the stock. This suggests a potential gain of 15% from its current levels. As such, I believe the stock will continue to grow in the years to come, and its current share price could indicate a bargain for long-term investors.