I’m searching for great penny stocks to buy following heavy share price weakness. Here are two I think are highly attractive at current prices.

Medical marvel

Medical technology business Polarean Imaging (LSE:POLX) has passed some significant milestones in recent months.

Its landmark XENOVIEW product — which allows MRI scans to give a more complete picture of a patient’s lung health — was signed off by the US Food and Drug Administration (FDA) at the end of 2022. Then in May, the first clinical scan took place at an Ohio hospital using the technology. This followed the company’s maiden sale a month earlier.

So what’s gone wrong with the Polarean share price? As is often the case with penny stocks, it’s money.

The business had a healthy $16m of cash on its balance sheet at the end of last year. But in February, it announced that “the company will need additional cash resources to achieve the 24 month commercial targets and to pursue the development of the next indications and their approvals, and advanced R&D for future products.”

A dip-buying opportunity

Tapping shareholders for cash is one option the business is exploring to plug the funding gap. Yet given recent share price weakness, I’m still considering adding some Polarean shares to my portfolio.

City analysts expect Polarean’s sales to more than double from around $3m this year to $8m in 2024. This is possibly no surprise given the advantages its technologies provide for both medical personnel and patients.

The company’s technology not only provides clearer images, but they can be taken without the use of harmful radiation and don’t require invasive procedures. As the number of people suffering lung-related problems explodes, XENOVIEW has huge growth potential.

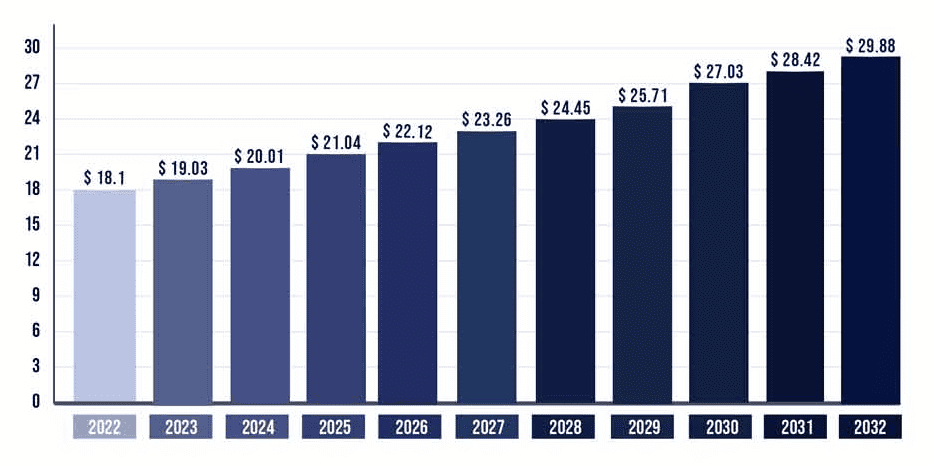

The number of people seeking treatment for chronic obstructive pulmonary disease (COPD) alone is tipped to soar over the next decade, as the graph above shows. Soaring cases of asthma, cancer and other conditions also mean demand for Polarean’s expertise could grow strongly.

A top dividend stock

Making a second income from penny stocks can be a difficult task. Usually, any surplus cash these growth-oriented shares make is ploughed back into the business rather than paid out in dividends.

Property stock Alternative Income REIT (LSE:AIRE) is one small-cap share that could provide a passive income however. Under real estate investment rules its required to distribute at least 90% of annual rental profits out by way of dividends.

This is why the firm offers up a huge 8.2% forward dividend yield. That’s more than double a corresponding 3.8% reading for FTSE 100 shares.

Alternative Income invests in a diverse range of real estate assets. This means that, while it can still theoretically struggle to collect rents during downturns, the risk is much reduced. The firm’s portfolio includes hotels, gyms, logistics hubs and care homes.

Encouragingly, 96% of the rental income it receives is inflation linked. This makes it an especially attractive penny stock to own in this period of rampant price rises.