AstraZeneca (LSE:AZN) shares are the crown jewels of the FTSE 100. Under the company’s current strategy, it focuses on areas such as cancer, cardiovascular, kidney, rare- and respiratory-diseases.

Today, I’m looking at the cancer unit and assessing whether this area will continue to drive AstraZeneca forward.

Top performer

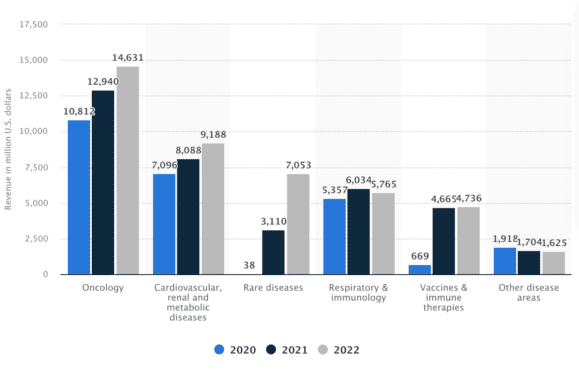

In 2022, revenue from oncology — the branch of medicine that specialises in the diagnosis and treatment of cancer — amounted to £14.6bn, meaning it’s the pharma stock’s largest business unit. As a whole, AstraZeneca earned $43bn — a fact that further demonstrates the importance of oncology unit.

Over the past three years, revenue from the cancer unit has risen from $10.8bn to $14.6bn. A rebound in diagnosis and treatment following the pandemic has boosted revenue, and will likely continue to do so.

The company hit CEO Pascal Soriot’s $40bn target by 2023 but, going forward, investors will be looking at the oncology unit to continue driving the business forward.

The oncology business

AstraZeneca develops and markets a portfolio of oncology drugs — such as Calquence, Enhertu, Tagrisso, Imfinzi, and Lynparza — used in the treatment of different types of cancer. These drugs to healthcare providers, hospitals, clinics, and wholesalers.

The biotech/pharma giant also enters into collaborations and licensing agreements which may see the company receive upfront payments, milestone payments, and royalties as part of these agreements. AstraZeneca also receives funding to support clinical trials.

Key trial data

Nearly £14bn was wiped off the stock market value of AstraZeneca on Monday after it published the first results from its phase three trial for datopotamab deruxtecan. It wasn’t that the drug proved ineffective, but that it was too soon to say with statistical significance whether patients would live longer.

This sent the share price tumbling, despite the drug, which was developed alongside Daiichi Sankyo, demonstrating that it could halt the progression of a patient’s cancer for longer than the drug currently considered the standard for chemotherapy.

Still, investors will be keeping a close eye on the trial’s development. These results weren’t what the market was hoping for as some analysts had suggested datopotamab deruxtecan may deliver up to $18bn in sales.

While AstraZeneca couldn’t publish the results, there may be a hidden positive. It could be interpreted that the patients are living longer and that is why there’s not enough data for comparison. Maybe the market overreacted. It’s hard to tell.

In short, datopotamab deruxtecan, if successful, would undoubtedly power the already strong oncology unit forward. It’s a wait and see moment.

Huge pipeline

There’s a lot of anticipation around datopotamab deruxtecan, but AstraZeneca has a huge pipeline of 178 projects — 24 additional projects, many in oncology, which are due to start this year. In many respects, the size of the pipeline dwarfs its peers.

A good number of these projects are line extensions, rather than entirely new products. There’s two ways to look at this. Entirely new products could be more lucrative. But line extensions should be less risky — and pharma trials are risky as most drugs just don’t make it.

Personally, I see this trial-induced fall as a great opportunity for me to buy AstraZeneca shares — it’s not over for datopotamab deruxtecan. Oncology is a huge, and sadly growing market. It will continue to power share gains in the coming years.