The Rolls-Royce (LSE:RR) share price has risen a whopping 59% during the first quarter of 2023. The economic outlook remains highly uncertain but ,further impressive gains could be around the corner.

The cheapness of Rolls-Royce shares certainly leave plenty of room for additional increases. At 150.3p per share the FTSE 100 engineer trades on a forward price-to-earnings growth (PEG) ratio of 0.2.

Any reading below 1 indicates that a stock is undervalued.

Having said that, I’m not convinced that the company is the bargain that it first appears. I think the risks of investing in Rolls-Royce shares might be too high even at current prices.

Defence sales grow

The fortunes of aerospace firms are linked closely to strength in the civil aerospace and defence markets. Rolls-Royce is a giant in both these areas, and brightening conditions across its business have helped its share price rebound since late 2022.

I’m pretty optimistic that demand from the company’s military customers will continue to strengthen, too.

Last year was a pivotal one in the geopolitical landscape following Russia’s invasion of Ukraine and growing tension with China over Taiwan. Defence spending spiked again and looks on course to keep expanding as Western nations get ready for a new Cold War.

Rolls took in £5.4bn worth of new orders in 2022. This was more than double the £2.3bn it racked up a year earlier and is an encouraging (if depressing in terms of the prospects for world peace) sign of things to come.

Strength at the core

And this is isn’t the only reason why Rolls-Royce’s profits might soar. It can also expect engine orders and aftermarket revenues from the civil aerospace sector to steadily increase.

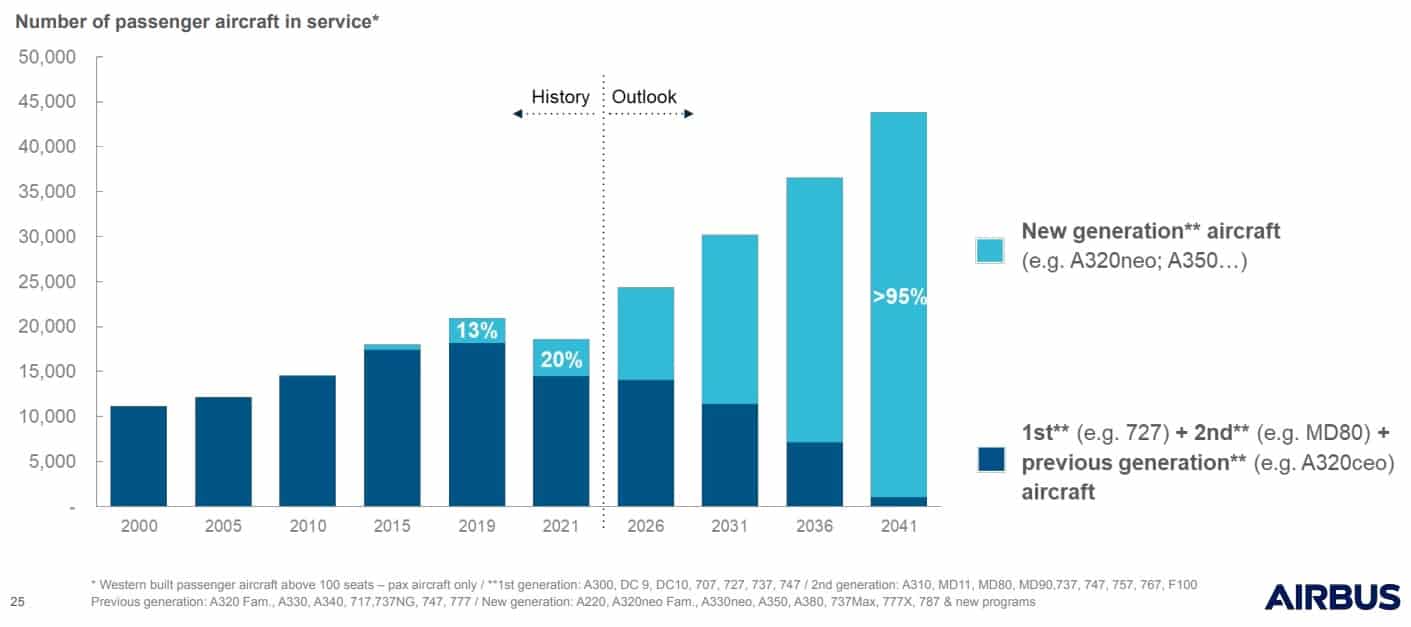

As the projections from Airbus below illustrate, airlines are set to grow their fleets rapidly in coming decades. This is chiefly on the back of soaring passenger numbers in emerging markets.

Debt worries

Given all this, some might think I believe Rolls-Royce shares are a ‘slam dunk’ buy. This isn’t the case, I’m afraid to say.

My main concern for the business is the size of its huge debt pile. Net debt has fallen, but still stood at a worrying £3.3bn as of December. This is costing the company a fortune to service as central banks continue to hike interest rates.

It also casts a shadow over Rolls’ ability to fully exploit the growing civil aerospace and defence markets.

The business operates in a highly competitive and capital-intensive industry. And its huge debts mean it may struggle to fund product R&D as effectively as its rivals like Raytheon Technologies and GE Aviation, damaging its ability to win business in the process.

Finally, its huge financial liabilities could also delay Rolls’ decision to restart dividends and could negatively impact the rate at which shareholder payouts might grow.

The verdict

Rolls-Royce’s ability to keep paying down its debts could hit a roadblock for various reasons too. A sudden downturn in the civil aerospace market as the global economy cools could be one. Elevated cost inflation and supply chain worries and their recent impact on profits is another danger to its repayment plan.

Given all of the above I’d rather buy other FTSE 100 value stocks right now.