Recession fears and the cost-of-living crisis led to a massive sell-off in consumer discretionary shares last year. However, the sector has been one of the better performers this year given the improved outlook for the economy. So, should I buy FTSE retail stocks today?

Not an April Fool’s joke

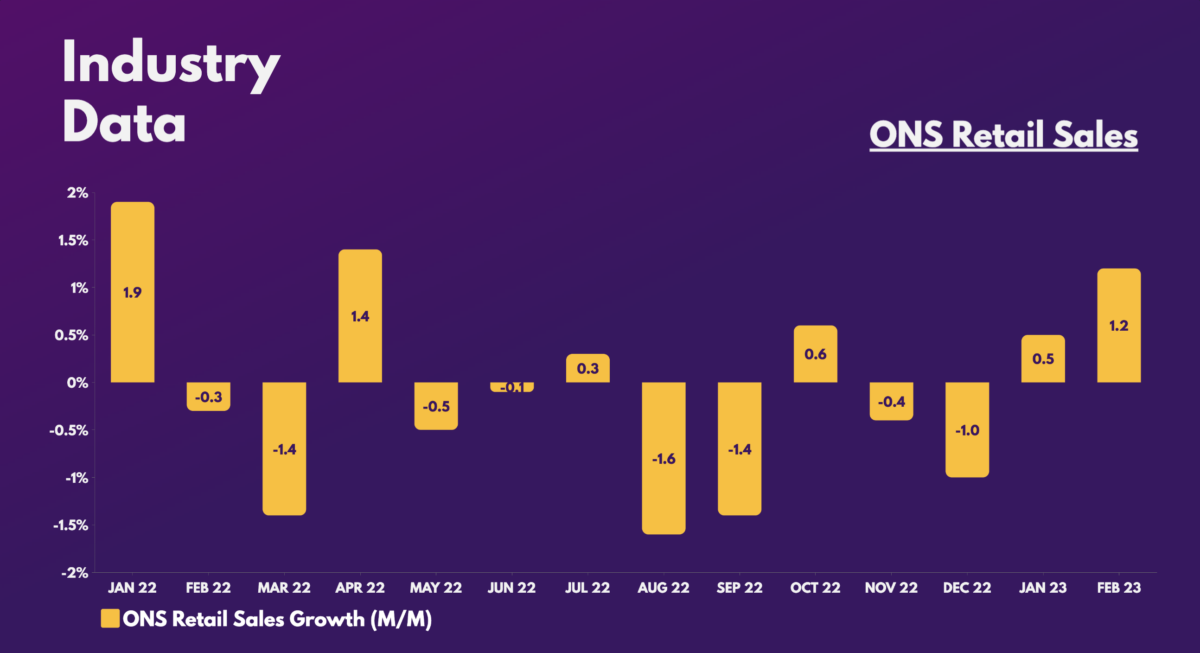

The result of higher interest rates paired with elevated prices don’t usually bode well for the economy, as discretionary spending gets hit the most. But to the surprise of many, retail sales data has proven to be stronger than expected so far this year — growing in January and February and even beating consensus expectations.

Therefore, it wasn’t overly surprising to see the recent reports from Next and Hennes & Mauritz (H&M) blowing expectations out of the water. After all, FTSE shares like Tesco and Associated British Foods (ABF) have seen double-digit increases this year with the positive retail data.

Next showed an increase in pre-tax profits of 5.7% to $879 million in the year to January with an increase of 8.4% in sales. H&M reported an operating profit margin of 1.3%, up from 0.9% a year earlier.

In 2022, Next’s share price dropped 35% in price with the stock market facing serious volatility and businesses fighting sky-high inflation and high shipping costs, but it’s now expected the retail sector will make a strong comeback in the first quarter of 2023, with Next up 11.85% in three months.

Harry Leyburn, Saxo

Time to go on a shopping spree?

On that basis, should I buy FTSE retail stocks as they rebound? Well, not necessarily. According to Leyburn, “the positive outlook for the sector, however, is not a cause for celebration just yet with businesses and consumers alike still facing a cost of living crisis”.

He’s not wrong in saying that either. Inflation is still hot, real wages continue to lag, and consumer confidence remains in the gutter. As such, buying shares in these FTSE winners could present some risks in that they could decline in value.

In fact, another angle on the data is that they indicate the positive sentiment might be overdone. That’s because sales volumes in three months to February actually fell 0.3%. Thus, more data is needed before such optimism can be truly cheered on.

Are these FTSE stocks on discount?

All that being said, it doesn’t stop me from potentially buying retail stocks if they’re trading on a discount — and there are a couple. For instance, FTSE classics like Marks and Spencer and Sainsbury’s are trading on valuation multiples that are below the industry average.

| Metrics | Next | ABF | Tesco | M&S | Sainsbury’s | Industry average |

|---|---|---|---|---|---|---|

| Price-to-sales (P/S) ratio | 1.6 | 0.9 | 0.3 | 0.3 | 0.2 | 0.3 |

| Price-to-earnings (P/E) ratio | 11.3 | 21.7 | 20.2 | 10.4 | 10.9 | 13.4 |

| Forward price-to-sales (FP/S) ratio | 1.6 | 0.8 | 0.3 | 0.3 | 0.2 | 0.5 |

| Forward price-to-earnings (FP/E) ratio | 13.0 | 15.7 | 14.0 | 11.0 | 14.3 | 13.1 |

And despite the current inflationary backdrop, it’s worth noting that inflation is forecast to come down to about the 2% mark by the end of the year. This should help the bottom line of these retailers. What’s more, footfall seems to be ticking up, which should boost the top line as well.

For those reasons, I’m more bullish than bearish on the retail sector, as the initial headwinds begin to convert to tailwinds. Thus, I’ll be looking to add more to my current M&S position and potentially explore other retail names to capitalise on long-term gains.