Immediately after listing in November 2021, the Rivian Automotive (NASDAQ:RIVN) stock price soared making the electric vehicle (EV) manufacturer the second most valuable automotive company in the world, beaten only by Tesla (NASDAQ:TSLA).

Beset by production delays and supply chain problems it’s since fallen by over 80%.

Early days

The company is still in its infancy. In 2023, it’s expected to sell 50,000 units — 97% fewer than its larger rival. But as recently as 2015 Tesla was producing a similar number.

And Elon Musk’s company has come a long way over the past eight years. Worth over $840m, it’s still the motor industry’s number one and has a market cap equal to the combined value of the next nine on the list. In 2022, it reported sales of $81.5bn and a pre-tax profit of $13.7bn.

| Year | Tesla deliveries | Rivian deliveries |

| 2012 | 2,650 | – |

| 2013 | 22,477 | – |

| 2014 | 31,655 | – |

| 2015 | 50,580 | – |

| 2016 | 76,295 | – |

| 2017 | 103,097 | – |

| 2018 | 245,240 | – |

| 2019 | 367,550 | – |

| 2020 | 499,550 | – |

| 2021 | 936,172 | 920 |

| 2022 | 1,313,851 | 20,322 |

| 2023 (forecast) | 1,800,000 | 50,000 |

Back to the future

Rivian is forecasting sales of 92,000 and 115,000 in 2024 and 2025 respectively.

If it achieves these figures it will be growing faster than Tesla did in 2016 and 2017, the two years after it delivered 50,580 cars, a similar number to what Rivian is expecting to sell this year.

By 2030 it hopes to reach 1m. It took its more established competitor 11 year to reach this milestone. If successful, it will have done it in nine.

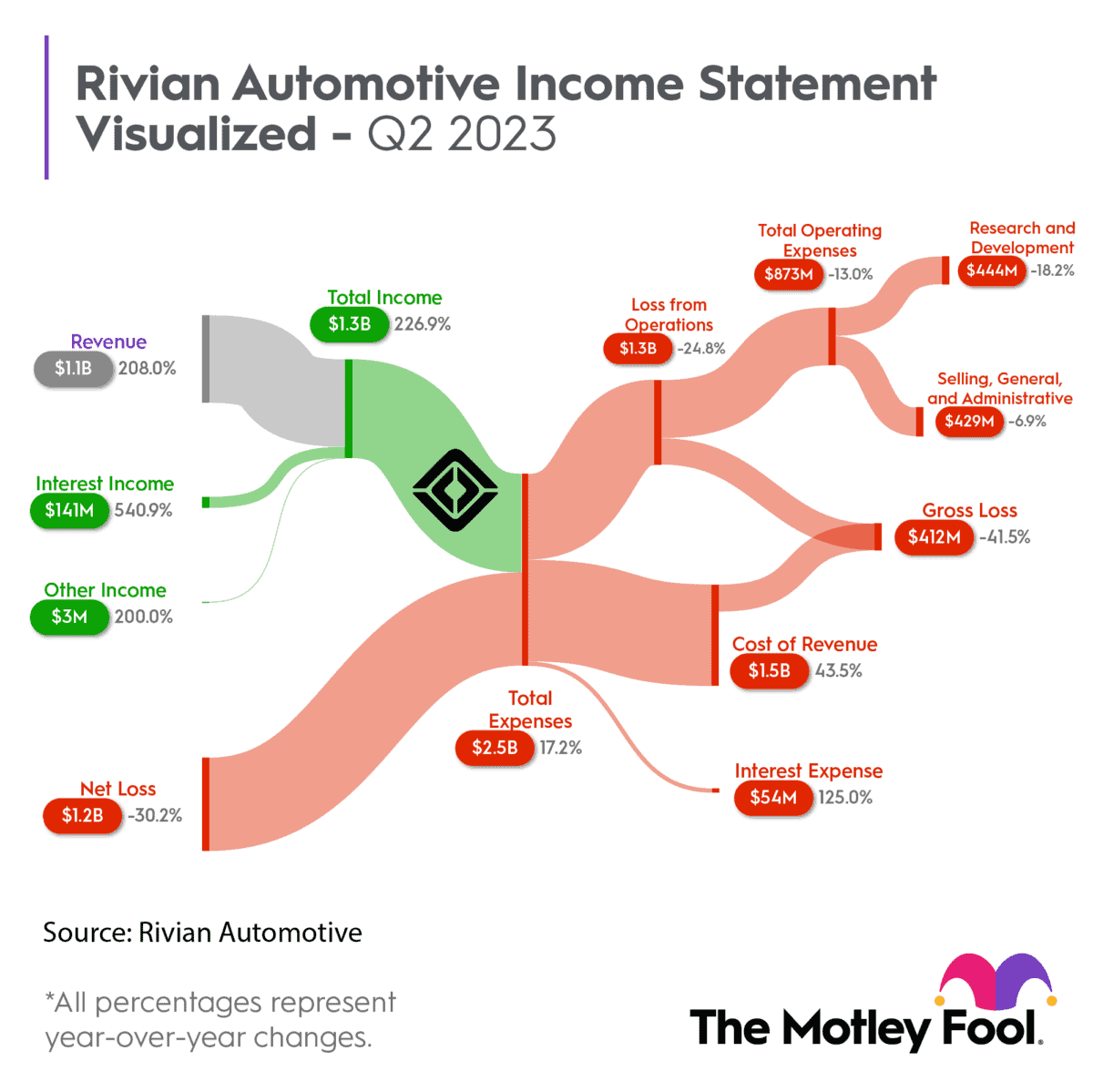

But it’s easy to produce impressive forecasts. The reality is that it’s presently losing money. In 2022, it made a loss before tax of $6.7bn on revenue of $1.7bn. This is seven times more than Tesla’s loss in 2015, when it was at a similar stage of development.

Picking winners

So which would I choose?

Rivian’s range is limited to a pick-up truck (TX1) and a sports utility vehicle. It also makes vans for Amazon, which has a 17% stake in the company. But they’re all expensive. For example, a TX1 has a list price of $74,800.

And later this year it will face direct competition from Tesla, when the automotive giant delivers its first long-awaited Cybertruck.

Pre-orders are close to 2m, even though those paying a deposit today will probably have to wait five years before driving their vehicle. It’s currently priced around $50,000 and this relatively low figure is in line with the company’s newly-adopted strategy of cutting prices — by up to 20% — to boost sales.

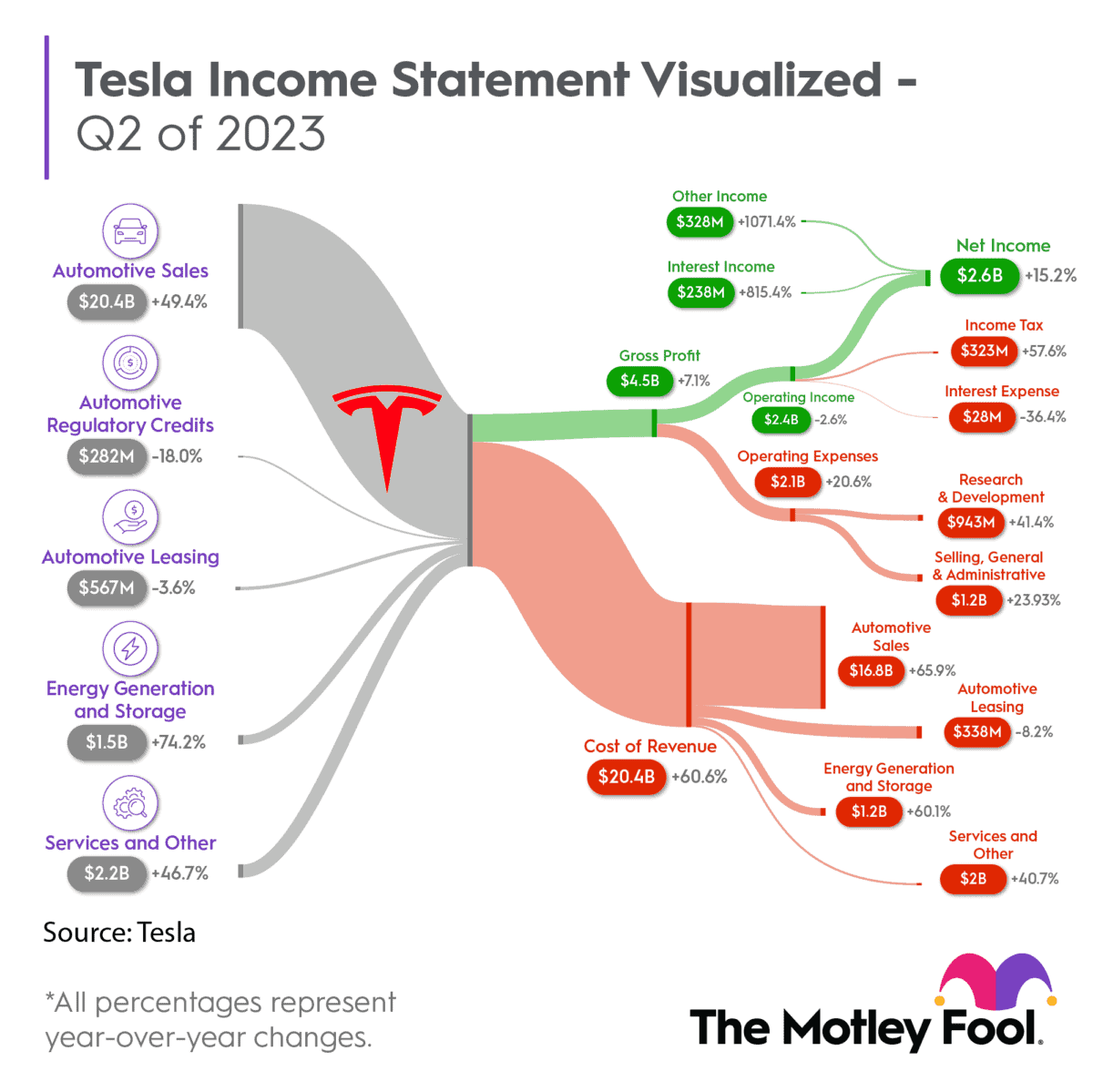

And this strategy appears to be working. The Model Y was the world’s best-selling vehicle during the first quarter of 2023. However, the impact on earnings isn’t yet clear.

Tesla’s forward price-to-earnings ratio is currently around 80 which would normally put me off buying. But although it’s extremely high, it’s much lower than it was a year ago, when it was in three figures. This could be an ideal buying opportunity.

Decision time

But I think there’s greater potential upside with Rivian’s stock — it’s more likely to double in value more quickly than Tesla’s.

Its vehicles receive good reviews from the automotive press. And Americans love their trucks and SUVs. In 2022, Ford alone sold 640,000 pick-ups.

Importantly, at the end of 2022 it still had $11.6n in the bank which the directors say should be enough to see the company through until 2025.

For these reasons, the next time I have some spare cash I’m going to seriously consider buying a stake in Rivian.