Growing excitement surrounding artificial intelligence (AI) has supercharged tech stock valuations in 2023. Signs of early success in this blossoming sector have, for instance, helped Nvidia’s (NASDAQ:NVDA) stock price to more than treble since 1 January.

The chipmaker is the third-most Googled S&P 500 stock in the UK over the past year, according to CMC Markets. It says that Nvidia’s name and ticker are typed into the search engine 58,250 times a month. Further underlining the frenzy around the US share, the search term “buy Nvidia stocks” is up 323% during the last 12 months.

I’ve been tempted to nip in and grab some Nvidia shares myself. But I’m mindful that a bubble might be forming around the stock. Could I still make a big profit by buying the company today?

Massive potential

Interest in AI stocks has soared since start-up OpenAI’s ChatGPT tool was launched in November. The chatbot has in some ways changed the game in showing what machine-led thinking could be capable of in the years ahead.

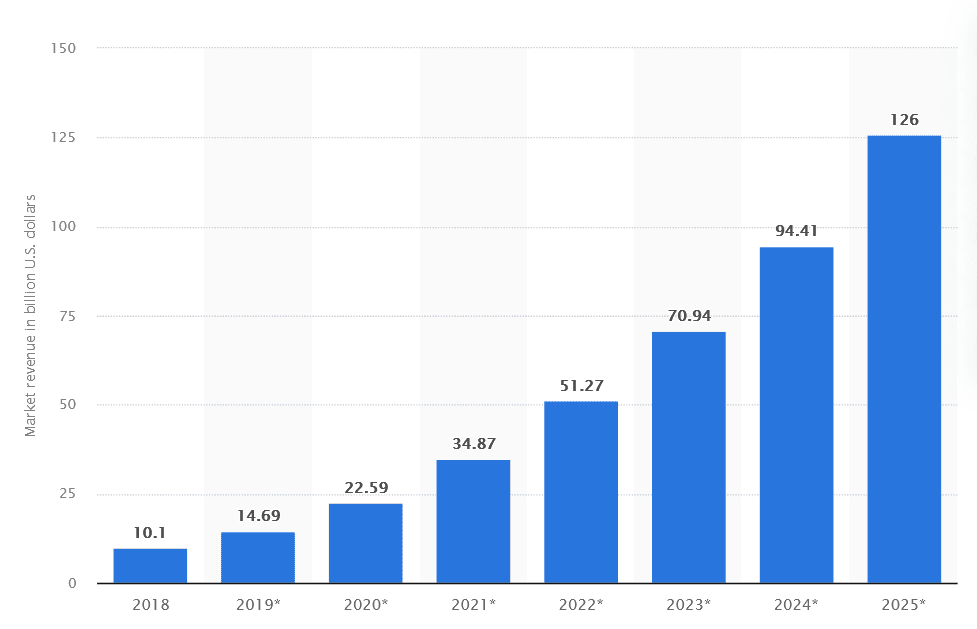

The benefits that AI could bring to businesses in terms of efficiency, costs and product quality are immense. And it’s why industry experts think spending in this area will rocket in the coming decades. Researchers at Statista, for example, think revenues from the AI software market will treble in the next three years alone, as the chart below shows.

The rewards this booming market could provide to Nvidia are clear. The company’s graphics processing units (or GPUs) are adept at handling heavier workloads thanks to their parallel processing capabilities. This makes them perfect for AI applications.

The chipbuilder is in fact already reaping the fruits of this technological phenomenon. Thanks to what chief executive Jensen Huang calls “two simultaneous transitions — accelerated computing and generative AI,” Nvidia predicted revenues of $11bn for the last quarter. That would be significantly up from $6.7bn a year earlier.

Has a bubble formed?

So will I buy Nvidia shares for my portfolio this August? The answer is no.

It’s not that I don’t believe in the company, nor in the growth potential of its markets. It’s not just AI that could power profits here through the roof. The company’s role in video gaming, self-driving vehicles, cloud computing and data centres also offers considerable earnings potential.

I do, however, have huge concerns over whether the stock offers value for money for me as an investor. At $448 per share, it currently trades on a forward price-to-earnings (P/E) ratio of 73 times.

This sort of rating means the market is expecting the firm to continue releasing jaw-dropping financials. If it doesn’t, and its expected growth trajectory starts to attract scrutiny, a sharp share price fall could well follow.

I’m concerned that the valuation on Nvidia stock is wildly out of sync with its fundamental value. The AI revolution is still in its early stages, and there’s a danger that machine-led thinking may not catch on like the market hopes, especially as concerns over its drawbacks to society grow.

Therefore I’d rather buy other growth shares for my portfolio right now.