Investing in a Stocks and Shares ISA is a good way to minimise my tax bill. With a £20k annual limit and tax-free treatment awarded to both capital gains and dividends, I try to shelter as many of my stock market positions as possible within the ISA wrapper.

Individual shares and passive index trackers both feature in my portfolio, but I also invest in two actively managed investment funds at present. Let’s take a close look at both.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Fundsmith Equity

Fundsmith Equity is managed by Terry Smith, sometimes dubbed ‘Britain’s Warren Buffett’. The fund’s designed to be a long-term investment, focusing on a small number of high-quality global businesses. Currently, it owns 26 stocks with a median market cap of £93bn.

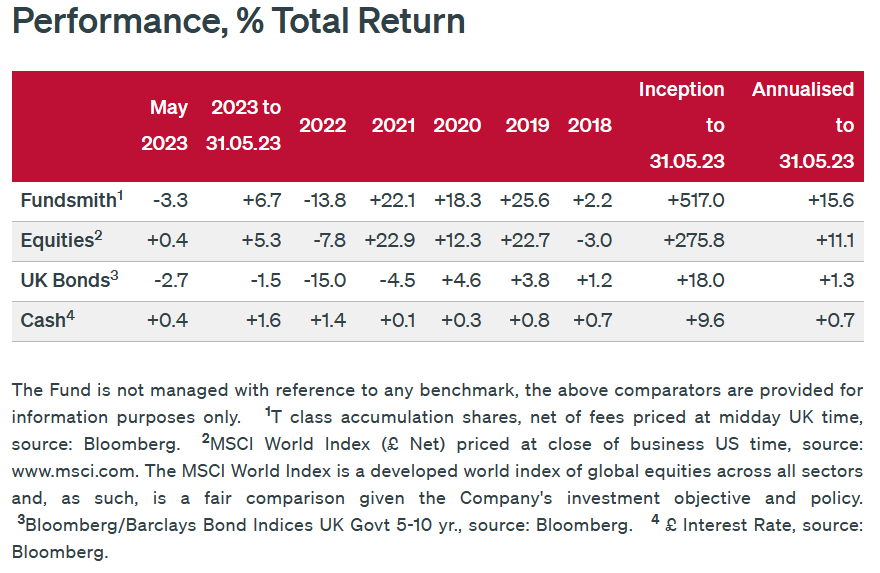

The top 10 holdings include tech titan Microsoft, tobacco giant Philip Morris, and the world’s largest payment processor Visa. Although past performance doesn’t guarantee future returns, Fundsmith’s performance since inception has comfortably outpaced other major asset classes.

One attractive feature is the presence of top-performing European stocks among the fund’s holdings. Most of my individual stocks are UK and US companies. Accordingly, I like the diversification Fundsmith adds to my portfolio.

Notable shares from Europe include French luxury goods conglomerate LVMH, French personal care company L’Oréal, and Danish pharmaceuticals firm Novo Nordisk.

Granted, the fund faces risks, like any stock market investment. Last year, Fundsmith posted a negative return of -14%. This means it underperformed the MSCI World Index. Plus, Terry Smith is 70. He won’t be around forever. Arguably, much of the fund’s success can be attributed to his stock-picking abilities.

That said, it’s not a one-man band. I expect Smith’s investing focus on highly profitable firms with long-term growth potential will continue to dictate Fundsmith’s future beyond his departure.

Despite the risks, I think this fund is a solid Stocks and Shares ISA holding.

Scottish Mortgage Investment Trust

I also own shares in Baillie Gifford’s FTSE 100-listed company, Scottish Mortgage Investment Trust (LSE:SMT). The fund aims “to identify, own and support the world’s most exceptional growth companies, whether public or private.”

Scottish Mortgage investors aren’t strangers to volatility. The share price is down 56% from its 2021 peak. The trust has received criticism for its valuation process regarding the private companies it owns.

Considering the fund is near its self-imposed 30% limit for the private equity portion of its portfolio, that’s a concern. Even more so in the context of broad market anxiety about growth stocks and private company investing.

Nonetheless, I like the private equity exposure Scottish Mortgage offers. The fund claims some companies it invests in, like Elon Musk’s SpaceX, “have no public market equivalent“. I think that’s a valid point. Plus, the growth potential in markets such as the space industry is enormous.

The trust’s largest position is also a European stock. Dutch company ASML has a monopoly on extreme ultraviolet lithography equipment, which is used in semiconductor device fabrication. This firm has performed well over the past year, posting a 44% share price gain. However, other Scottish Mortgage holdings have disappointed.

Overall, I admire the trust’s investment philosophy. I’ll continue to hold my shares for the long run.