I’ve been considering which penny stocks to add to my ISA and two stand out to me right now. Admittedly they’re very different businesses, but I think that could prove useful in diversifying my portfolio.

Fashion

The small position I started in Sosandar (LSE: SOS) shares two months ago is down 12%, but I’m ready to top it up soon.

This company is one of the fastest growing women’s fashion brands in the UK. Its revenue rose 30% year on year to £11.6m in the three months to 31 December.

There was growth across all its sales channels and, importantly, it was also the group’s fifth consecutive quarter of profitability.

Following this, the retailer announced a deal with Sainsbury’s to sell its clothes through the supermarket’s website as well as being stocked in some of its stores.

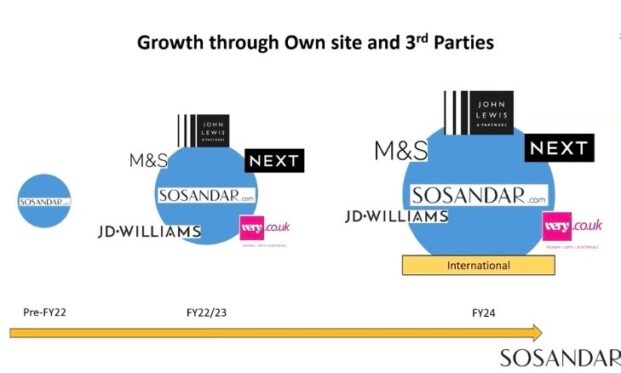

Sosandar already has existing online partnerships with Marks & Spencer, John Lewis, and Next. The sales mix is broadly split between its own website and third-party channels.

While the retailer’s customers are relatively affluent, they’re probably still not immune to the continuing cost-of-living crisis. So sales growth could be impacted if inflation remains elevated. And small fashion businesses have a lot of hurdles to jump before they turn into big fashion businesses.

However, I think a recent £4.5m fundraise by the company should enable it to bolster its product range and pursue additional growth initiatives. The opportunity to grow overseas, for example, looks sizeable to me.

Overall, I think the shares are attractively priced at 23p. The market cap is currently just £58m.

Construction

Steppe Cement (LSE:STCM) is a leading low-cost cement manufacturer in Kazakhstan, where it has been operating since the 1950s.

Whilst cement isn’t an investment to get the heart racing, it’s still indispensable for modern construction. This makes it appealing to me.

The main competitive advantage this firm enjoys is the strategic location of its plant, in a former Soviet Union coal mining hub. This area has well-developed infrastructure that enables rapid and reliable delivery to its customers.

Its annual production capacity has steadily increased to 2m tonnes over the last few years. And the firm grew its net income from $1.28m in 2017 to $17.1m in 2021.

Yet, while it achieved record revenue growth last year, profits are expected to fall when the firm reports its audited full-year results in May. The reason for this was that production costs were higher as inflation soared 20% last year in Kazakhstan.

However, I expect earnings to grow steadily again once inflation normalises.

The stock carries a huge 11.7% dividend yield, though the payout could be cut as it’s only covered once by earnings. A reduction could cause short-term volatility in the share price.

Still, I like the long-term growth story here. Kazakhstan is the richest country in Central Asia, with vast natural resources. And according to the World Bank, its GDP growth in 2023-24 will accelerate to between 3.5% and 4%.

More specifically, the government has committed billions to modernising the country’s roads, railways, ports, airports, and IT infrastructure. This should keep cement demand robust and underpin the company’s growth.

Meanwhile, with a price-to-earnings (P/E) ratio of just 5.5, the stock looks dirt-cheap. If I had spare cash to invest, I’d buy some shares today.