What does it mean to be rich? That question will prompt a myriad of answers, but buying dividend shares has handsomely rewarded many investors over the years. After all, much of Warren Buffett’s $112bn net worth comes from dividend stocks that underpin Berkshire Hathaway‘s investment portfolio.

Obviously, I’d settle for a tiny fraction of that amount to call myself rich! However, Buffett’s method of picking undervalued stocks that can beat the market is worth emulating.

So could this pair of high-yield FTSE 250 shares boost my portfolio’s gains? Let’s explore.

Bakkavor Group

Fresh food manufacturer Bakkavor Group (LSE:BAKK) currently yields 7.45%. But the Bakkavor share price has slumped 11% in the past year.

The company’s geographic footprint spans three countries, the UK, the US, and China. The lion’s share of its revenue is home-grown. It generates income by producing meals, desserts, pizza, salads, and other foodstuffs.

The FY22, financial results contained some encouraging numbers. Like-for-like revenue increased 10.6% to exceed £2bn. In addition, the stock’s passive income credentials were bolstered by a 5% hike in the total dividend per share from 6.60p to 6.93p.

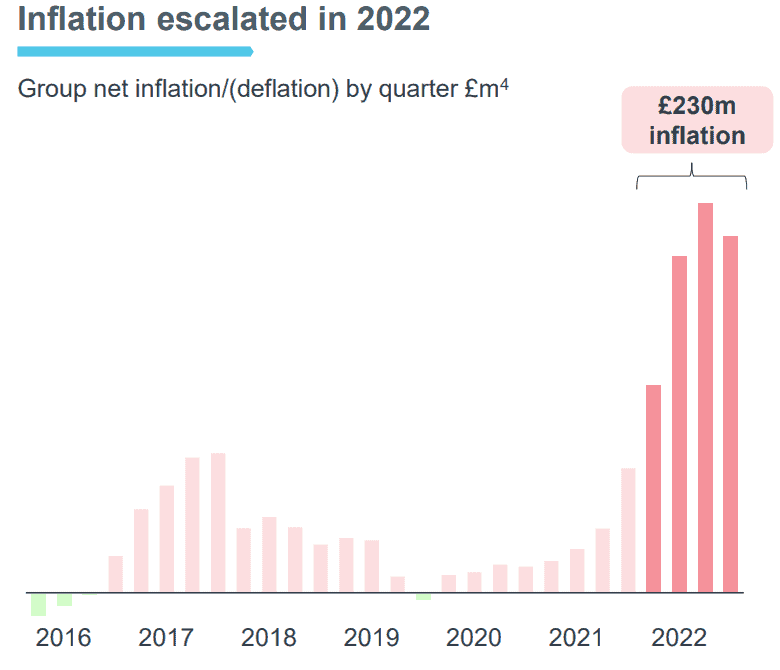

However, it’s not all plain sailing. Spiralling inflation dented the group’s profitability. The adjusted profit margin shrank to 4.2% from 5.4% the prior year. Rising raw materials, packaging, distribution, and labour costs all contributed to the slump.

To compound difficulties, trading in China was severely impacted by Covid-related disruption. That said, the group’s aiming to rebuild its volume levels in the country as conditions normalise.

Harbour Energy

Oil and gas producer Harbour Energy (LSE:HBR) has a 7.59% dividend yield. After a colossal 46% decline in the Harbour Energy share price over 12 months, could this stock be a value investment opportunity for me?

Harbour Energy is the largest North Sea energy producer. Although it’s predominantly UK-focused, the business is also expanding its portfolio of international development opportunities. Norway, Indonesia and Mexico comprise its key target locations.

Oil production for Q1 2023 is expected to be robust at 202,000 barrels per day. That’s down slightly from 215,000 in the previous quarter.

I’m especially encouraged by the firm’s progress in slashing its net debt levels. A £475m reduction since the end of 2022, to £158m today, shows the company’s on track to realise its ambition of being net debt free in 2024.

However, the government’s 35% windfall tax on oil and gas firms has decimated Harbour Energy’s profits. While FY22 pre-tax profits rose from $315m the prior year to $2.46bn, post-tax profits plummeted from $101m to a paltry $8m as the firm set aside money to cover expected tax liabilities until 2028.

A chance to get rich?

I’m not tempted by the monster yields offered by these dividend stocks, despite some reasons to be bullish. Stubborn inflation could continue to hurt Bakkavor and the UK’s tax regime makes Harbour Energy a less attractive investment prospect than might otherwise be the case.

Nonetheless, I’ll keep both on my watchlist, as the macro environment could become more favourable.

Fortunately, there are plenty more FTSE 100 and FTSE 250 dividend shares that could generate substantial future returns. I’ll continue searching for stock market bargains as I aim to get rich.