I’m searching for the best penny stocks to buy following fresh volatility on the London Stock Exchange. I believe many small-cap shares are too cheap to ignore after recent panic selling.

Here are two such companies I’m aiming to buy when I have spare cash to invest.

Anglo Asian Mining

Base and precious metals miner Anglo Asian Mining (LSE:AAZ) has slumped back into penny stock territory. It’s fallen as worries over interest rate hikes have depressed gold, silver and copper values.

Volatile commodity prices are always a threat to businesses like these. Yet I believe the rewards of owning this share over the long term outweigh the risks. At current prices of 88p per share, I think opening a position is an attractive idea.

Anglo Asian owns a string of exploration, development and production assets in Azerbaijan. And it is hoping to double metal production over the next five years by sequentially opening a string of new mines.

The business hopes, for instance, to produce 36,000 tonnes of copper by 2028. That’s up from the 10,300-11,200 tonnes it hopes to dig up this year.

Getting new production online is difficult. But work to achieve first output at its Gilar and Zafar high-grade projects in 2023 and 2024 is progressing well. Anglo Asian has a strong balance sheet to help it realise its growth strategy too. It had cash of $10.7m on hand as of March.

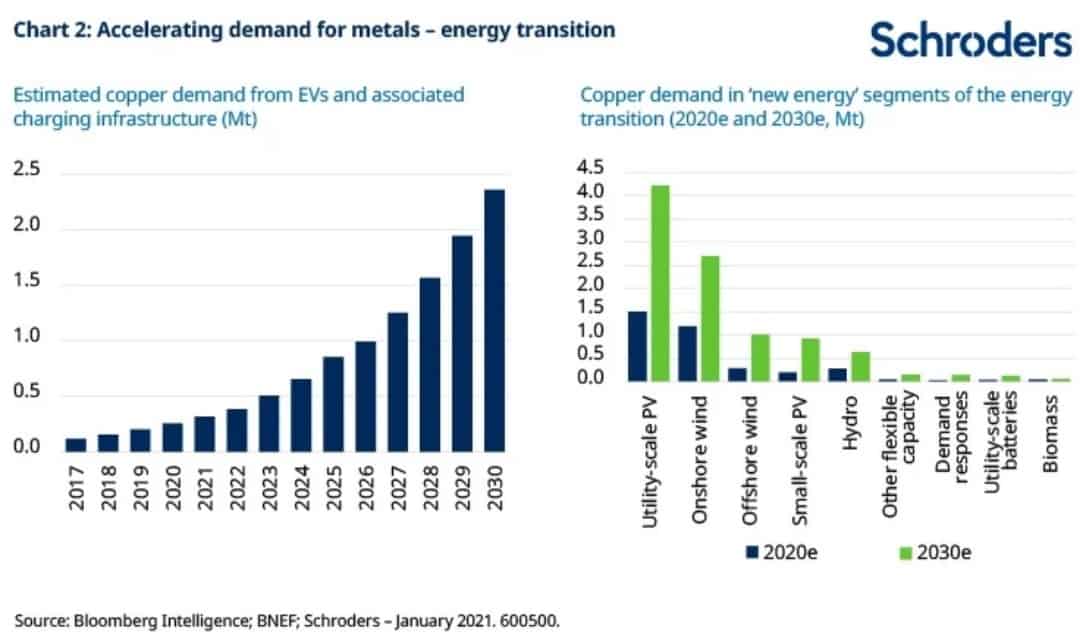

The miner’s pivot towards copper could prove hugely profitable as investment in green technologies heats up. As the chart above shows, red metal demand is tipped to soar over the coming years.

Today, its shares trade on a forward price-to-earnings growth (PEG) ratio of 0.3. This is below the widely regarded value watermark of 1.

What’s more, City analysts expect Anglo Asian to pay another full-year dividend of 8 US cents per share in 2023. As a result, the miner also offers a mighty 7% dividend yield.

All things considered, I think the miner is one of the best-valued penny shares on the market.

Kodal Minerals

Lithium business Kodal Minerals (LSE:KOD) is another top mining share I have my eye on today. Though, unlike Anglo Asian, it isn’t at the producing stage just yet.

Buying early-stage miners is riskier than those already selling raw material. They don’t have the cash flows coming in to help fund project development. But I believe the profits Kodal could deliver over the next decade make it an exceptional buy.

It owns the Bougouni mine in Mali, an asset which may produce 220,000 tonnes of lithium-packed spodumene per annum. Demand for the silvery-white metal is tipped to balloon as electric vehicle production speeds up.

The business has agreed a $100m funding package with China’s Hainan Mining that will help it get Bougouni off the ground too. But be aware that Kodal hasn’t yet met the conditions to receive the cash.