I’m always on the lookout for ideas to increase my passive income. My go-to place is the London Stock Exchange because of the value and juicy dividend yields it offers.

One cheap FTSE 250 stock I’ve been looking at is broadcaster ITV (LSE: ITV).

The long-term share price performance has been disappointing. Excluding dividends, we’re looking at a 45% decline over five years. However, over the last six months, the shares are up 20%.

Is now the time for me to invest?

Encouraging results

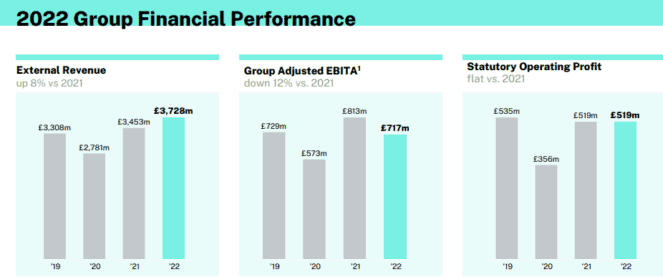

Last month, the broadcaster reported a decent set of full-year results for 2022. External revenue increased 8% year on year to £3.7bn. Most of that growth was driven by its Studios business, which grew its revenue 19%.

ITV Studios is the business — described as a “crown jewel” by CEO Carolyn McCall — which makes and distributes shows in the UK and abroad. It has produced hit series such as Love Island, Bodyguard, I’m A Celebrity…Get Me Out of Here, Come Dine With Me and Hell’s Kitchen.

Additionally, the firm’s new streaming platform, ITVX, continues to be well received. In fact, two months after launching in December, it had already attracted 1.5m new registered users. Total streaming hours were up 9% over 2021.

One concern was that Media & Entertainment revenue declined 1%. This was due to a slowdown in advertising revenue, which is hardly surprising given the tough macroeconomic environment. There’s a risk this slowdown could continue.

However, one bright spot was that digital advertising revenue increased 17% to £343m. This growth is an encouraging sign as the broadcaster transitions towards a digital future.

A grand a year in passive income

ITV stock trades on a cheap price-to-earnings (P/E) multiple of just 6.5 and has a dividend yield of 6.1%.

The total payout for 2022 was 5p per share. Assuming that is matched this year, which isn’t guaranteed, that means I’d need about 20,350 shares for £1,000 a year in passive income.

Those shares would cost me approximately £16,650, as things stand.

That’s obviously a lot of money and certainly more than I’d want to invest in a single income stock.

Will I buy some shares?

I’ve recently been watching some content on ITVX and I’m impressed with the platform. However, I’m not ready to become a paying subscriber just yet. I have a job keeping up with the subscriptions I already have!

It’s no secret that ITV faces intense competition in the streaming world. Netflix, HBO Max, Amazon, Disney and Apple all have much deeper pockets.

Netflix, for example, is set to spend $17bn on content in 2023 compared to ITV’s scheduled budget of £1.3bn. I think it will have to spend increasing amounts of money on content, which limits how much it can raise the dividend.

Plus, there are rumours that the company is exploring a partial sale of its Studios division. It wouldn’t surprise me if one of these content-hungry streaming giants tried to acquire the whole of this Studios business at some point. It’s a proven hit factory.

Finally, ITVX also competes with the likes of TikTok when trying to attract a younger audience. I think that’s a tough ask.

Overall then, I think there are better passive income options for me today.