I’m searching for high-dividend shares to add to my portfolio in June. Here are two on my radar today.

Assura

Primary healthcare property providers like Assura (LSE:AGR) have tremendous investment potential. As the UK population steadily ages, footfall in facilities like GP surgeries and diagnostics centres is predicted to increase strongly.

Facilities like this are expected becoming increasingly important given the huge strain on the NHS. In a recent report CBRE Group said “primary care will become an important part of delivering healthcare services” in light of record-high NHS waiting lists.

The property services group expects primary care rents to increase in 2023. This should “enable and encourage third-party development, to meet increasing demand and deliver on NHS ESG strategies.”

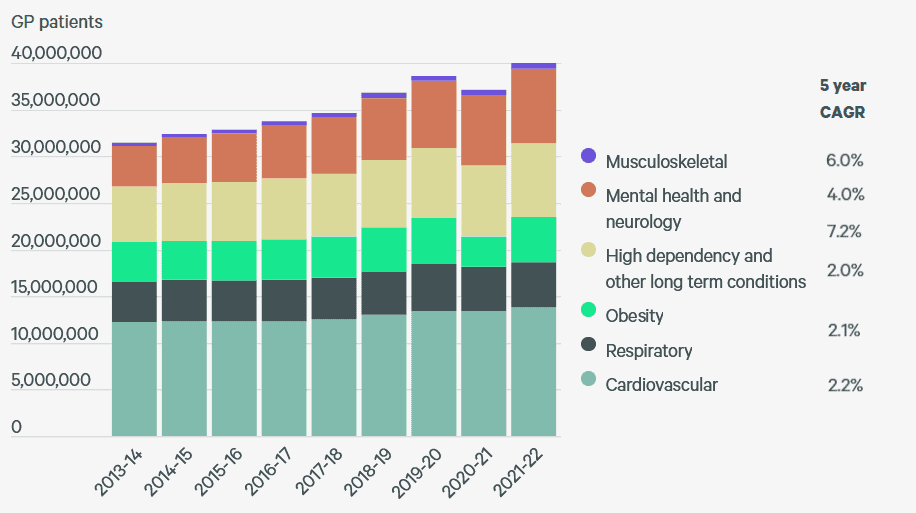

These are long-term trends I think could deliver sustained profits growth at the likes of Assura. As the graph below shows, serious health conditions that require treatment are rising across the board.

High build-cost inflation is an issue for companies like this. And there is a possibility this could prove a prolonged problem. But I still believe the potential benefits of owning primary healthcare operators such as this outweigh this problem.

As a dividend investor I’m especially attracted to Assura. Its classification as a real estate investment trust (or REIT) mean it has to pay at least 90% of annual rental profits out in the form of dividends.

For this year the firm carries a mighty 6.8% dividend yield. I expect it to deliver market-beating dividends for years to come.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Rio Tinto

FTSE 100 business Rio Tinto (LSE: RIO) is another high-yield dividend share on my radar today. I opened a position in the mega miner back in summer 2022. And I’m thinking of adding more shares to my portfolio following recent price weakness.

At today’s prices the company offers a 7.8% forward dividend yield. And it also trades on a forward price-to-earnings (P/E) ratio of just 8.1 times.

Concerns over near-term commodities demand have driven Rio Tinto’s share price southwards in recent months. And they will intensify should key data from China and the US continue to be disappointing.

But this doesn’t concern me as an investor. I buy UK shares based on the returns I expect to receive over the long haul. And I expect the firm to deliver exceptional capital gains and dividend income over this kind of time horizon.

The world is on the cusp of another major commodities supercycle. Urbanisation rates are increasing in emerging markets, and spending to upgrade creaking Western infrastructure is increasing. Investment in renewable energy is taking off and consumer spending on electronics and electric vehicles is on the rise.

The result is that Rio Tinto can expect demand for its copper, iron ore, aluminium and other raw materials to rise strongly in the coming decades. And the business has considerable balance sheet strength to exploit this opportunity through acquisitions and upgrades to current mines.