Meta (NASDAQ:META) stock is up 135% this year. This has led investors to think that perhaps they’ve missed the boat. But given the monumental rise of its new app, Threads, is there room for the shares to rise further?

A loose Thread

Having seen the potential of Twitter, Mark Zuckerberg opted to launch his own version of the platform with the name of Threads. And to no surprise, Threads is now the fastest app to gain 100m users — in just five days. For context, ChatGPT took two months, while TikTok took nine months to gain the same number.

Therefore, Meta stock has continued to hold onto its gains this year, despite the wider stock market seeing some consolidation in recent days. But the question now is whether this truly is a Twitter killer, as it’s intended to be. After all, it’s one thing getting users to sign up; it’s another getting them to stay.

Despite the monumental rise of Threads, user retention could quickly become an issue. The app’s lack of features, such as the lack of a ‘Following’ tab, along with several other hiccups to do with functionality, has seen several users return to Twitter after a matter of days.

A positive spin

That said, Threads has a unique selling point and could end up boosting the prospects for Meta stock. Zuckerberg plans to make the platform more ‘positive’ and ‘happier’. This should attract more advertisers, especially at a time when companies are going out of their way to avoid controversies.

Combining that with the company’s family of apps, Threads will be able to thrive through the network effect. Case in point — the main reason why it’s managed to grow its user base so rapidly thus far is due to its integration with Instagram.

While this all sounds promising, investors should also be cautious about buying Meta stock. That’s because Zuckerberg’s idea of a ‘positive’ platform will invariably result in a high amount of censorship. This may very well result in a lack of content, resulting in slower user growth and/or user engagement.

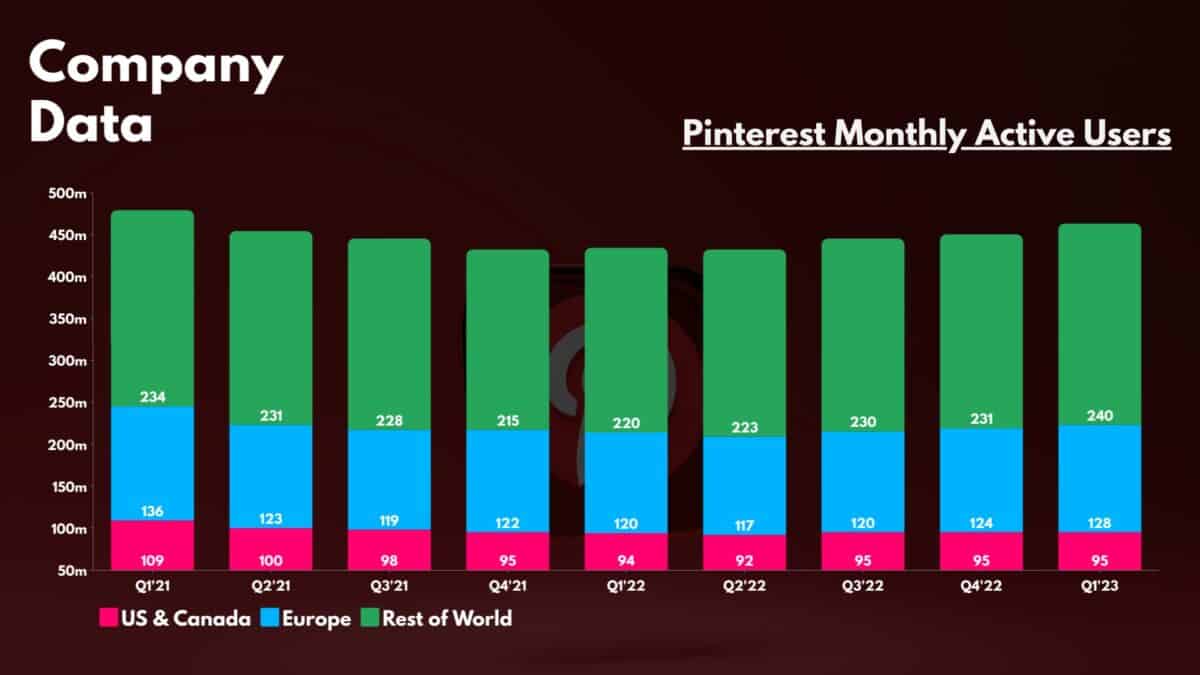

Pinterest is one such instance, where user engagement has remained stagnant over the past two years. This shows that positivity doesn’t always lead to user retention and revenue growth. Advertisers may be more willing to spend, but they might not be as generous if users aren’t engaging with the platform.

Is Meta stock a buy?

Either way, as exciting as Threads is, it’s still in its infancy. There’s plenty of potential, but also equally, as much uncertainty. But whether Meta stock is worth buying should be considered on the basis of its family of apps, and not on the basis of Threads alone.

Considering that Meta stock is still some way off its all-time high, there is certainly potential for it to continue running up. Analysts have been upgrading their earnings per share expectations by 19% over the past three months, with Cathie Wood’s flagship Ark Innovation ETF recently buying over 170,000 shares.

Nonetheless, Meta stock currently has an average price target of $300, indicating limited room for the shares to continue growing in the short term, especially with a forward P/E of 23. As such, investors may be better off waiting on the sidelines and buying in when the stock drops in value.