Just as with many of its retail peers, Next (LSE:NXT) shares started the year on the front foot. However, they’ve faced quite some turbulence in recent weeks. With that in mind, how much better off would I be had I bought the stock earlier this year?

A sleek return

If I’d invested £1,000 exactly three months ago, the retail stock would have generated a return of approximately 10% on my investment. This translates to roughly a profit of £117 (excluding broker fees and/or capital gains tax).

| Metrics | Next shares |

|---|---|

| Amount invested | £1,000 |

| Stock growth | 10% |

| Total dividends | N/A |

| Total return | £1,110 |

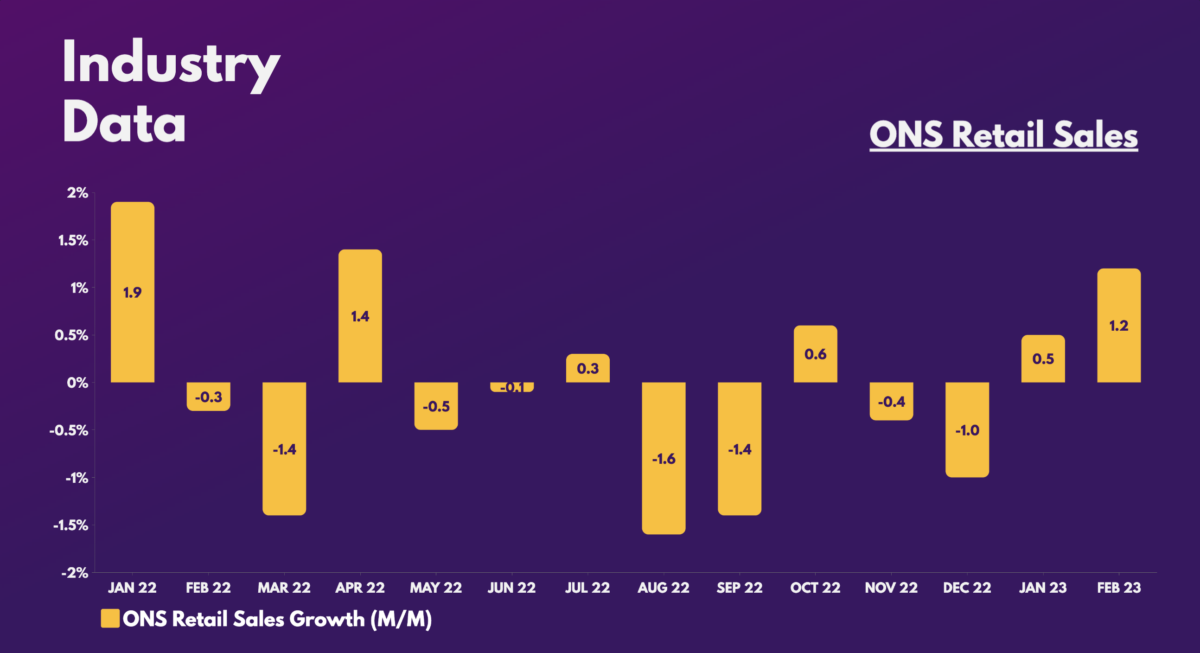

Given the time frame and wider performance of the stock market, Next shares have actually generated a rather decent return. The FTSE 100 is pretty much flat, while the S&P 500 is up 7% since January. Nonetheless, there are a couple of reasons for the shares’ rally in the first quarter of the year.

For one, consumer confidence started to tick back up, which encouraged an increase in discretionary spending. Additionally, forecasts for a UK recession were retracted. Thus, it was no surprise to see the clothing company’s stock gain as much as 20%.

Fashionable numbers

Having said that, the strong double-digit gains that Next shares experienced have dissipated since early March. This can be attributed to the wider effects of the banking crisis, as well as investors practicing some caution.

The positive outlook for the sector is not a cause for celebration just yet with businesses and consumers alike still facing a cost-of-living crisis.

Harry Leyburn, Saxo

What’s more, investors didn’t seem to feel particularly jubilant about the firm’s most recent earnings report, despite it posting higher profits than guided. The group even reiterated its guidance for the year ahead. It anticipates full-price sales to be down 1.5% and profits of approximately £800m.

| Metrics | FY23 | FY22 | Change |

|---|---|---|---|

| Total revenue | £5.03bn | £4.63bn | 9% |

| Operating profit | £0.94bn | £0.91bn | 4% |

| Profit before tax (PBT) | £0.87bn | £0.82bn | 6% |

| Basic earnings per share (EPS) | £5.73 | £5.31 | 8% |

All in all, this was a good report with plenty of positives to take away. Therefore, it’s a surprise to see the sell-off in Next shares. What’s more, the FTSE 100 stalwart expects inflation to play a more benign role in its cost structure, which is good news for its bottom line.

Should I buy Next shares?

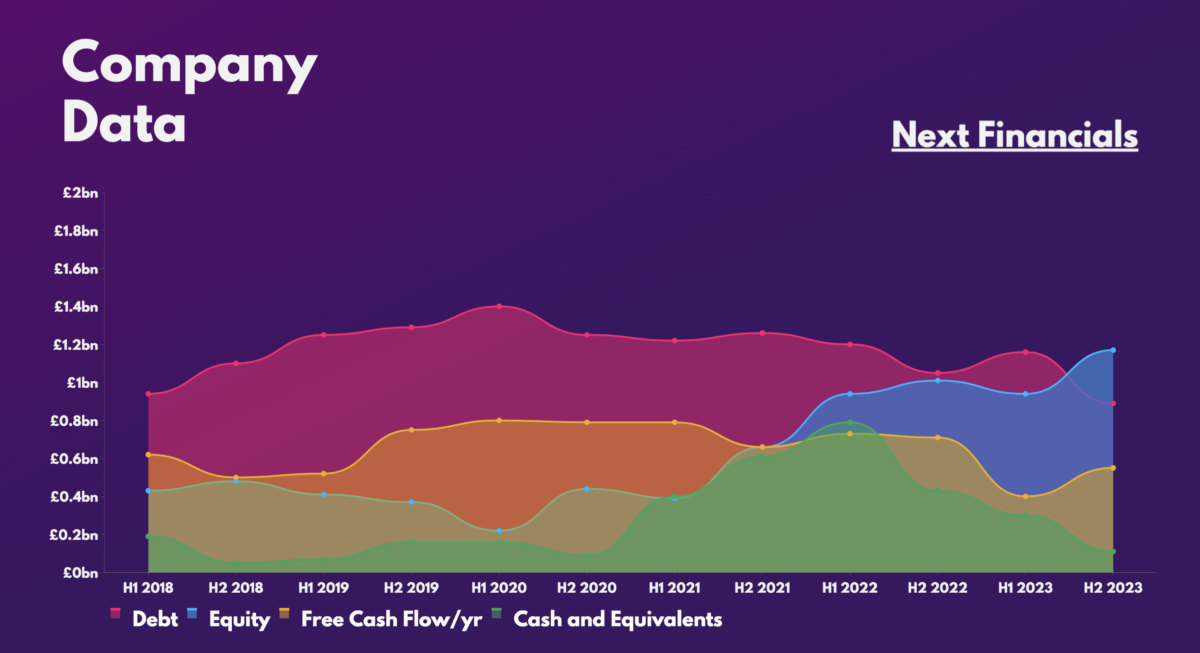

Healthy free cash flow and robust profit margins (14%), despite the inflationary backdrop, shows that Next is a strong business with excellent pricing power. Nevertheless, the state of its balance sheet leaves plenty to be desired — it has high levels of debt with thinning liquidity.

Moreover, Next shares aren’t particularly cheap either when assessing its valuation multiples against the industry average. As such, it’s no wonder brokers Jefferies and Shore Capital rate the stock a ‘hold’. And with a target price of £67.50, the potential gain from current levels isn’t big either (12%).

| Metrics | Next | Industry average |

|---|---|---|

| Price-to-book (P/B) ratio | 7.0 | 1.7 |

| Price-to-sales (P/S) ratio | 1.6 | 0.9 |

| Price-to-earnings (P/E) ratio | 11.4 | 17.6 |

| Forward price-to-sales (FP/S) ratio | 1.6 | 0.4 |

| Forward price-to-earnings (FP/E) ratio | 13.0 | 12.3 |

Ultimately, I believe the company will continue to grow in the years to come. After all, its acquisition of many smaller names should expand its product offerings. But due to its high multiples, I see better opportunities in other FTSE retail names for now, hence I won’t be buying Next shares today.