We’d all love to invest like Warren Buffett. He’s mightily successful and is among the world’s richest individuals with a net worth in excess of $100bn.

Some investors may not realise that his portfolio is relatively concentrated. In fact, 47% of his Berkshire Hathaway portfolio is invested in three American tech stocks that utilise artificial intelligence (AI) to optimise their operations.

AI has certainly emerged as an investment buzzword this year. However, let’s delve deeper into these stocks and endeavour to gain a more insightful perspective on whether they might present an attractive investment opportunity for British investors.

Investing in US stocks

Investing in US stocks opens up the chance to tap into high-growth tech companies not typically found in the UK market.

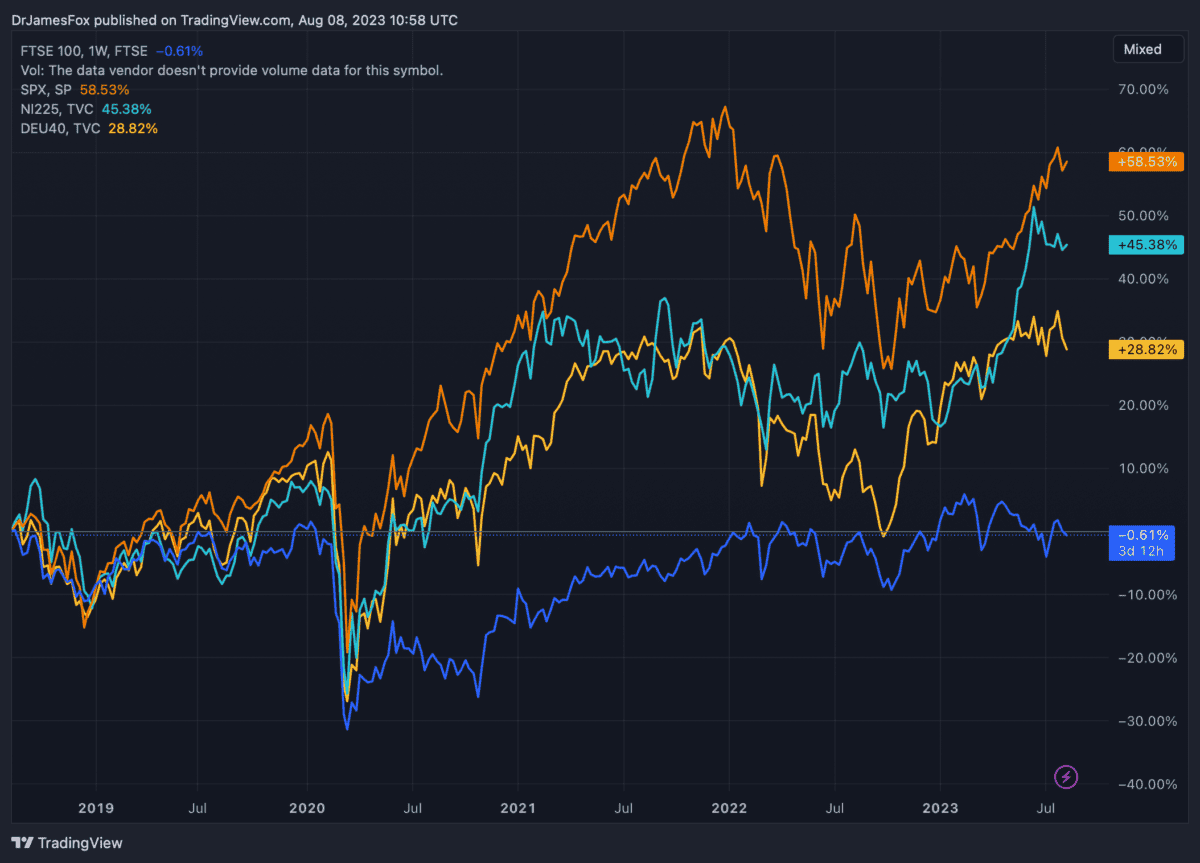

Alongside the potential for greater growth, it’s worth noting that the S&P 500 has significantly outperformed the FTSE 100 in the last five years. We can view this in two ways:

- UK stocks are undervalued. Better opportunities lie in the UK.

- Stronger investor sentiment, as seen in the US, will benefit my investments and avoid stagnation.

We can observed the underperformance of the UK blue-chip index over the aforementioned five-year period in the following chart.

However, it’s crucial to keep one important aspect in mind – currency. Values, especially the pound against the dollar, have shown significant fluctuations over the past year. If I were to invest in US stocks today and the pound were to strengthen tomorrow, it could lead to a corresponding drop in the value of my investment.

Buffett’s 47%

Currently, a substantial portion of Buffett’s managed investment portfolio at Berkshire Hathaway, totalling over $177bn (equivalent to 47% of the $375bn), is allocated to only three AI-oriented stocks. These stocks include Apple, Amazon, and Snowflake.

- Apple’s utilisation of AI goes far beyond Siri. It plays a pivotal role in crafting the upcoming generation of apps, refining autocorrection capabilities, enhancing face recognition, and perfecting voice recognition tools. These integrated AI features not only foster brand loyalty but also consistently elevate the productivity appeal of Apple’s offer.

- Amazon’s integration of AI spans across its brand. Its cloud infrastructure service division, Amazon Web Services (AWS) heavily relies on AI capabilities. Moreover, the Alexa speaker, powered by AI, commands a notable 28% share in the global smart speaker market. Additionally, Amazon’s software employs AI algorithms to guarantee that customers browsing its marketplace see products that align with their highest likelihood of purchase.

- Snowflake, a data-warehousing company, will start utilising generative AI and extensive language model technology this year.

So are these stocks right for British investors? Well, in all honesty, every investment opportunity requires considerable research into a company’s fundamentals and an assessment of its balance sheet and future credentials. Of course, for some investors, knowing Buffett owns these stocks is enough. But that might not be a wise decision.

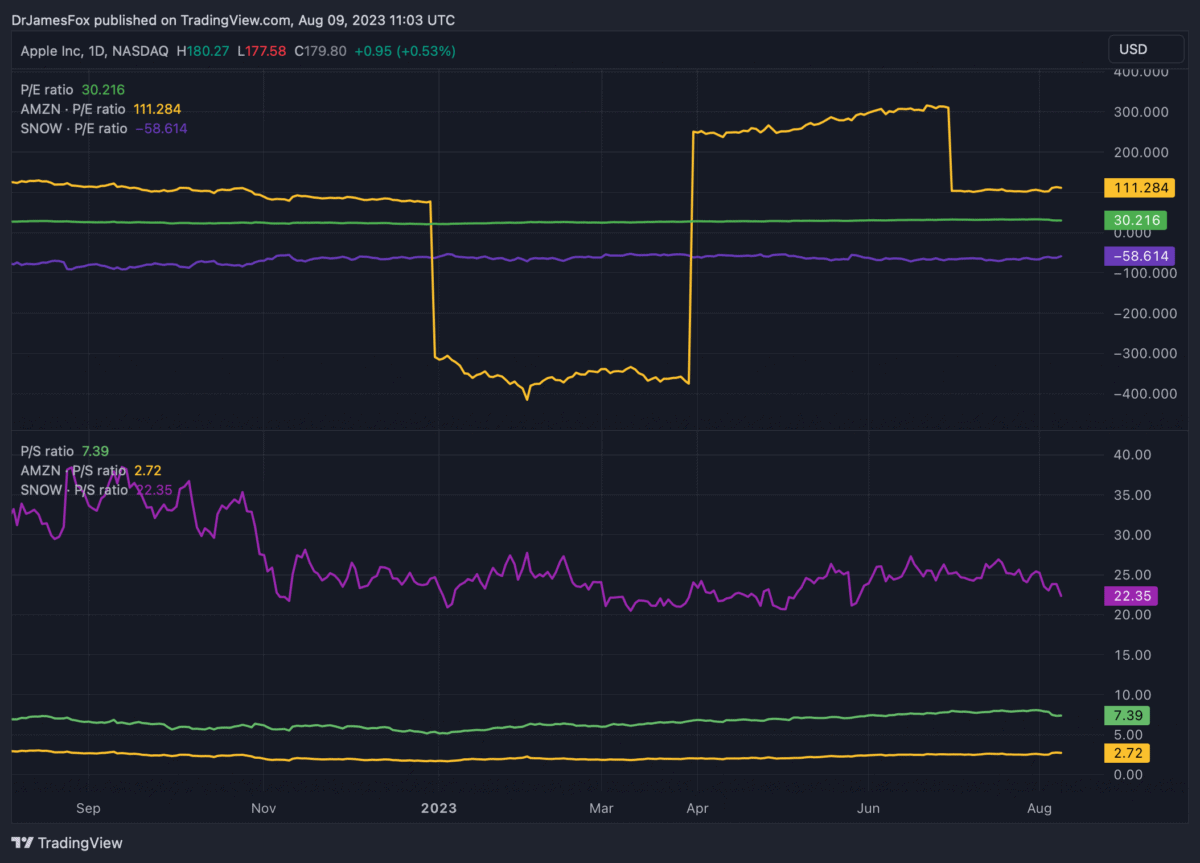

However, it’s worth noting that none of these stocks are particularly cheap, at least compared to what we’re used to in the UK — this is evidenced by the below chart comparing price-to-earnings and price-to-sales ratios.